Excessive valuations and investor overcrowding in US megacap tech stocks in our view represent the biggest risk to the overall US stock market and economy today. Competition from US VC-funded startups, creative destruction from open-source AI innovation itself, and Chinese state-sponsored cyber warfare all threaten the high-margin monopolistic business models of the US tech giants.

Crescat may or may not hold positions at any given time in the securities referenced. This is not a recommendation or endorsement of any secure or other financial instrument.

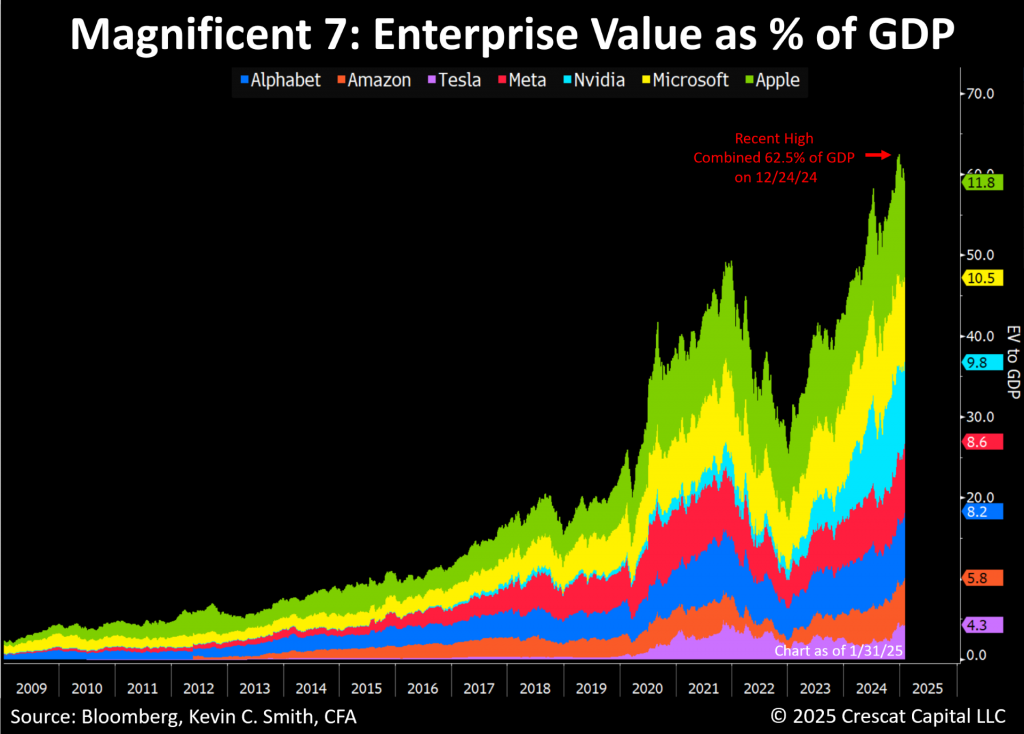

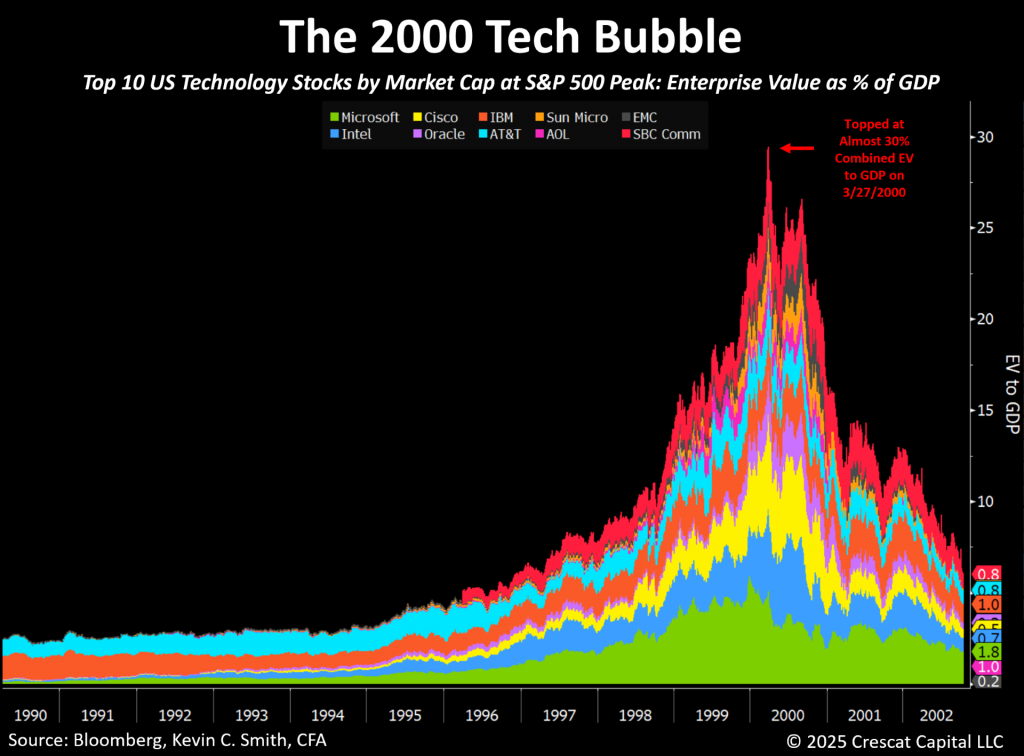

More Imbalanced Than the 2000 Tech Bubble

As measured by combined enterprise value to GDP, the overvaluation of the Magnificent Seven US tech stocks is more than twice that of the ten largest stocks at the 2000 tech bubble peak.

Crescat may or may not hold positions at any given time in the securities referenced. This is not a recommendation or endorsement of any secure or other financial instrument.

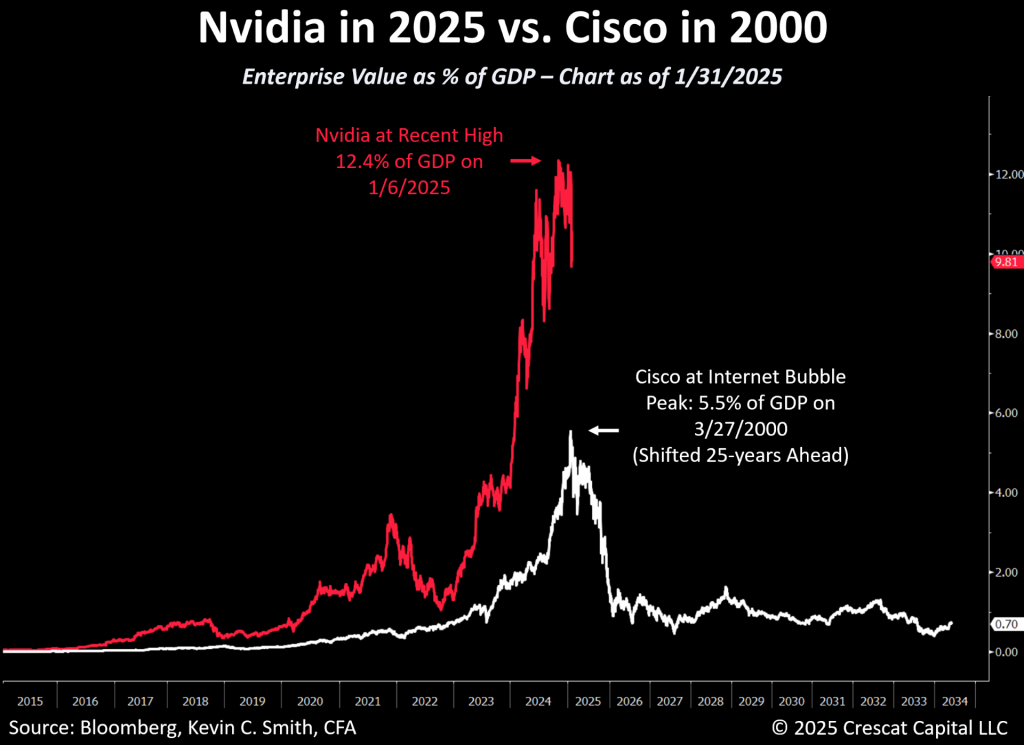

Nvidia Under Attack

The release of China’s open-source DeepSeek R1 may get the credit for bursting the Nvidia bubble, but a potentially even more relevant Nvidia threat is an innovative US AI-semiconductor private company called Cerebras that invented a new chip that outperforms Nvidia’s most advanced GPUs. Cerebras claims a single wafer-scale chip with 900,000 AI-optimized cores and 4 trillion transistors, making it ~56x larger than NVIDIA’s largest GPUs.

Crescat may or may not hold positions at any given time in the securities referenced. This is not a recommendation or endorsement of any secure or other financial instrument.

A Market Meltdown Early for Trump Could be a Blessing in Disguise

While the Trump administration may have preferred to avoid it, a megacap-tech-led stock market crash and recession, if it were to happen in 2025, could be blamed on the Biden administration and would allow for the drastic interest rate cuts required by President Trump to achieve his grand macroeconomic and geopolitical rebalancing agenda. Thus, an early market meltdown could help facilitate a more successful four-year term in the end.

We believe that Treasury Secretary Scott Bessent is one of the key masterminds behind the Trump Administration’s economic and geopolitical plan. Bessent has been telegraphing this plan over the last year. We are eager to see him go into action. This plan includes:

- A new Bretton Woods accord on currency and trade with existing and potentially new NATO allies.

- Peace through military strength funded by US century bonds.

- A new role for gold to underpin the strength of the US dollar as the global reserve currency. We encourage you to subscribe to Zoltan Pozsar’s Ex Uno Plures if you want to learn more or you can reach out to us privately if you want to discuss it.

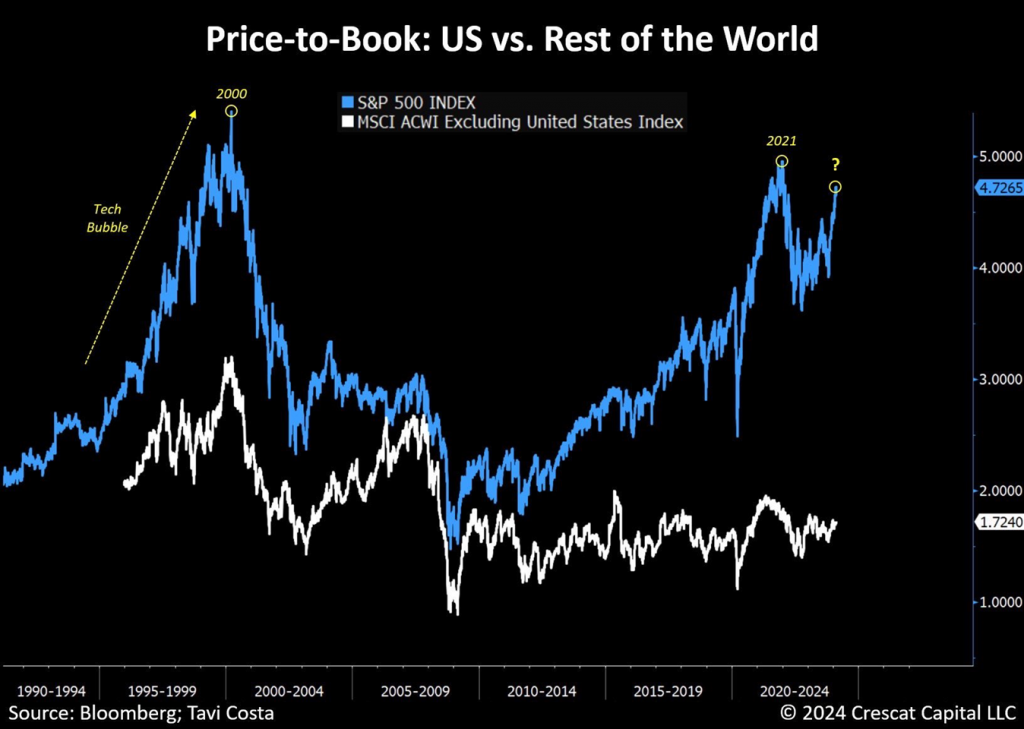

One of the most pressing concerns in global financial markets is the significant valuation imbalances across equity markets. We anticipate a major capital reallocation away from U.S. equities and toward international markets. Investors are often persuaded by narratives that suggest these valuation disparities can persist indefinitely; however, historical patterns indicate that such divergences eventually correct. At a certain point, growth alone is insufficient to justify excessive valuations. In our assessment, a substantial rotation from U.S. equities to global stocks is increasingly likely. While DeepSeek may act as the immediate trigger, the structural foundation for this global rebalancing was firmly established well before its emergence.

In the grand scheme of the financial markets and world economy today, the critical macro imbalances that we see are as follows:

- Speculative asset bubbles in US megacap tech stocks, US corporate credit, and cryptocurrencies.

- Unsustainable interest cost on the US debt burden which threatens the steepest decline in pro-growth fiscal spending in 40 years.

- Persistent global trade imbalances that have destroyed good-paying US middle-class jobs and made the country too reliant on the supply chain of a foreign geopolitical adversary.

- Economic distress among broad US lower and middle-income population from high inflation.

- US and worldwide underinvestment in critical precious and base metal resources that are necessary to support a growing, non-inflationary, and technologically advanced civilization.

We identify multiple potential catalysts that could trigger a reconciliation of these imbalances:

- China DeepSeek’s bursting of the US megacap tech bubble.

- Tariffs: While a potentially viable negotiating play, Trump/Bessent tariffs threaten trade, corporate profitability, and the overvalued US stock market.

- Tariffs: Consider that the 1929 stock market collapse began on Oct. 28,1929 when news spread that the Smoot Hawley Tariff Bill would become law. The front-page New York Times article read: “Leaders Insist Tariff Will Pass.”

- Tariffs: Now consider today’s lead Wall Street Journal Story: “Trump Threatens Widening Trade War as First Tariffs Loom”.

- Liquidity: The lag-effect of Jay Powell’s higher interest rate hikes to fight inflation as low-interest-rate Covid debt is starting to roll over and needs to be refinanced.

- Liquidity: The draining of almost all the excess liquidity from the Fed’s Reverse Repo Facility, an incoming gift to the Trump Administration from Janet Yellen and Jay Powell.

- Liquidity: China and the East are challenging the supremacy of the US dollar as the world reserve currency for trade at the same time as a rising US dollar versus other fiat currencies poses a global liquidity squeeze, a Triffin Dilemma.

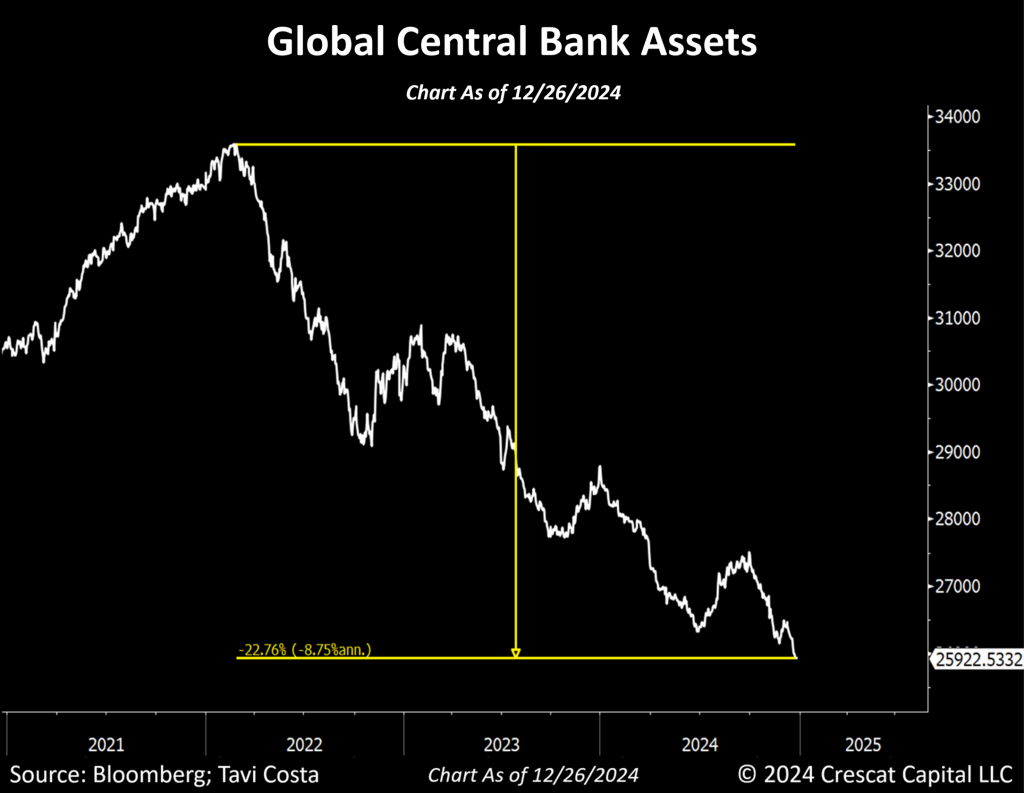

Importantly, global central bank assets have contracted to their lowest level in over four years. This is largely due to the strength of the dollar, which is suffocating the global economy. We believe a USD devaluation, whether coordinated or organic against other currencies, is inevitable.

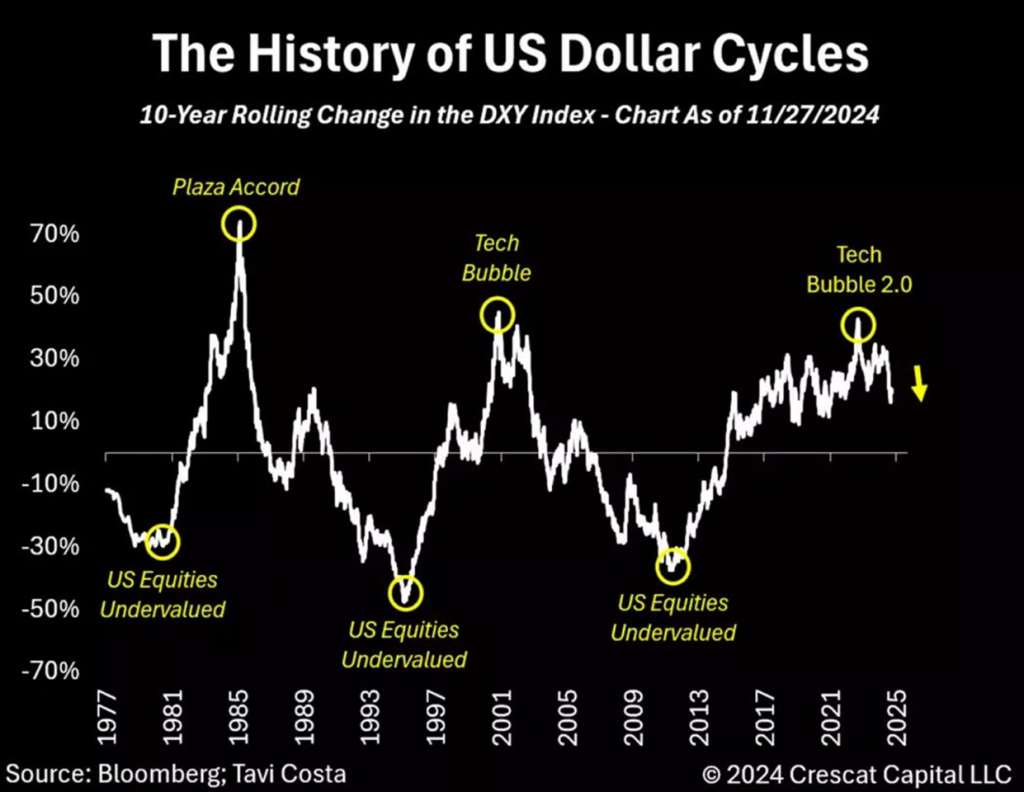

As we start the year, we have been reflecting on what we consider to be one of the most consequential macro trends likely to unfold in 2025 and beyond. We contend that the US dollar is approaching a cyclical peak, with its long-term decline already evident on a 10-year rolling basis.

In our assessment, the interplay of declining fiscal stimulus and structurally lower interest rates—partially designed to alleviate the government’s debt burden—is poised to serve as the primary catalyst for the dollar’s depreciation in 2025. However, currency movements are inherently relative. Notably, no other major economy—whether Japan, Canada, the Eurozone, the UK, or Australia—faces the same imperative as the United States, which must sustain GDP growth of nearly 5% merely to service its debt.

An often-overlooked factor in the dollar’s recent strength is the potential impact of trade policies, particularly the enduring effects of Trump-era tariffs. While these measures could generate a short-term shock, they represent only one facet of the broader policy agenda of the new administration, in our view. As newly appointed Treasury Secretary Scott Bessent has articulated, Trump’s vision of a weaker dollar coexisting with its reserve currency status is not mutually exclusive.

Overall, the risks to the U.S. dollar appear asymmetrically skewed to the downside. Even if short-term fluctuations result in an initial appreciation, the broader and more consequential trajectory is likely to be one of long-term depreciation. If this scenario materializes, this shift could represent one of the most profound transformations in the macro landscape since the Global Financial Crisis.

Scott Bessent takes office as Treasury Secretary under enormous US budget and trade deficits, facing a potential tech bust, an empty liquidity piggybank, and an unwieldy near-term balance sheet refinancing requirement. Fortunately, we believe the new Treasury Secretary has many constructive surprises in store to loosen up the monetary plumbing. These ideas have been advised by Zoltan Pozsar and others to free up new liquidity, and we expect Bessent will implement them over the next several weeks and months. We think the shock of a US stock market meltdown in the near term would only help him and President Trump to move forward more urgently with their big ideas.

Crescat’s Positioning

Our activist metals portfolio is the largest thematic long exposure across all Crescat’s private funds today. The Crescat Precious Metals Fund is long-only at this time and predominantly focused on what we believe are deeply undervalued gold and silver miners that have the potential for substantial countercyclical upside in a potential megacap tech selloff as well as under Pozsar’s vision for gold in the new Bretton Woods monetary order. Our Long/Short and Global Macro funds also have substantial long exposure in our activist metals portfolio but in addition have significant asymmetric short exposure through put options on the S&P 500, Nasdaq 100, and select megacap tech stocks at this time.

We have built our activist metals portfolio over the last four years by providing capital to exploration-focused companies. In the process, our companies have made some of the biggest and most exciting new, economic metal discoveries in viable mining jurisdictions around the world.

Working with an experienced geologist over the last four years, we have created a portfolio of bona fide and incipient metal deposits that we are confident are deeply undervalued and offer what we believe is a high margin of relative safety for new and existing investors in our funds. The mining industry has been out of favor for about fourteen years now, and this has allowed us to accumulate large activist stakes cheaply in a portfolio of companies that have been flying below the radar. There is still a great opportunity to put money to work at depressed levels while the world is still chasing overvalued megacap tech stocks. Given our macro outlook for continued higher gold, silver, and base metal prices in the near-to-intermediate term, and the lack of investment in exploration and building new mines by the majors, we think our deep-value strategy in the exploration segment is highly compelling.

We are comfortable that the intrinsic value of our portfolio is worth substantially more than today’s market prices for our companies, and that volatility can work to the upside in a profound way to more than justify the risk. As value and macro investors working with a renowned exploration geologist helping to advise us, we believe Crescat has an edge to deliver strong upside for our clients over the course of a new secular commodity bull market that we think is long overdue and only in the early innings.

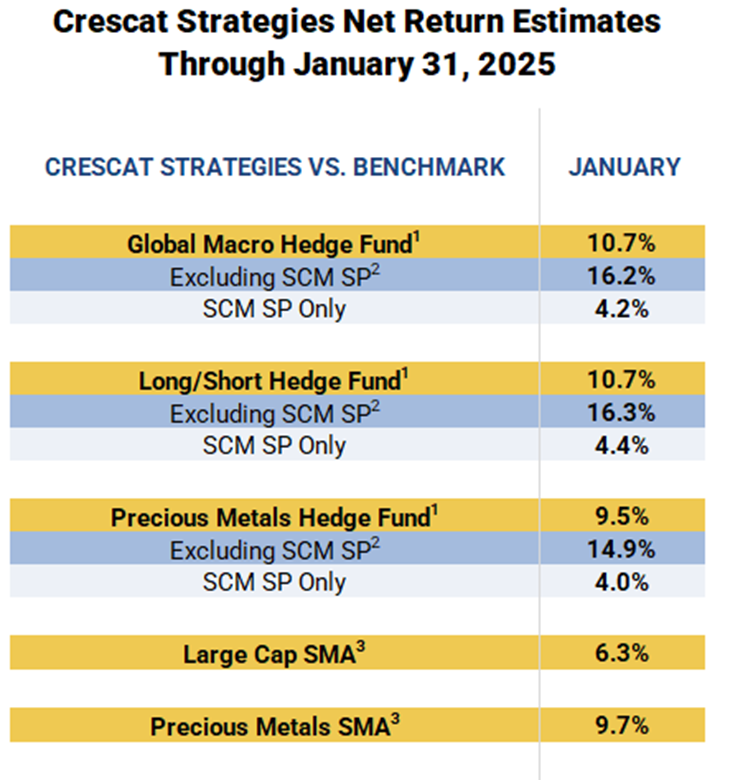

Estimated Performance for January 2025

Crescat’s private funds delivered strong performance in January. Note the especially strong performance in the table below outside of the San Cristobal side pocket which was driven mainly by our publicly traded activist metals positions though offset by a small loss in the Canadian dollar. A dividend at SCM also contributed a 4.2% net gain inside the side pocket which was not otherwise revalued in January. Short positions in Nvidia, Apple, and Microsoft also delivered net gains in the Global Macro and Long/Short funds within our megacap growth ceiling theme partially offset by small losses in that theme. The last two years have been extremely frustrating as our performance suffered while we stayed true to our core convictions. We believe those convictions are only just starting to be vindicated. For the sake of all our loyal investors, whom we truly appreciate, our goal is to deliver for you by pushing to new high-water marks in 2025 and beyond.

*See disclosures below. Past performance is not indicative of future results.

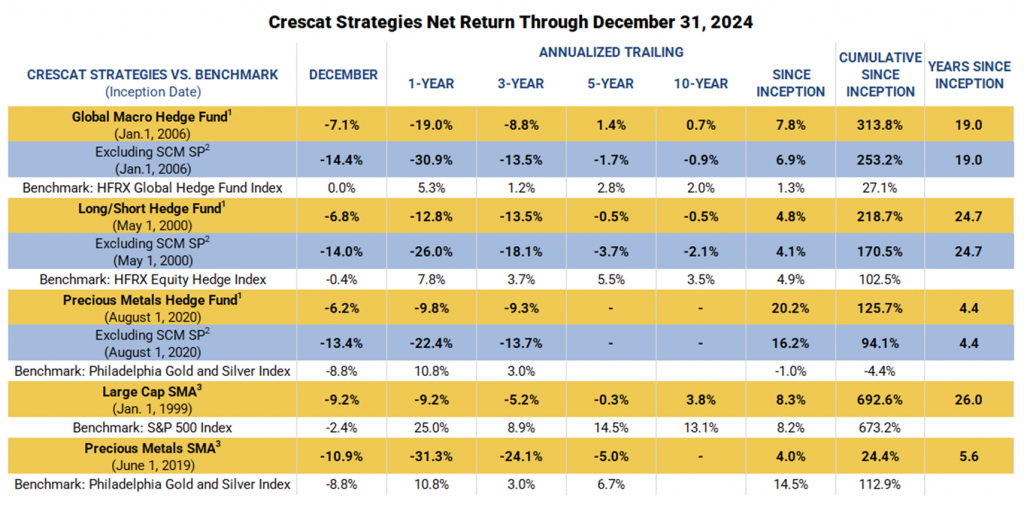

Performance Through December 2025

*See disclosures below. Past performance is not indicative of future results.

We encourage you to reach out to any of us listed below if you would like to learn more about how our investment vehicles might fit with your individual needs and objectives.

Sincerely,

Kevin C. Smith, CFA

Founding Member & Chief Investment Officer

Tavi Costa

Member & Macro Strategist

Quinton T. Hennigh, PhD

Member & Geologic and Technical Director

For more information including how to invest, please contact:

Marek Iwahashi

Head of Investor Relations

miwahashi@crescat.net

(720) 323-2995

Linda Carleu Smith, CPA

Co-Founding Member & Chief Operating Officer

lsmith@crescat.net

(303) 228-7371

© 2025 Crescat Capital LLC

Important Disclosures

This letter is being provided for informational purposes only. It does not have regard to the specific investment objective, financial situation, suitability, or the particular need of any specific person who may receive this presentation and should not be taken as advice on the merits of any investment decision. The letters represent the opinions of CPM, as an exploration industry advocate, on the overall geologic progress of our activist strategy in creating new economic metal deposits in viable mining jurisdictions around the world. Issuers discussed have generally been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. Any securities discussed herein do not represent an entire portfolio and in the aggregate may only represent a small percentage of a strategy’s holdings. The Issuers discussed may or may not be held in such portfolios at any given time. The Issuers discussed do not represent all of the investments purchased or sold by Funds or Strategies managed by CPM. It should not be assumed that any or all of these investments were or will be profitable. Investments in Issuers discussed may not be appropriate for all investors. Actual holdings will vary for each client or fund and there is no guarantee that a particular account will hold any or all of the securities discussed.

Projected results and statements contained in this letter that are not historical facts are based on current expectations and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results.

This letter may contain certain forward-looking statements, opinions and projections that are based on the assumptions and judgments of Crescat with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Crescat. Because of the significant uncertainties inherent in these assumptions and judgments, you should not place undue reliance on these forward looking statements, nor should you regard the inclusion of these statements as a representation by Crescat that these objectives will be achieved. These opinions are current as of the date stated and are subject to change without notice. The information contained in the letter is based on publicly available information with respect to the Issuers as of the date of such letter and will not be updated after such date.

Discussion and details provided is for informational purposes only. This letter is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security, services of Crescat, or its Funds. The information provided in this letter is not intended as investment advice or recommendation to buy or sell any type of investment, or as an opinion on, or a suggestion of, the merits of any particular investment strategy.

CPM has not sought or obtained consent from any third party to use any statements or information indicated herein that have been obtained or derived from statements made or published by such third parties.

All content posted on CPM’s letters including graphics, logos, articles, and other materials, is the property of CPM or others and is protected by copyright and other laws. All trademarks and logos are the property of their respective owners, who may or may not be affiliated with CPM. Nothing contained on CPM’s website or social media networks should be construed as granting, by implication, estoppel, or otherwise, any license or right to use any content or trademark displayed on any site without the written permission of CPM or such other third party that may own the content or trademark displayed on any site.

Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data, including Estimated Performance, is subject to revision following each monthly reconciliation and/or annual audit. Individual performance may be lower or higher than the performance data presented. The currency used to express performance is U.S. dollars. Before January 1, 2003, the results reflect accounts managed at a predecessor firm. Crescat was not responsible for the management of the assets during the period reflected in those predecessor performance results. We have determined the management of these accounts was sufficiently similar and provides relevant performance information.

1 – Net returns reflect the performance of an investor who invested from inception and is eligible to participate in new issues and side pocket investments. Net returns reflect the reinvestment of dividends and earnings and the deduction of all expenses and fees (including the highest management fee and incentive allocation charged, where applicable). An actual client’s results may vary due to the timing of capital transactions, high watermarks, and performance.

Benchmarks

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

Standard and Poor’s 500 Metals & Mining Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The parent index is SPXL3. This is a GICS Level 3 Industries. Intraday values are calculated by Bloomberg and not supported by S&P DJI, however the close price in HP<GO> is the official close price calculated by S&P DJI.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a CPM hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. CPM’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to CPM’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any CPM hedge fund with the SEC. Limited partner interests in the CPM hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in CPM’s hedge funds are not subject to the protections of the Investment Company Act of 1940.

Those who are considering an investment in the Funds should carefully review the relevant Fund’s offering memorandum and the information concerning CPM. Investors may obtain the most current performance data, private offering memoranda for CPM’s hedge funds, and information on CPM’s SMA strategies, including Form ADV Part 2 and 3, emailing info@crescat.net. For additional disclosures including important risk disclosures and Crescat’s ADV please see our website: https://www.crescat.net/due-diligence/disclosures/