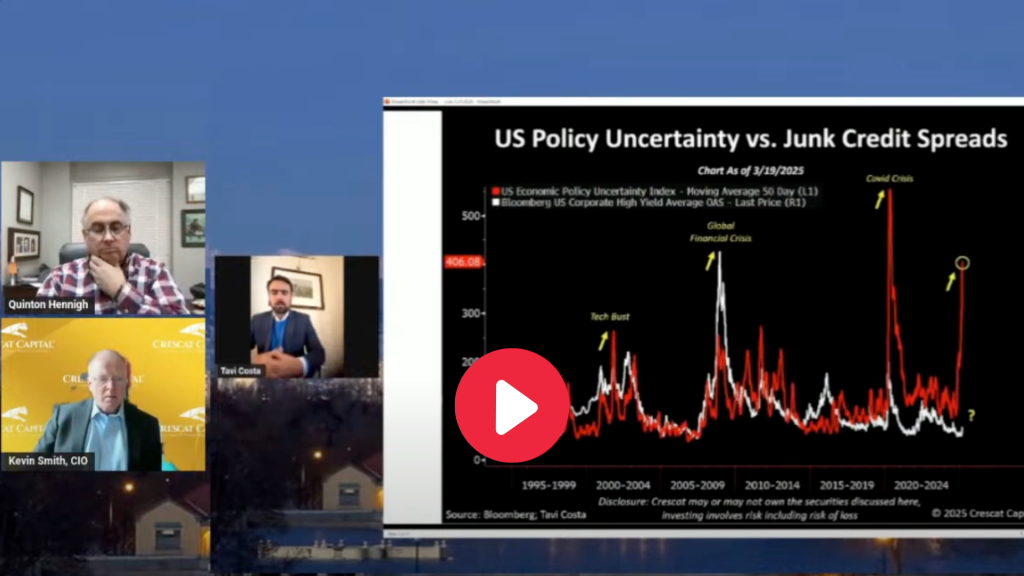

Crescat’s Live Market Call – March 21st, 2025 Commentary

March 21, 2025 - Covers the recent White House mineral production initiative, gold miners historic levels, US 2-year yield, policy uncertainty and more from the macro side, led by Kevin Smith, CIO, and Tavi Costa, Macro Strategist. From there, Dr. Quinton Hennigh takes over to discuss mining updates from Goliath Resources, Snowline Gold and many more Crescat invested exploration companies. Learn More »

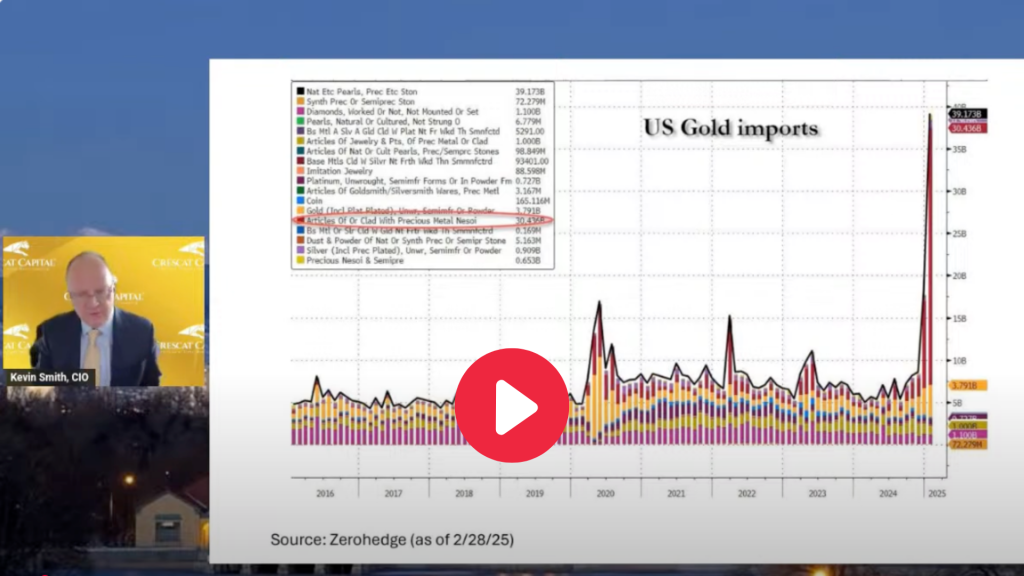

Crescat’s Live Market Call – March 7th, 2025 Commentary

March 7, 2025 - Covered key financial topics, including gold imports, U.S. versus global gold reserves, Bitcoin's market performance, and global equity markets' price-to-book ratios. The discussion also explored the relationship between the U.S. dollar and the 10-year Treasury yield, providing insights into macroeconomic trends. Additionally, the team shared updates on companies like Eloro, Inflection, Sitka, and Hannan, highlighting recent developments and investment opportunities. Learn More »

Eric Sprott Kitco PDAC Interview

March 7, 2025 - Kitco: “Who’s the next Eric Sprott?” Eric Sprott: “Crescat!” Eric points out why it is important to be invested in small-cap gold and silver miners now. Learn More »

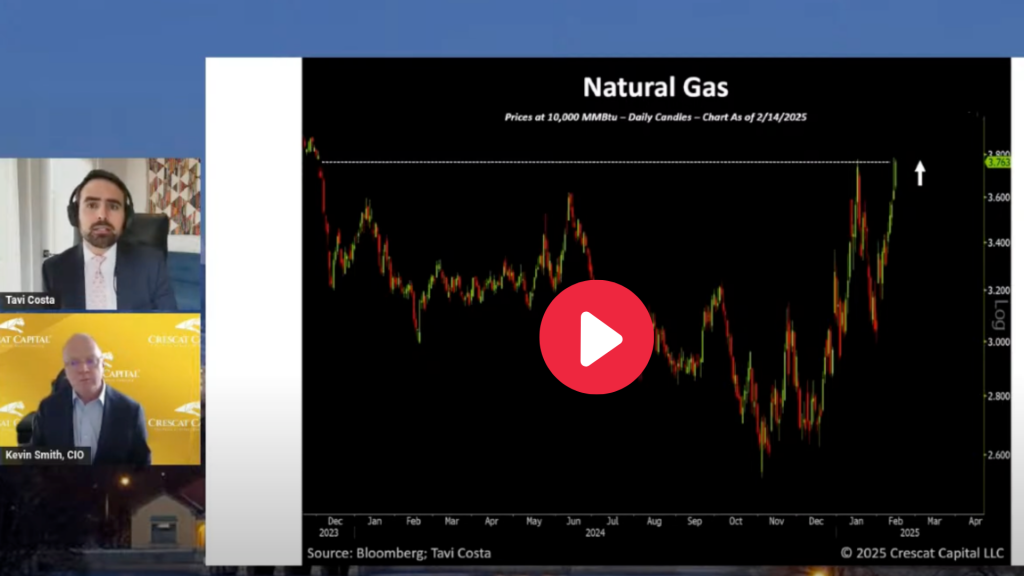

Crescat’s Live Market Call – February 21st, 2025 Commentary

February 21, 2025 - This week’s call covers key macroeconomic trends, including rising U.S. net interest payments and defense spending as a percentage of GDP, along with long-term inflation expectations. It also highlights natural gas price movements, the performance of the U.S. dollar index (DXY), and updates on mining companies like Eloro Resources and Eskay Mining. Learn More »

Crescat’s Live Market Call – February 14th, 2025 Commentary

February 14, 2025 - Crescat’s Live Market Call – macro edition, featuring @crescatkevin and @TaviCosta. Covering YTD performance by currency, commodity prices, gold prices vs. the cost of mining and more. Then diving into the history of gold equity prices, historical gold takeout prices, and how Crescat is positioned to capitalize on these macro moves. Learn More »

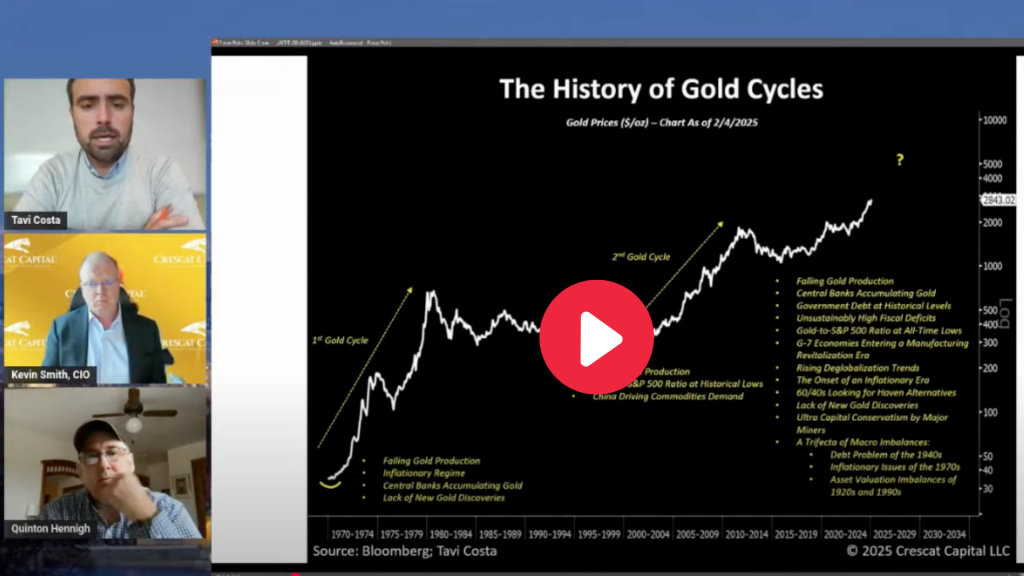

Crescat’s Live Market Call – February 7th, 2025 Commentary

February 7, 2025 - This weeks call covers long-term inflation expectations, the “Magnificent 7”, and gold miners cash flow per share. How does the history of gold compare to the current gold cycle? Then Quinton Hennigh, PhD, jumps in to cover recent updates for the mining world. Learn More »

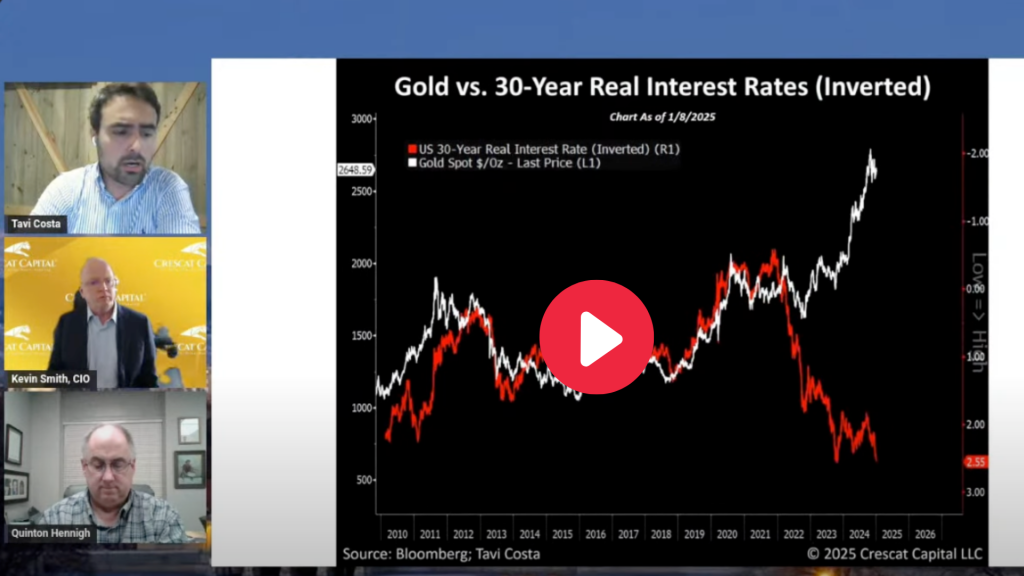

Crescat’s Live Market Call – January 17th, 2025 Commentary

January 17, 2025 - Looking at macro imbalances in the current market and the overarching disruptive catalysts. Conversation covers oil prices, inflation expectations, and gold vs. 30-year real interest rates. From there, Quinton Hennigh, PhD, takes over to provide updates on the 2025 plans of a few of our junior explorers. Learn More »

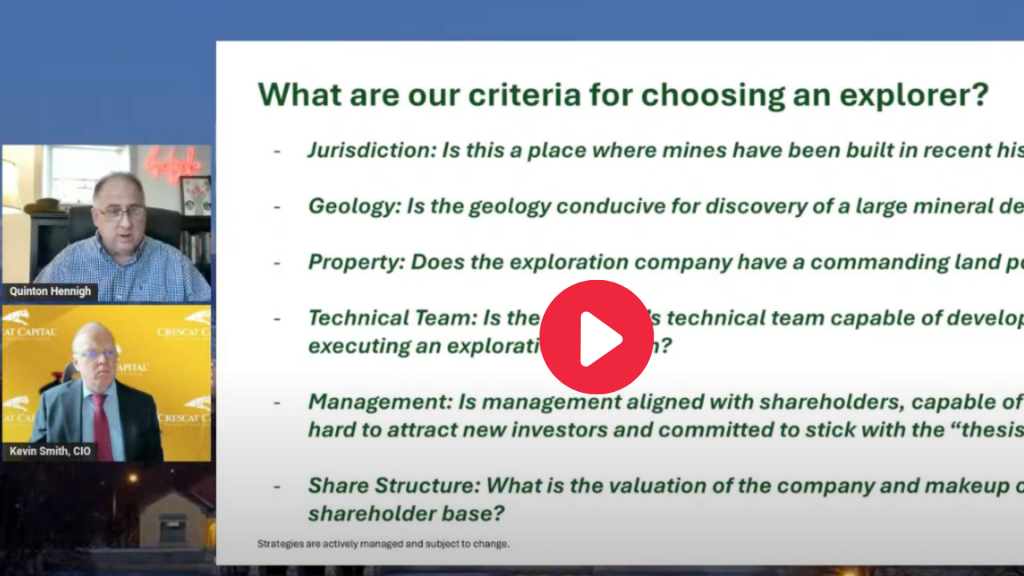

Crescat’s Live Market Call – January 3rd, 2025 Commentary

January 3, 2025 - Crescat's Live Market Call featured insights from Kevin Smith (CIO), Tavi Costa (Macro Strategist), and Quinton Hennigh on macro-level investment strategies and 2025 market projections. The team emphasized predicted upcoming trends, and covered our criteria for investing in an exploration mining company. Learn More »

Crescat’s Live Market Call – December 20th, 2024 Commentary

December 20, 2024 - If you are an accredited investor and want to see a research paper that synthesizes all of this and more for Crescat’s private fund clients and qualified prospective clients, please email miwahashi@crescat.net requesting the Mara-a-Lago Accord client letter. Learn More »

Crescat’s Live Market Call – December 6th, 2024 Commentary

December 6, 2024 - This weeks video features detailed market insights and charts, with discussions on resource estimation methods for companies with drill results and projected production metrics in mining operations. Learn More »