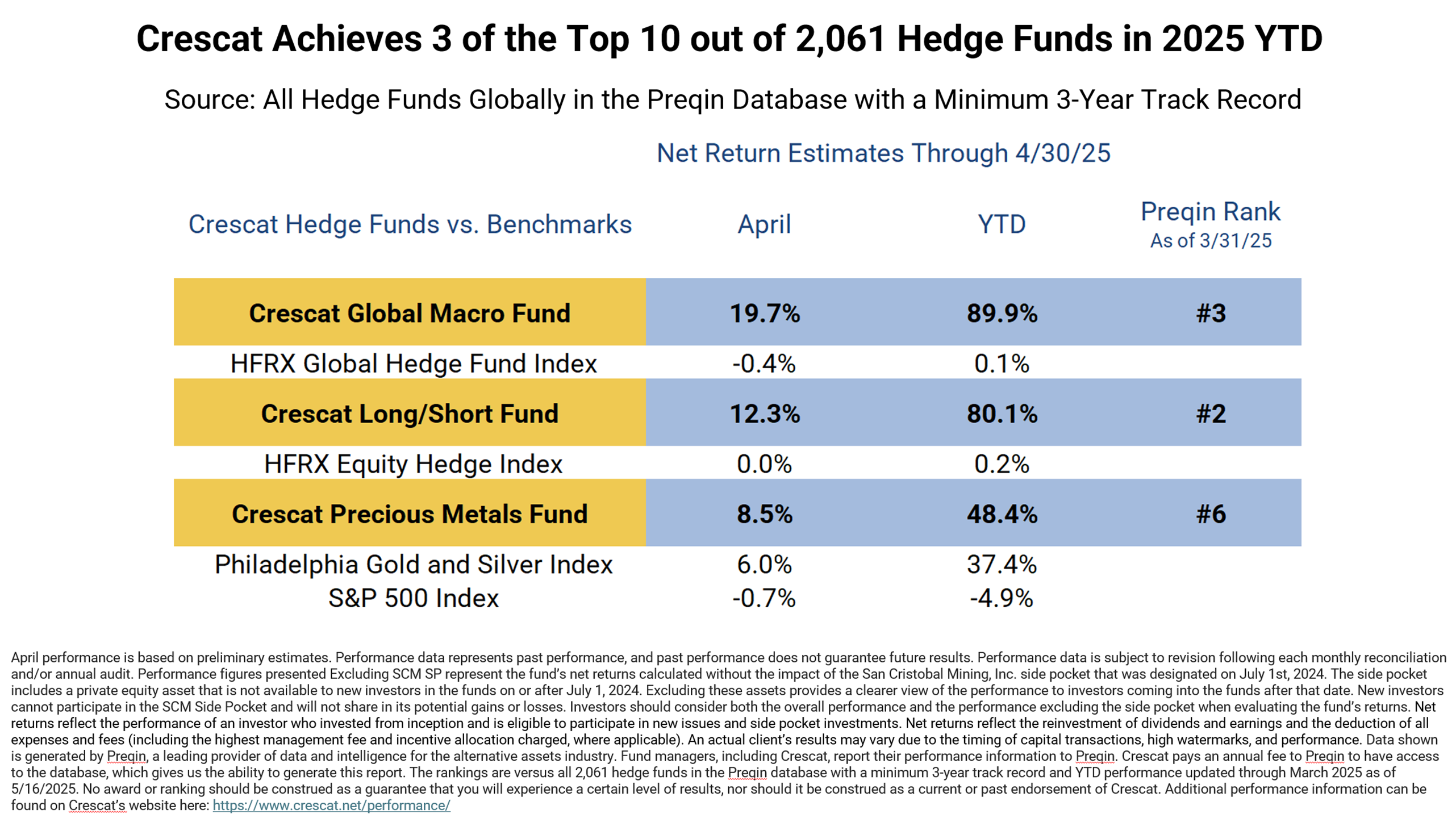

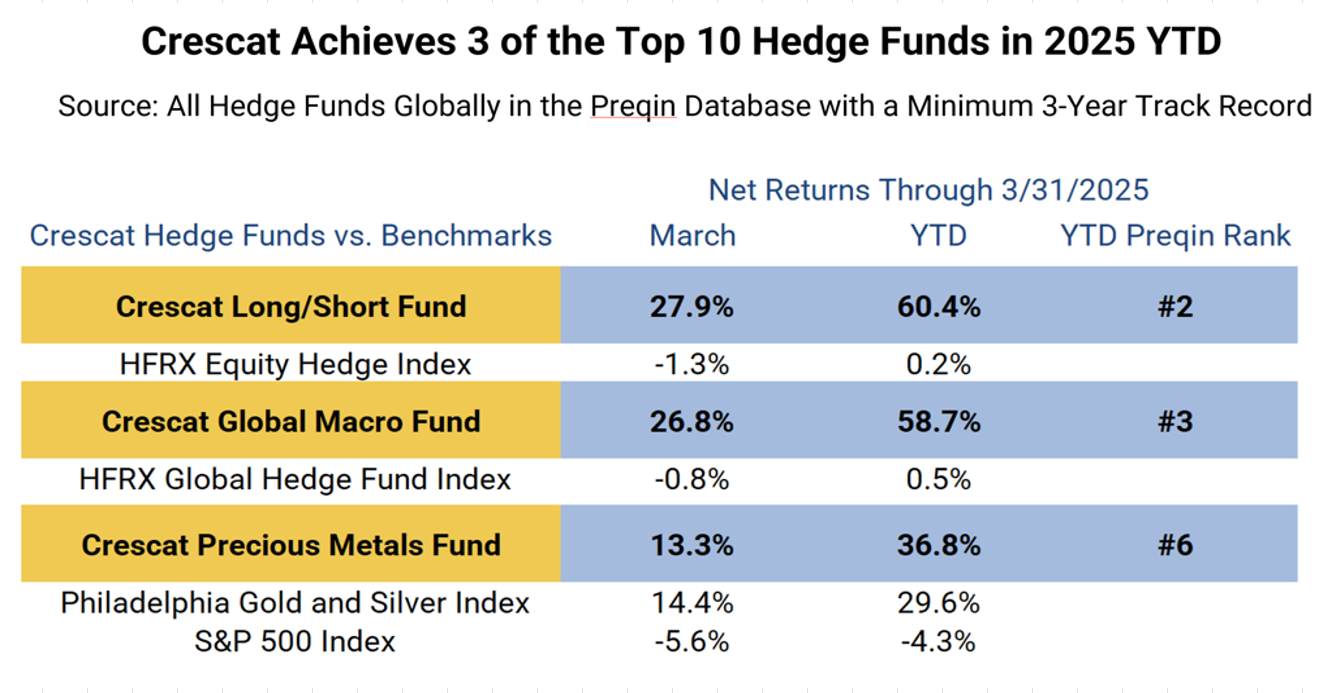

Crescat Achieves 3 of the top 10 Hedge Funds in 2025 YTD

Source: All hedge funds globally in the Preqin database with a minimum 3-year track record. See chart with disclosures here: Click Here.

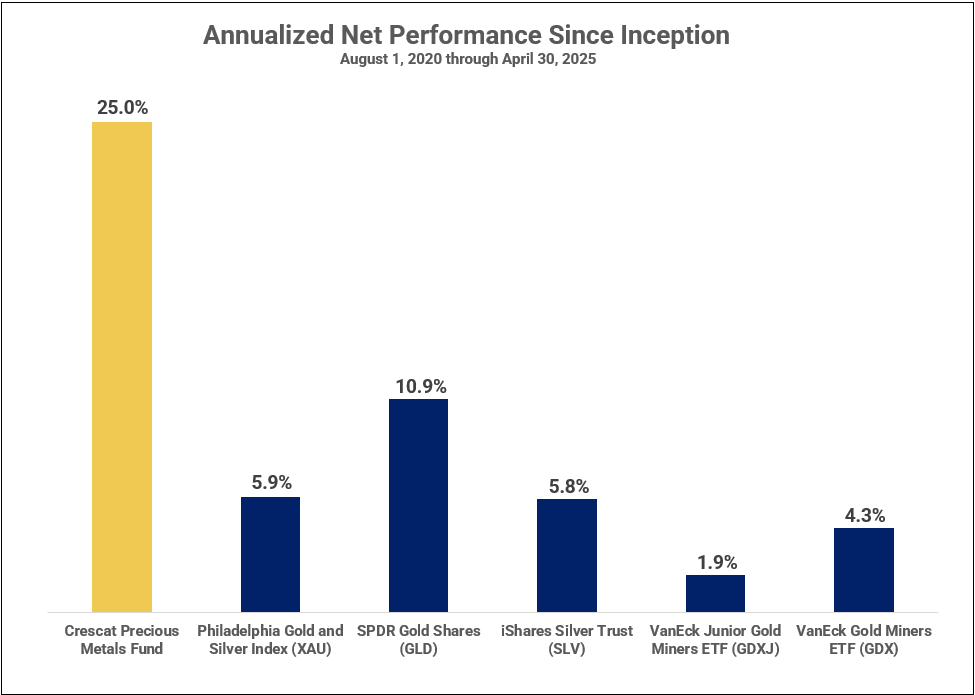

Crescat Precious Metals Fund vs. Benchmarks

The Crescat Precious Metals Fund has outperformed all of its relevant benchmarks since inception. See chart with disclosures here: Click Here.

Eric Sprott Kitco PDAC Interview

March 7, 2025 – Kitco: “Who’s the next Eric Sprott?” Eric Sprott: “Crescat!” Eric points out why it is important to be invested in small-cap gold and silver miners now. Learn More »

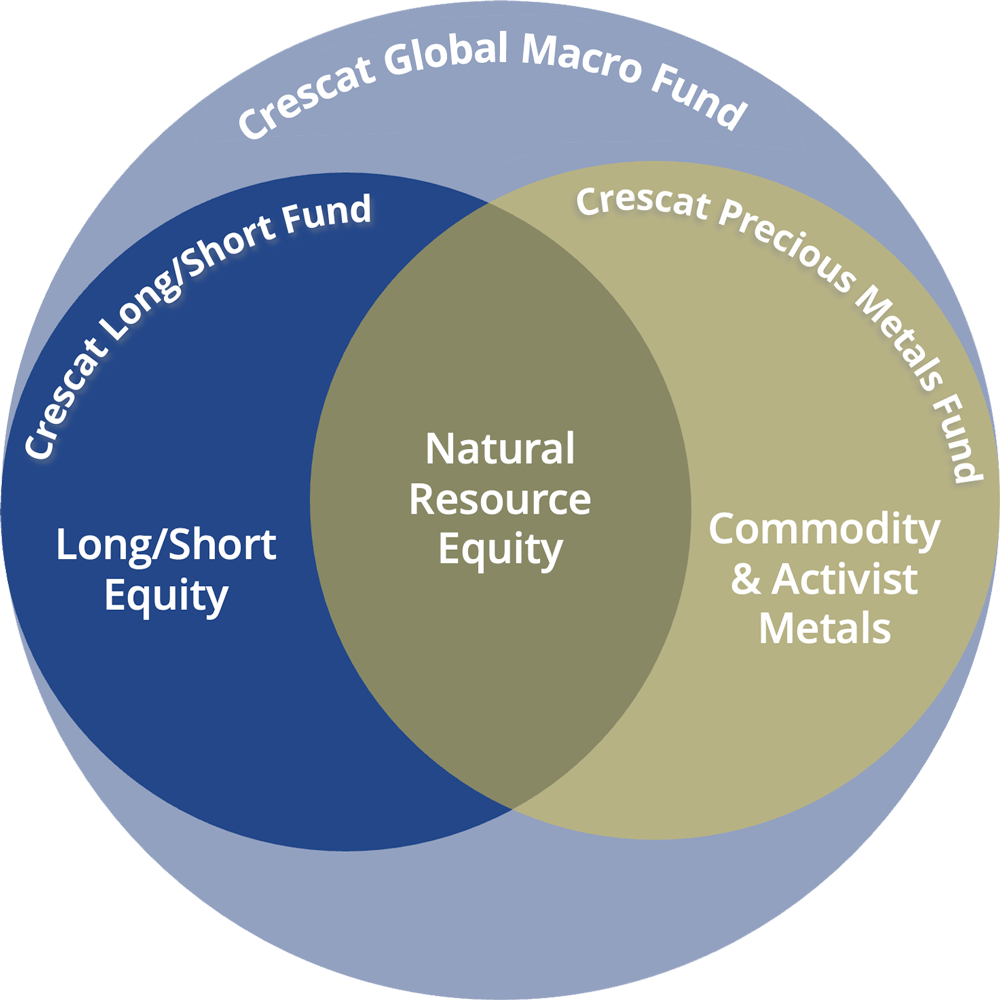

Crescat Hedge fund Strategies

Crescat Global Macro Fund

Crescat’s flagship fund and its most comprehensive strategy with exposure to all the firm’s macro themes.

Crescat Precious Metals Fund

An activist fund focused on precious and base metals mining.

Crescat Long/Short Fund

Our equity-focused hedge fund seeks to deliver alpha from long and short stock picking combined with macro themes.

CRESCAT’S INVESTMENT PROCESS

Primary Values & Supporting Methods

- Development and expression of tactical macroeconomic themes.

- Proprietary valuation-based research.

- Quant models

- AI Quantamental Equity

- Macro

- Precious Metals

- Energy

- Hiring of industry professionals whom we consider to be experts in their field.

- Risk management that embraces volatility to realize intrinsic value.

OVERARCHING MACRO THEME: THE GREAT ROTATION

Related Subthemes

- Megacap Tech Overvaluation

- Recession Watch

- Widening Credit Spreads

- Yield Curve Steepening

Related Subthemes

- Entrenched Inflationary Pressures

- Government Debt & Deficit Challenges

- Stagnating Growth

- Weakening US Dollar

Related Subthemes

- Precious Metals Mining

- Energy Transition Metals

- Agricultural Commodities

- Oil & Gas

- Commodity Rich Emerging Markets

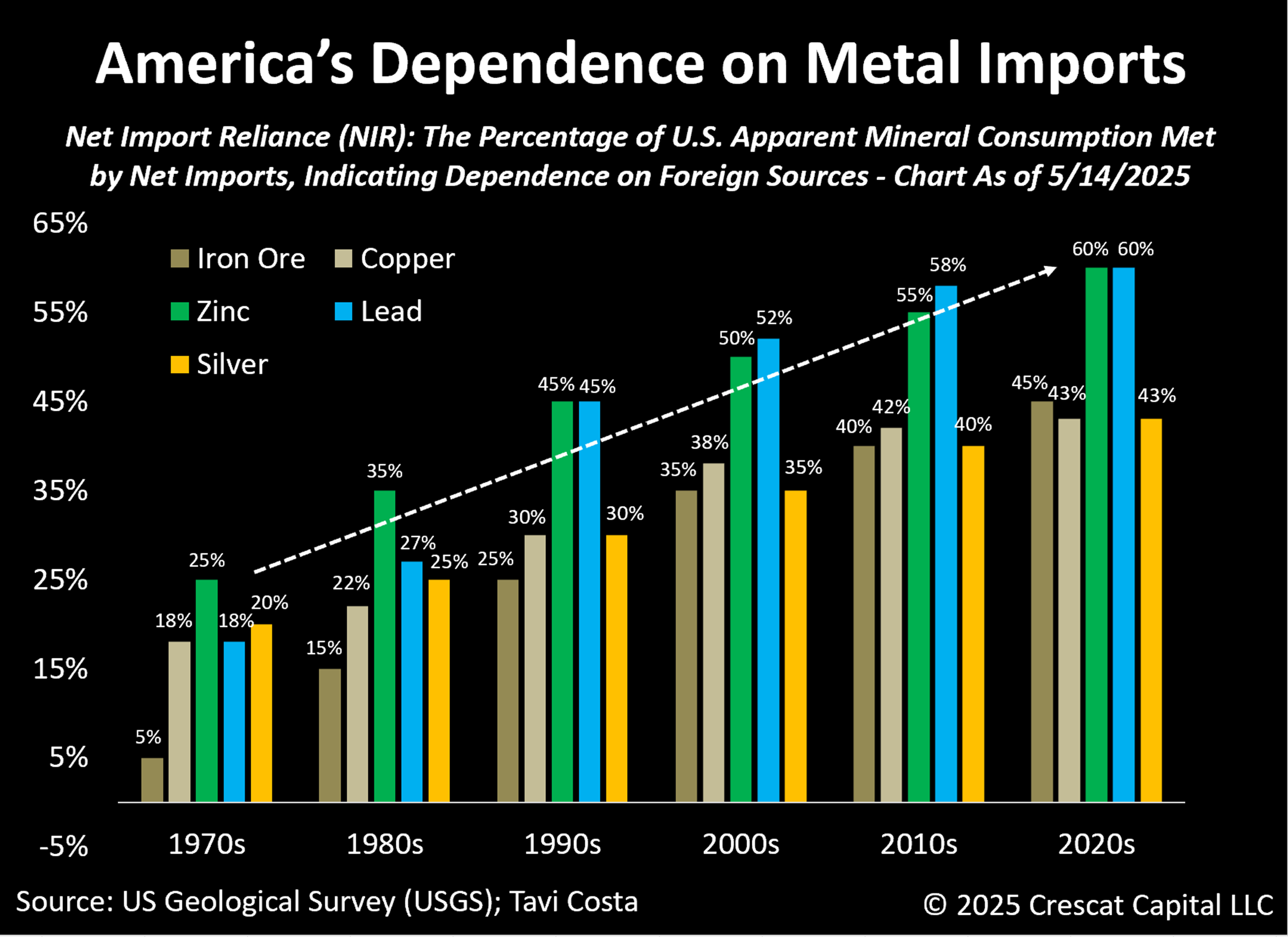

Mining: The Bedrock of Innovation and Industrial Revival

The United States faces a foundational challenge: the pursuit of leadership in artificial intelligence, industrial regeneration, and domestic manufacturing depends not only on digital infrastructure or intellectual capital… Continue Reading Here ›

3 of the Top 10 Hedge Funds in 2025

We are thrilled to report that Crescat’s funds are off to a great start in 2025. All three Crescat funds rank in the top 10 of the 873 hedge funds in the Preqin database with year-to-date performance through March. Continue Reading Here ›