The recent surge in gold prices reflects what we believe are the inevitable consequences of decades of ultra-loose monetary policies, excessive debt accumulation, and fiscal mismanagement. Those who have long dismissed gold’s role as a safe-haven asset are now witnessing a stark reminder of its historical significance. For centuries, gold has served as the cornerstone of monetary systems, offering a crucial reference point in periods of economic overleveraging. History provides invaluable insights into gold’s role in stabilizing monetary frameworks during times of financial strain.

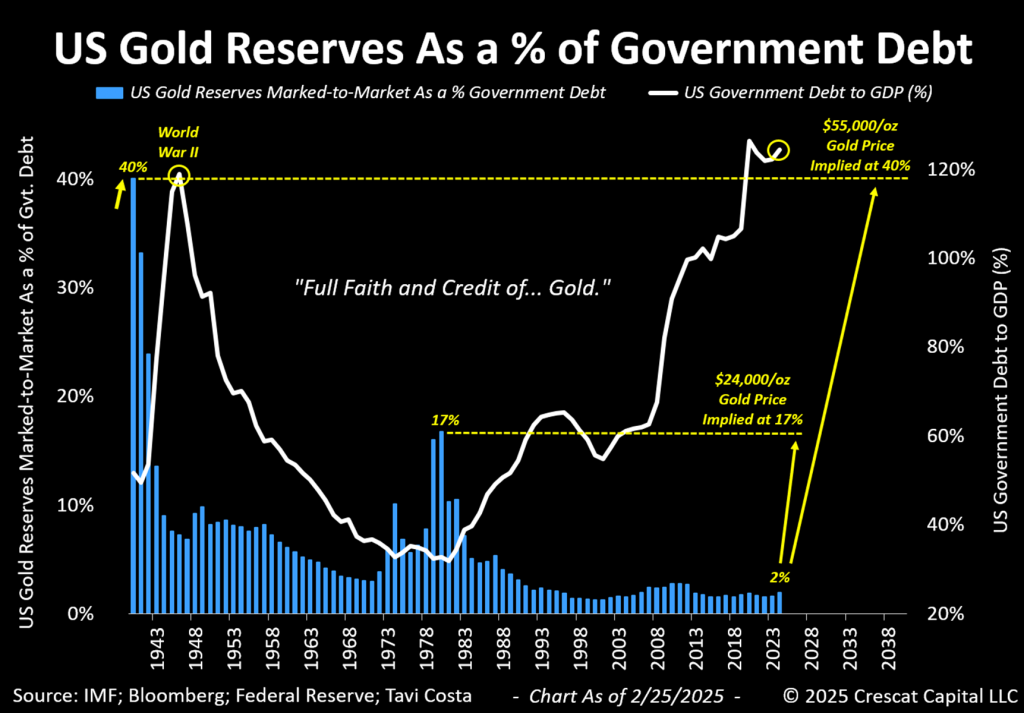

As illustrated below, US Treasury gold reserves currently account for a mere 2% of total outstanding government debt — one of the lowest levels in history. To dispel any debate, this figure already reflects the mark-to-market adjustment at prevailing gold prices.

The current situation stands in sharp contrast to earlier periods, particularly the onset of World War II, when government debt was 40% backed by gold reserves. Notably, wartime financing drove a nearly 150% expansion in the money supply and a record debt-to-GDP ratio — yet even that remained below today’s levels.

The chart above illustrates implied gold prices if US metal reserves were to be revalued to historical peak levels relative to current government debt, assuming all else remains constant. Notably, if the value of the US gold reserves to government debt were to rise to 17%, it would imply a gold price of approximately $24,000 per ounce or an 8.5-fold increase. More dramatically, should this ratio reach 40%, it would suggest a price of $55,000 per ounce.

However, these are just illustrations, not price targets, and all else is not equal.

Our macro interest in gold comes from our long-held belief that the United States must ultimately intervene by expanding its gold reserves to reestablish a degree of fiscal and monetary discipline in proportion to its mounting debt obligations. Historically, the ratio of gold reserves to government debt has exhibited pronounced cyclicality, and in our assessment, the current policy trajectory is long overdue for a strategic shift toward gold accumulation. International central banks have already begun acting in their own self-interest by increasing their gold reserves. In our view, time is running out for the United States to do the same.

International Gold Buying Spree

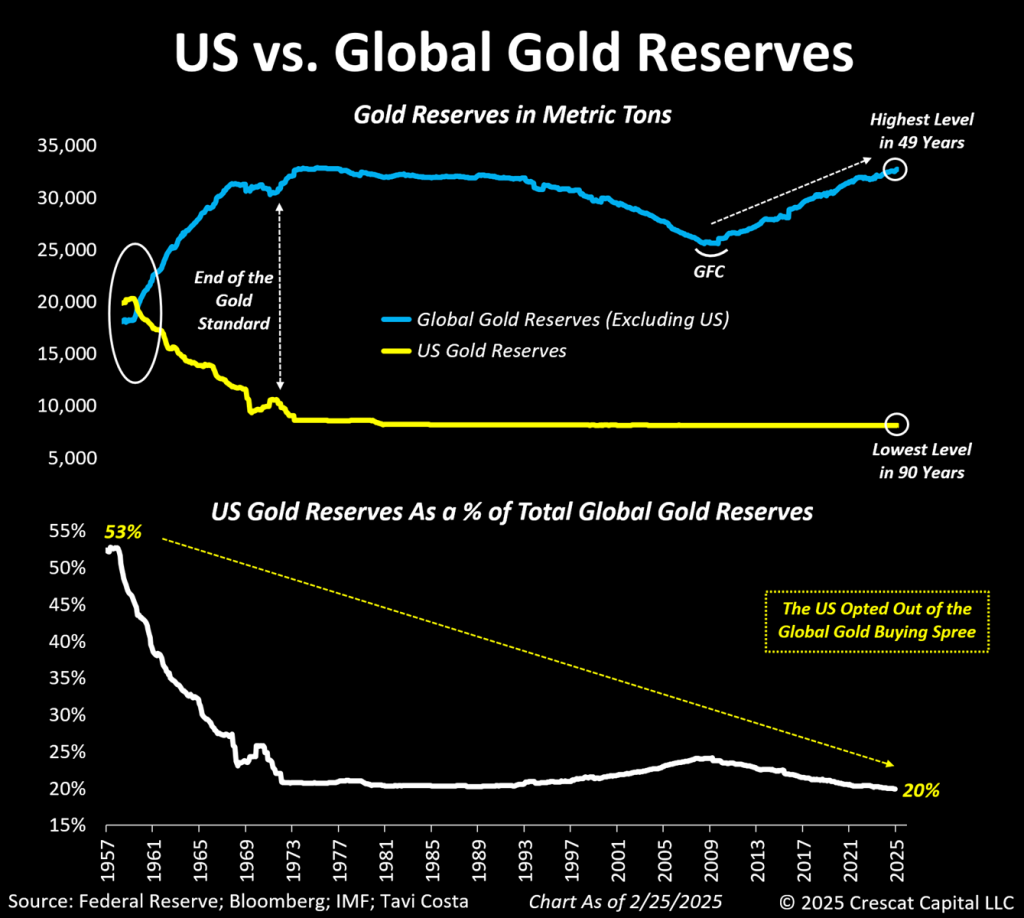

The chart below gains increasing significance as we appear to be entering a critical phase of global monetary realignment — a view shared by Scott Bessent during his ascension to Treasury Secretary.

The United States’ lack of participation in the central bank gold accumulation trend since the Global Financial Crisis has been notable. Excluding the US, global gold reserves have now surged to their highest level in 49 years, whereas US reserves have plunged to a 90-year low.

It is worth noting that in the 1950s, the United States held more gold than the rest of the world combined. Since then, an unmistakable and seemingly irreversible downward trajectory has taken hold. Today, US gold holdings account for just 20% of total global reserves — the lowest proportion in nearly a century.

Two critical considerations must be addressed. First, the assumption that the US indeed holds the gold it officially reports. This is not to indulge in speculative conjecture, but given the decades of fiscal and monetary mismanagement, a prudent degree of skepticism is not only justified but necessary. Second, the data presented accounts solely for officially disclosed reserves. In a world where central banks outside the US have been amassing gold, the scale of unreported accumulation remains an open question.

A Global Rebalancing Ahead

Irrespective of political leadership, economies burdened by extreme leverage inevitably reach a tipping point where bond investors begin pricing in either heightened default risks or the necessity of inflationary policies to erode unsustainable debt burdens. This shift has been playing out in the US economy since the post-Covid era, with the Treasury market enduring a 15% three-year rolling decline for three consecutive years — an event unprecedented in over two centuries.

This dynamic creates a self-reinforcing policy dilemma. While fiscal consolidation is essential for restoring investor confidence in US Treasuries and reducing long-term interest rates, one of the most immediate and effective approaches to lowering government spending is for the Federal Reserve to cut interest rates itself.

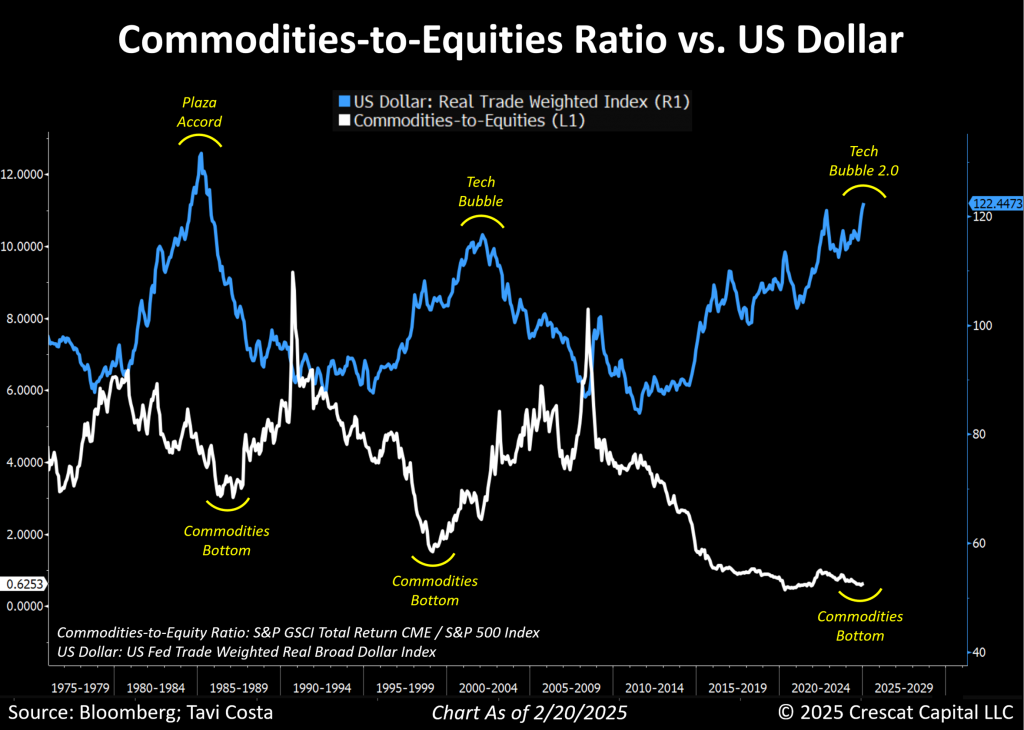

Ultimately, when a country is compelled to achieve a minimum annual growth rate of 5% to manage its debt effectively, prioritizing a reduction in yields becomes paramount at virtually any cost. The larger question, however, is: what is the usual outcome of austerity combined with lower rates? A weaker dollar, which, in our assessment, could have profound implications for global financial markets. Empirical evidence suggests that the dollar’s long-term movements exhibit a strong inverse correlation with the commodities-to-equities ratio. Historically, when the dollar enters a structural downtrend, commodities and other hard assets tend to significantly outperform US equities.

US Dollar: At a Turning Point

The recent depreciation of the US dollar, which is now re-testing levels from two years ago, remains underappreciated by investors despite its far-reaching implications for global financial markets.

If the US dollar is nearing a structural peak, with the commodities-to-equities ratio at 60-year lows, a reversal of these trends in the coming years would be a natural progression — particularly in an environment where US equity valuations remain historically elevated.

In anticipation of these macro shifts, our investment strategies are structured accordingly. We are repositioning away from inflated US equities, particularly in the technology sector, and reallocating capital toward historically underfunded segments of the market. These include commodities, natural resource equities, emerging markets, select developed economies. Most notably, we are investing in precious and base metal mining stocks in viable mining jurisdictions around the world, including in the US, with the goal of capitalzing on what we believe will be on the biggest and most exciting gold bull markets in history.

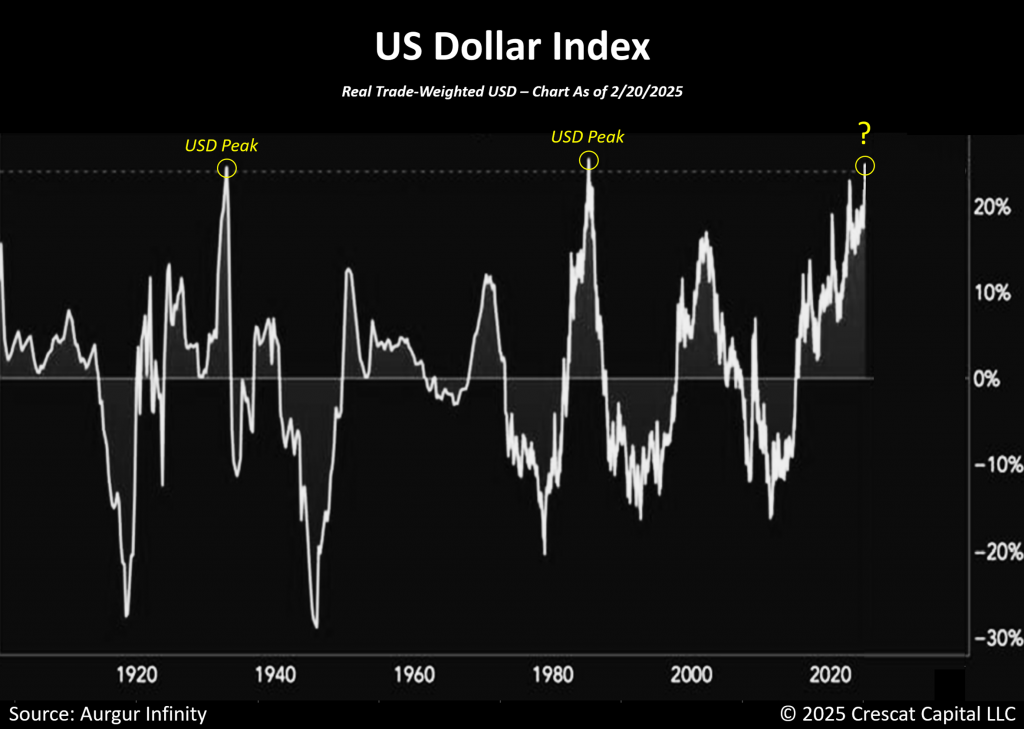

The chart below is arguably one of the most important in this letter. The dollar real trade-weighted index quantifies the value of the US dollar against a basket of currencies from key trading partners, factoring in inflation. This index provides a comprehensive view of the dollar’s purchasing power and competitiveness in global trade by incorporating both exchange rates and price levels among countries.

The US dollar is currently at one of its most overvalued levels relative to other fiat currencies in over 120 years of data. Comparable extremes in 1933 and 1985 were ephemeral and preceded significant devaluations.

Thanks to Augur Infinity for the inspiration behind the chart.

Unlike the coordinated efforts of global central banks to weaken the dollar during its 1985 surge, known as the Plaza Accord, the situation with the dollar’s 1933 peak was different. This earlier period was marked by a lack of international collaboration and unilateral actions taken by the United States.

During the Great Depression, several major economies abandoned the gold standard, causing the US dollar to appreciate sharply against other currencies. This placed pressure on the American economy, prompting President Franklin D. Roosevelt to take action.

On March 6, 1933, he declared a bank holiday to curb a banking crisis. A month later, on April 5, Executive Order 6102 forced US citizens to surrender most of their gold in exchange for dollars. This order aimed to remove constraints on the Federal Reserve’s ability to increase the money supply during the Great Depression and prevent gold hoarding.

The prolonged economic downturn spurred international efforts to restore currency stability, revive trade, and drive recovery. The London Economic Conference, held from June to July 1933, was one such attempt at global coordination. Although the US initially backed these discussions, Roosevelt grew wary of currency stabilization efforts that might constrain his domestic policy options. On July 3, 1933, he effectively withdrew US support, prioritizing domestic recovery over global coordination.

In 1934, the Gold Reserve Act further reshaped the monetary landscape by raising gold’s price from $20.67 to $35 per ounce. This effectively devalued the dollar by 41% against gold, significantly weakening it relative to other currencies. Roosevelt’s approach reflected a broader commitment to unilateral economic recovery, independent of international agreements.

Nearly four decades later, President Richard Nixon made a similarly bold move in 1971 by suspending the dollar’s gold convertibility with foreign central banks, once again redefining the global monetary system.

The history of prior US dollar peaks raises the question of whether we could experience a unilateral or an internationally coordinated effort to devalue the US dollar that is at one of its highest levels in history.

We think a combination of both international cooperation and strong US leadership is the ideal framework to manage a dollar devaluation to alleviate this pressure. The Bretton Woods Agreement of 1944 bridged both of these concepts with US security guarantees and international currency cooperation, ideas that could be applied again today. Such a model could incorporate a Plaza accord twist. Treasury Secretary Scott Bessent has talked about a potential New Bretton Woods Agreement. We believe the Trump Administration is working toward a geopolitical, trade, and currency accord that combines these elements.

A New Era for Global Equities

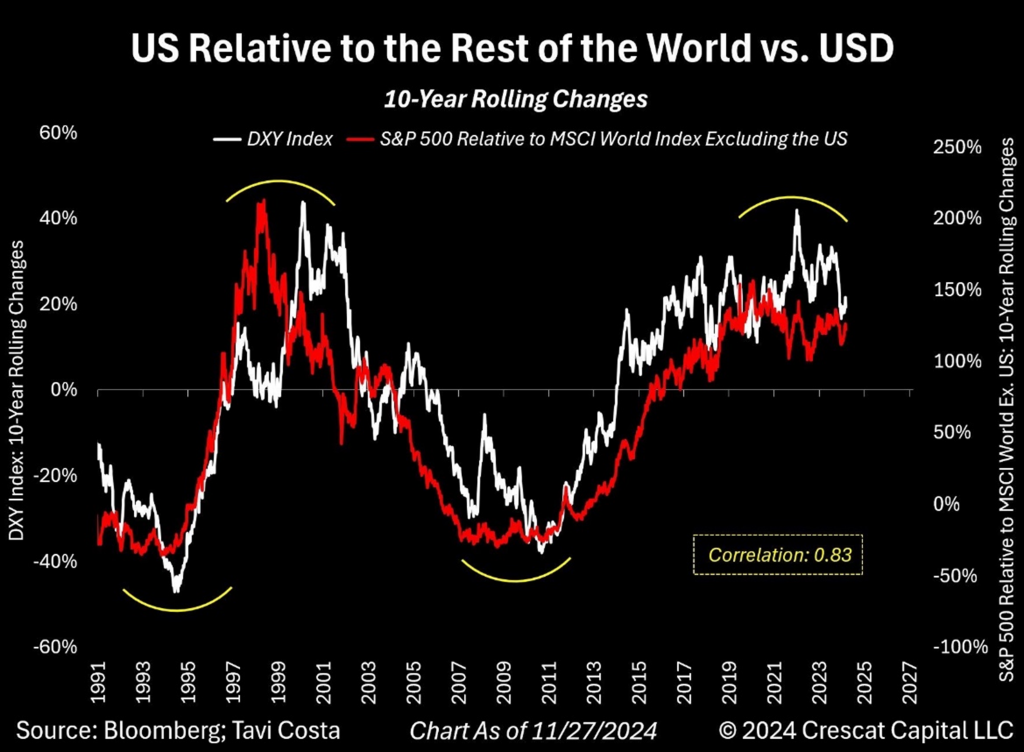

Although the chart below is from a recent letter we wrote, it remains highly relevant today. Global equities are outpacing US stocks as the dollar and yields decline, a trend historically correlated, especially in the long term. We are witnessing a substantial global rebalancing, and in our view, this is just the beginning.

A Tightening Fiscal Climate

Since the Global Financial Crisis, the United States has sustained an extraordinary fiscal trajectory, with deficits averaging 8% of GDP annually. Combined with unprecedented expansions in the monetary base and money supply, government spending has been the dominant driver of economic growth since 2009. No other economy has experienced intervention of this scale, a key factor behind the extreme overvaluation of US equities. Now, policymakers are reversing course, withdrawing the very stimulus that has fueled market gains. This raises a fundamental question:

How can valuations remain elevated when their primary catalyst is being removed? The reality is that the administration’s push for fiscal restraint directly undermines the economic support that has defined the post-GFC era.

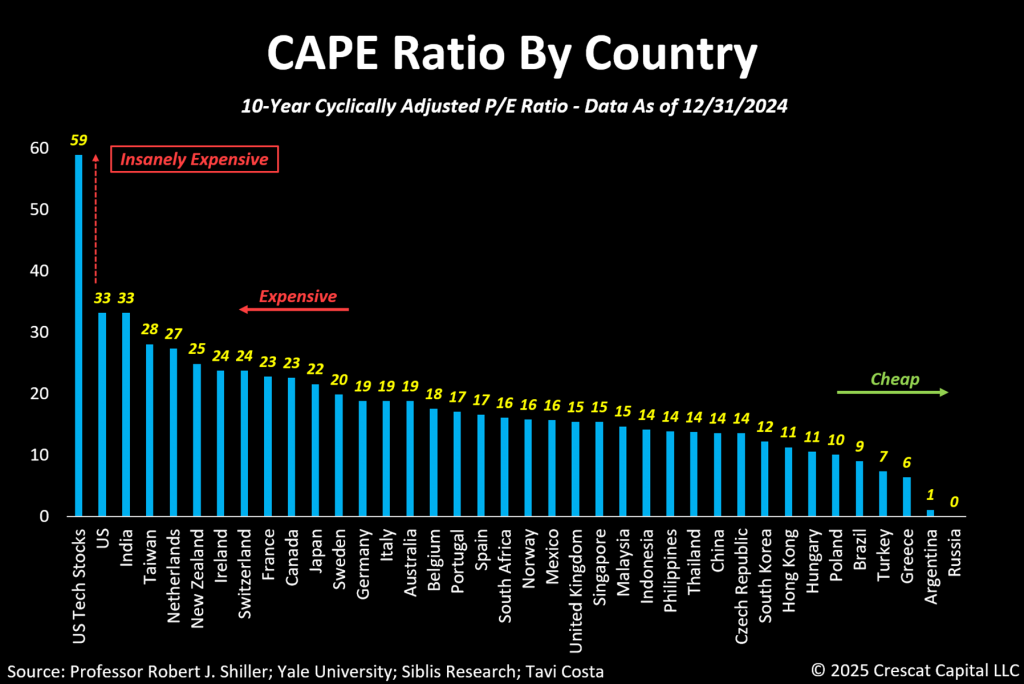

US equities now hold the highest cyclically adjusted price-to-earnings (CAPE) ratio globally, yet even within this overvalued market, technology stocks remain particularly extreme. Historically, a 10-year cyclically adjusted P/E above 30x has consistently preceded weak long-term returns. Today, tech valuations are approaching twice that level — an undeniable sign of speculative excess. Financial bubbles are never permanent, and as macro conditions weaken and liquidity tightens, the likelihood of a sharp reversal grows. We believe this is the risk at hand.

Simultaneously, tariffs at levels unseen since the early 20th century and restrictive immigration policies introduce structural headwinds with severe implications for long-term growth. Global central bank assets, meanwhile, have contracted by double digits from recent peaks, further constraining liquidity. At today’s valuations, these pressures create a precarious setup for financial markets.

This is not a political argument but an objective assessment of policy shifts and their macro consequences.

Some justify extreme US equity premiums by pointing to technological leadership. While innovation has been a crucial factor, it has been amplified by extraordinary fiscal stimulus. More concerning, the U.S. market has reached a level of concentration that is historically unprecedented. American equities now represent an astonishing 70% of the MSCI World Index. Within this dominance, a handful of mega-cap technology stocks have absorbed disproportionate capital inflows, largely driven by passive investment flows that systematically allocate to the largest market-cap-weighted firms.

The prevailing belief is that this dynamic can continue indefinitely, yet history suggests otherwise. Every prior episode of extreme market concentration has ended in sharp reversions, and there is little reason to expect a different outcome this time.

Periods of financial euphoria are often characterized by unrealistic earnings projections used to justify unsustainable valuations. This cycle appears no different. With excessive optimism, record-high concentration, deteriorating macro conditions, and an environment of tightening liquidity, the market faces an unavoidable reckoning.

Extracting Opportunity from Chaos

Despite all the attention on technology and AI, gold is quietly reasserting itself as a crucial macro asset amid growing debt imbalances. While this trend is already unfolding, investors continue to underestimate its broader implications, particularly for assets often viewed as gold derivatives.

The most straightforward high-beta play on rising gold prices remains mining companies, which tend to exhibit significant leverage during metal price upcycles. Yet, the market has largely overlooked the potential for miners to generate substantial profits. The reality is now evident — these companies are reporting earnings, and nearly all are experiencing dramatic margin expansion.

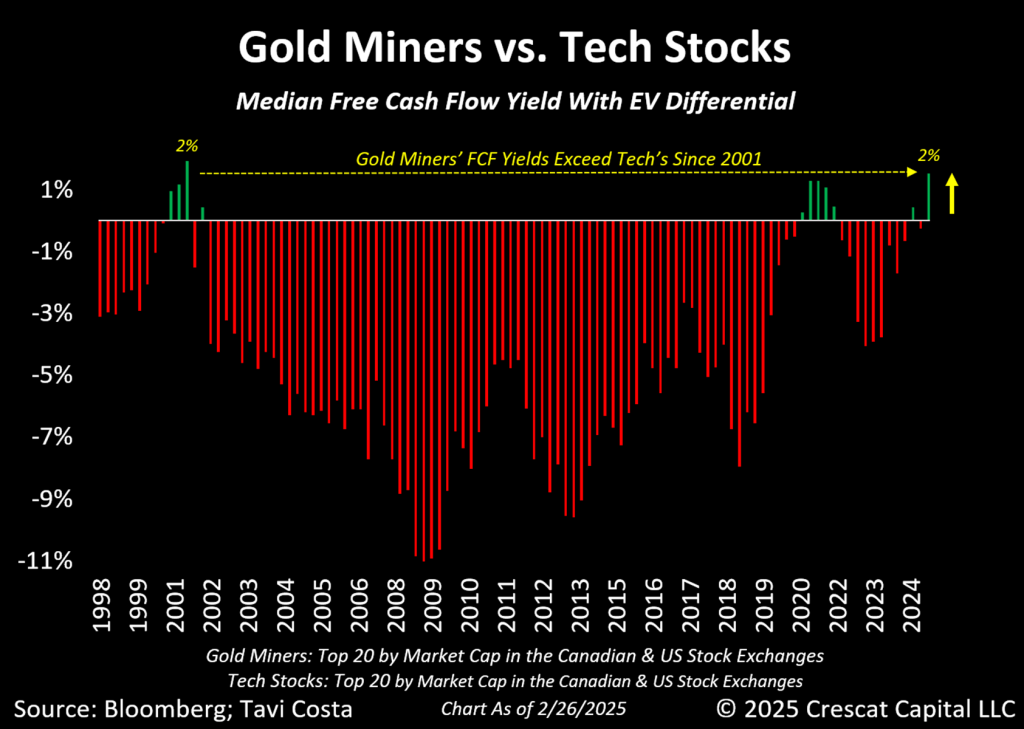

Notably, gold miners currently offer a superior free cash flow yield compared to U.S. equities. As the chart below highlights, this is the first time since 2001 that mining stocks have appeared this attractive. That period marked the beginning of one of the industry’s strongest decades.

Additionally, while many fear that a broader rotation out of U.S. equities could negatively impact mining stocks, despite historical evidence showing resilient performance of mining stocks during major equity market corrections. In the early 2000s, technology stocks collapsed while gold miners found a bottom and surged. We believe a similar dynamic could unfold again, particularly given the widespread skepticism toward this view, despite historical evidence showing varied miner performance during major equity market corrections.

A Disconnect Too Large to Ignore

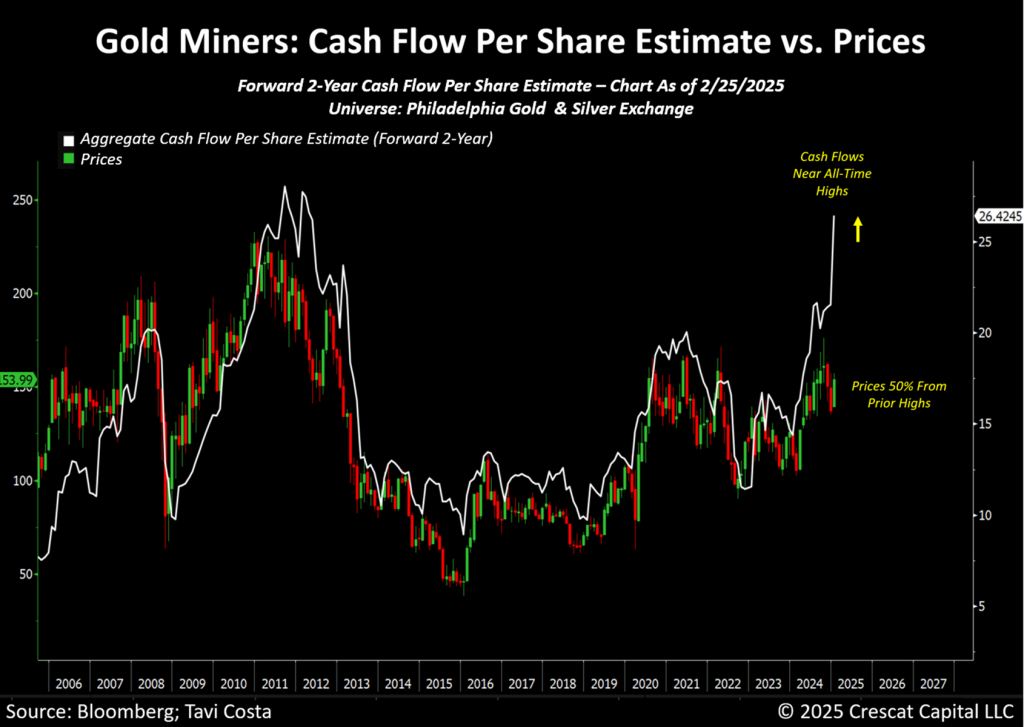

To expand upon our prior observations, the latest earnings report represents one of the most profound positive surprises in recent memory. Yet, despite this exceptional fundamental improvement, share prices have scarcely reflected these developments. As illustrated in the chart below, projected cash flow per share for 2026 is now approaching historic highs — a metric that has historically maintained a strong correlation with equity performance in the mining sector.

Paradoxically, despite this clear fundamental strength, mining stocks remain nearly 50% below their peak levels. Given the magnitude of this valuation disconnect, we assert that the sector is on the cusp of a substantial rerating. In our view, the current setup presents one of the most compelling opportunities for precious metals investors in decades.

The Golden Age of Mining

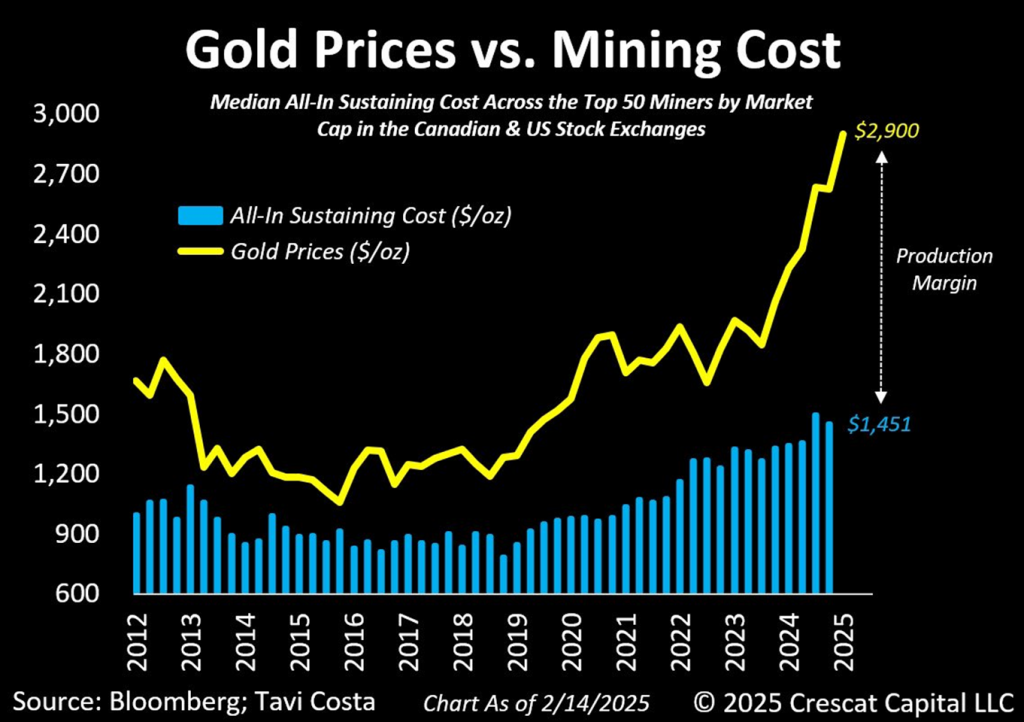

With gold prices nearly twice the median all-in sustaining cost of the 50 largest mining companies listed on US and Canadian exchanges, the current environment represents one of the most potentially profitable periods for gold production in recorded history.

Even in the event of a $500 per ounce decline, prevailing cost structures would still sustain exceptionally robust profitability. Despite this extraordinary margin expansion, we believe market participants have yet to fully recognize the profound valuation implications. We contend that this fundamental mispricing presents a highly compelling opportunity, as gold equities remain historically depressed relative to bullion prices, signaling a potential revaluation of the sector.

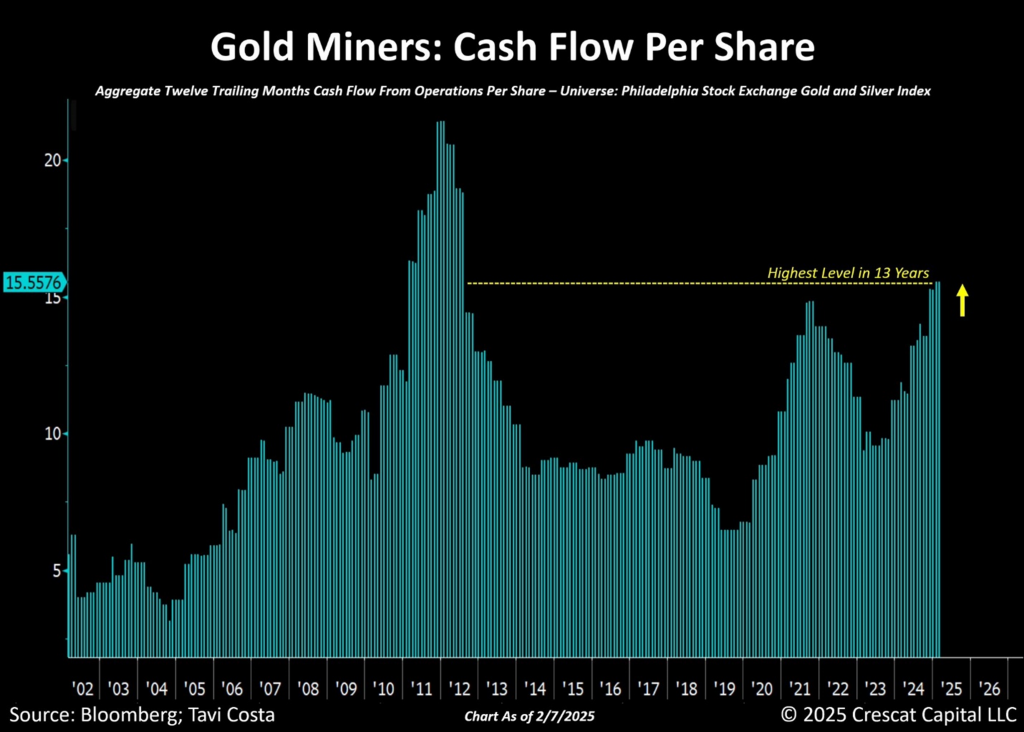

Cash Flows Making 13-Year Highs

As a direct consequence of these fundamental improvements across mining companies, one particularly striking development is the sharp rise in cash flow per share, now reaching its highest level in 13 years.

This trajectory closely mirrors the evolution of the energy sector — where years of skepticism led many investors to overlook its profitability, only for the industry to transform into one of the most efficient and lucrative in the market. A similar paradigm shift now appears to be unfolding in mining, marking a potential inflection point for the sector.

Exploration Stocks: An Imminent Explosive Move

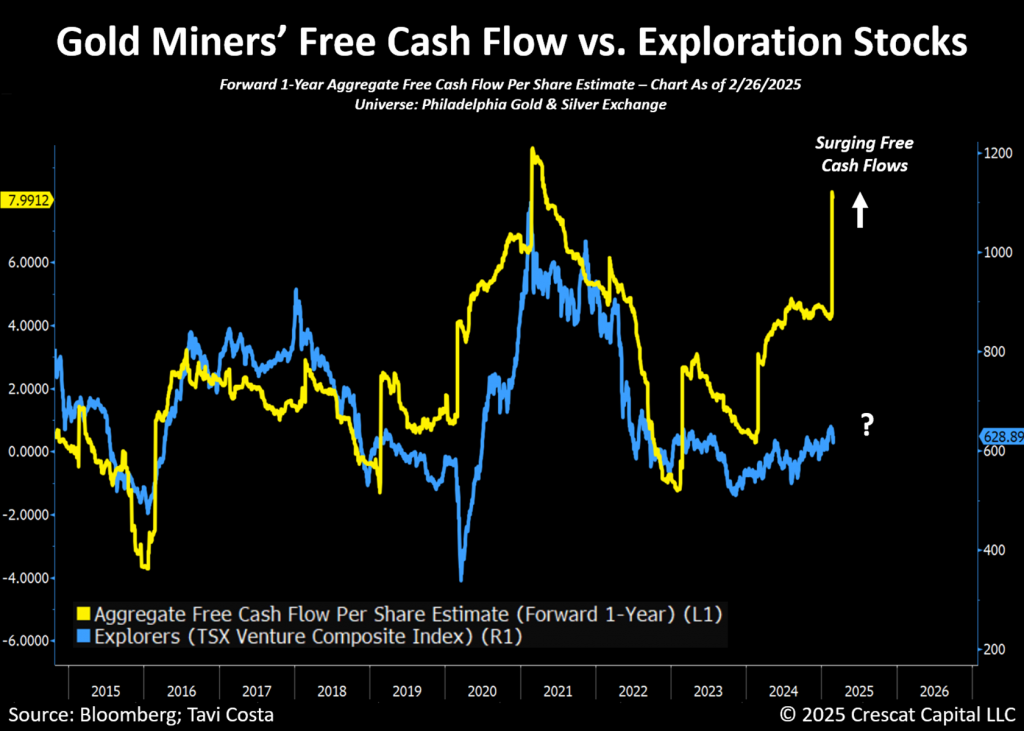

Gold cycles are frequently characterized by a pronounced surge in overall mining stocks; however, one enduring trend throughout history is that exploration companies, which carry the greatest risk and potential reward, tend to emerge as the best performers during a secular bull market in mining. To simplify, the primary reasons for this phenomenon are twofold. First, speculation plays a significant role: when a frenzy environment is triggered, exploration companies often experience exponential increases in their valuations. Second, a mining cycle frequently catalyzes a mergers and acquisitions (M&A) cycle, as mining companies seek to acquire assets in pursuit of growth and production expansion.

In our view, this surge of acquisitions may be particularly pronounced this time, given the urgent need for producing companies to replenish their depleting grades and deteriorating metal reserves. The lack of investment in exploration has significantly impacted the number of major resource discoveries globally. Companies with new, high-quality metal discoveries in mining-friendly jurisdictions are poised to be in high demand, in our strong opinion.

Throughout history, the correlation between the fluctuations in free cash flow generated by gold producers and the performance of exploration stocks has been remarkably pronounced. As the profitability of gold producers expands, exploration companies tend to flourish, and conversely, when profitability contracts, exploration stocks experience a downturn. The current disparity we are witnessing is, in our assessment, a significant opportunity for investment. We believe that an explosive move in this segment of the industry is imminent.

While this may sound promotional, it reflects the focus of Crescat since the launch of our Precious Metals Fund in 2020. Over the past few years, we have accumulated what we believe to be some of the most exciting new metal discoveries in history, with full credit attributed to our advisor, Dr. Quinton Hennigh, who stands out as one of the most accomplished exploration geologists of our era. We are confident that our time has come.

The Return of Silver’s Legacy

Silver has been making significant moves recently, steadily appreciating while remaining largely unnoticed. As previously discussed, gold’s derivatives are now beginning to catch up to the metal itself. Notably, the gold-to-silver ratio remains near 90 — one of the highest levels in recorded history — offering a highly compelling asymmetry. Most critically, when adjusted for the expanding money supply, silver’s valuation presents one of the most structurally bullish setups in recent memory.

For those who dismissed gold’s importance, the recent surge served as a sobering history lesson. Yet an even more profound lesson awaits: the existence of the other monetary metal, silver. Gold is the tangible, hard money of the rich, but for the broad population, it’s silver. Silver tends to thrive in a rising gold environment and stands out as one of the most asymmetric opportunities we have seen in years.

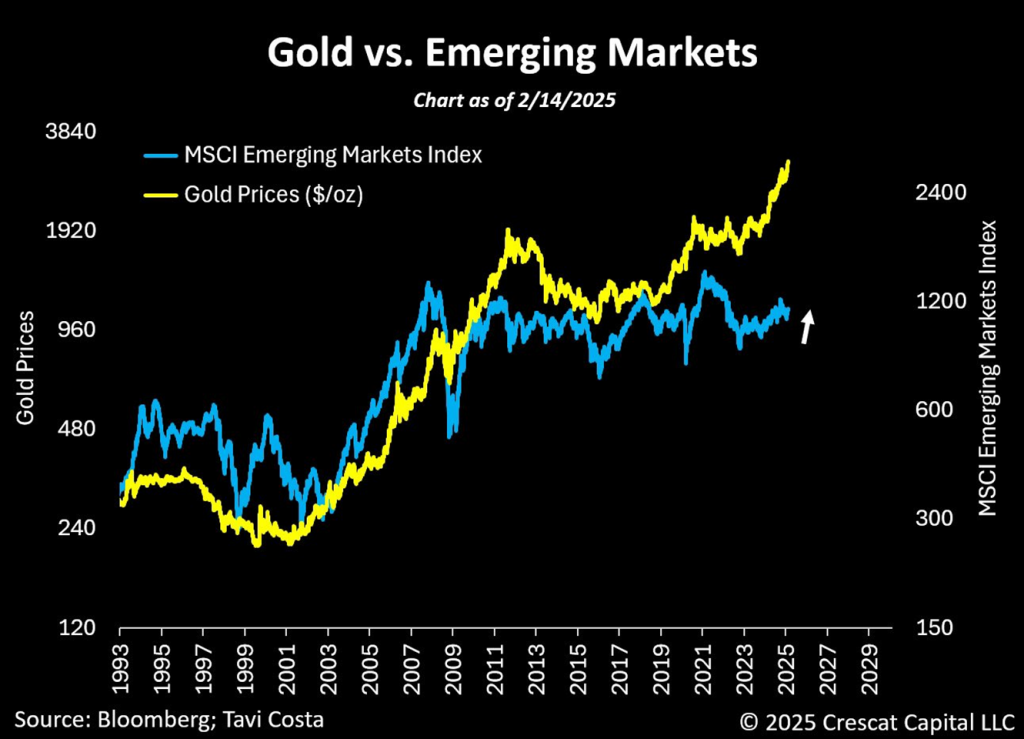

The Catalyst for Emerging Markets

Furthermore, we perceive a significant and often underestimated relationship between emerging markets and gold. Historically, extended bull markets in gold have been correlated with widespread increases in natural resource prices, bolstering economies that have significant exposure to commodity markets.

Emerging markets, especially resource-rich nations in South America, exemplify this trend. Additionally, the structural limitations on further appreciation of the US dollar, a belief we hold firmly, foster a highly advantageous macro environment for emerging market economies to perform well on these dynamics.

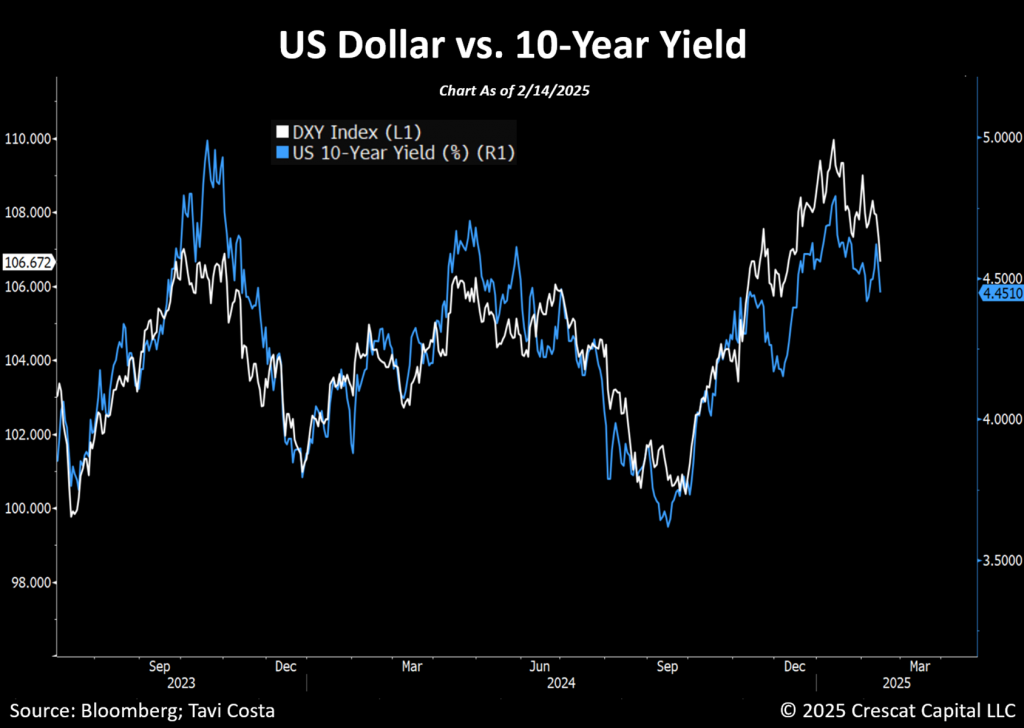

The Twin Dynamics of Dollar and Yields

As investors begin to recognize that the current US administration may be compelled to restore fiscal order, it becomes evident that the decline in interest rates is increasingly aligned with their political priorities, rather than an unwavering commitment to driving US stock prices higher at any cost. This shift carries significant implications for the markets.

In a recent interview with Fox News, Scott Bessent observed, “Since President Trump took office, the 10-year yield has dropped for five consecutive weeks.” This observation is significant, yet it’s important to note that he did not mention the concurrent decline of the dollar, which has closely tracked yields.

Our interpretation suggests a rationale for this phenomenon. When a country needs to achieve at least 5% nominal annual growth to manage its debt, maintaining favorable yields becomes paramount, ultimately at the expense of both the dollar and the equity market.

The problem with cutting government spending is that it can only be curtailed until the detrimental effects on growth become evident. This dynamic explains why fiscal stimulus typically escalates during recessions. Although this viewpoint may appear unconventional at present, we believe history is poised to repeat itself, ultimately leading to increased spending as growth begins to wane. It is at this juncture that yield curve control measures will likely become inevitable.

In our view, in a world marked by capped yields and a weakening dollar, it is imperative to adjust capital allocation strategies. These two significant risks are often the primary catalyst for gold, commodities, and emerging markets, offering what we see as a strong green light for investment in these market segments.

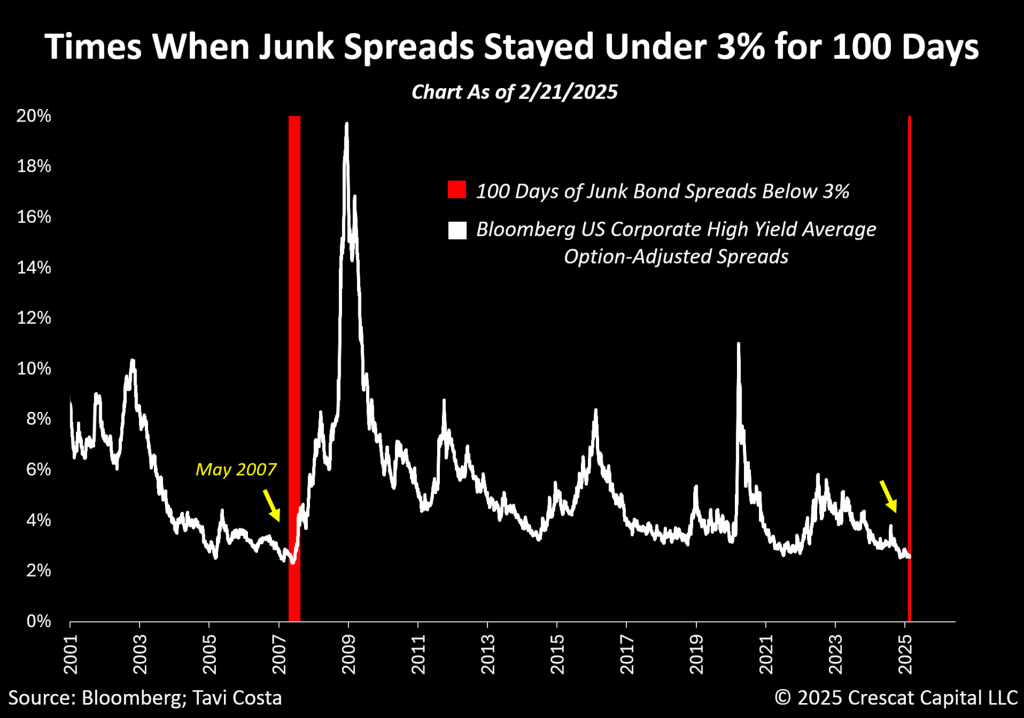

The Calm Before the Storm

Finally, tied to our bearish perspective on the current complacency of investors, this analysis may serve as one of the best indicators of that sentiment, in our opinion. Credit spreads are a crucial indicator that closely mirror investors’ risk appetite, level of aggressiveness, and overall economic outlook. As seen in the chart below, exceptionally low spreads often precede significant volatility events. Conversely, when spreads widen excessively, it typically indicates heightened fear among investors, which can signal an opportune time to deploy capital in the broader market — certainly not today’s case in our view.

Junk bond spreads have stayed below 3% for 100 straight days. The last time this happened was in May 2007, and within two months, volatility spiked, marking the end of an era of investor complacency. Tight credit spreads are like tinder — just waiting to catch fire. We believe we are on the verge of a significant volatility event that could spark a significant decline in overall equity markets, particularly those with very expensive multiple such as technology companies.

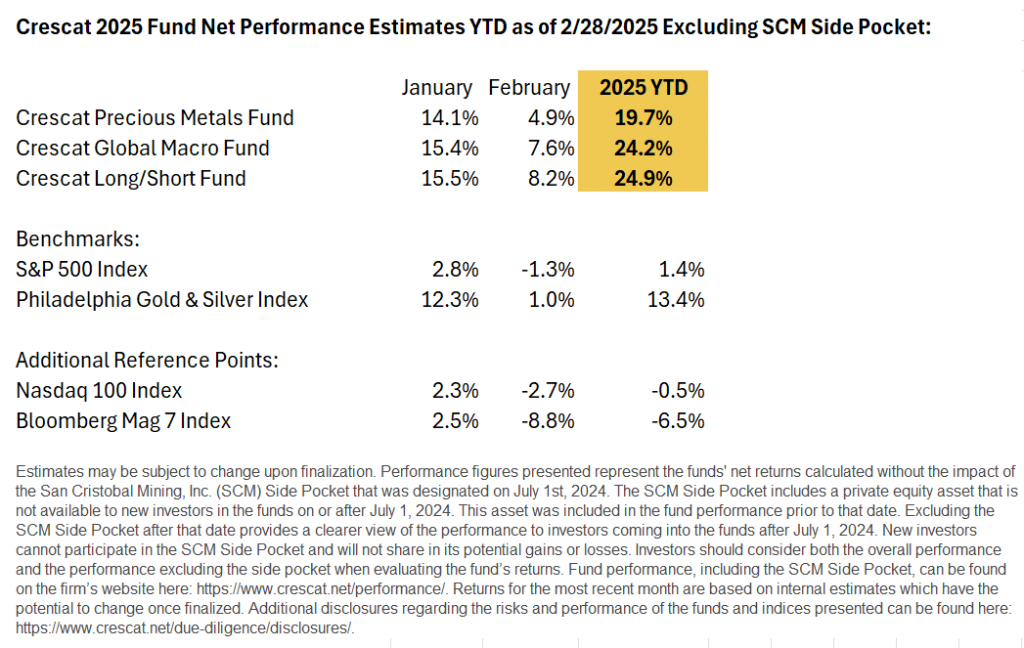

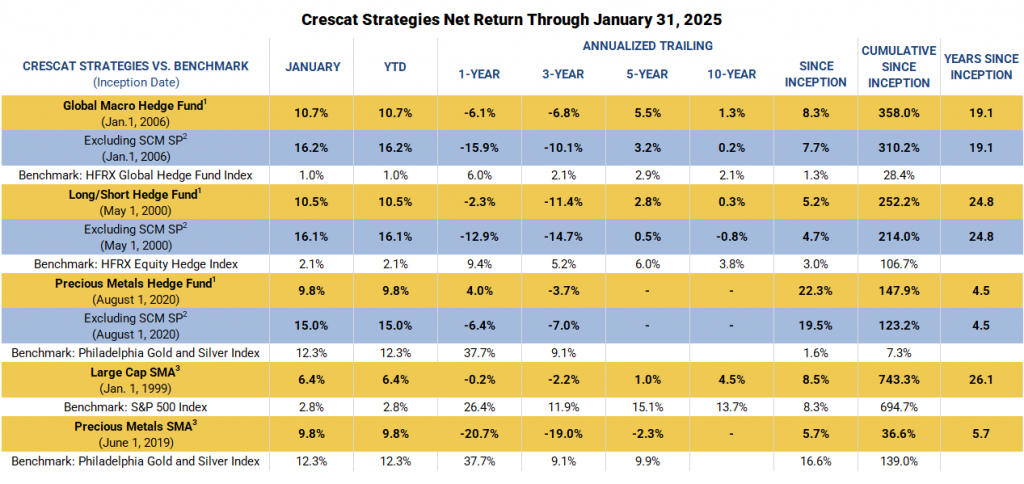

Performance

Crescat’s funds are off to a strong start in 2025 through the end of February driven by gains in our long activist metals theme across all funds. Short positions through put options in Magnificent 7 stocks, SPDR S&P 500 ETF TRUST, and INVESCO QQQ TRUST SERIES 1 also contributed to gains in the Global Macro and Long/Short funds. Weakness in the Canadian dollar related to our long mining positions has offset the gains to small degree year to date in all the funds.

We are excited about the opportunities in the markets ahead and encourage you to reach out to any of us listed below if you would like to learn more about how our investment vehicles might fit with your individual needs and objectives.

Sincerely,

Kevin C. Smith, CFA

Founding & Chief Investment Officer

Tavi Costa

Member & Macro Strategist

Quinton T. Hennigh, PhD

Member & Geologic and Technical Advisor

For more information including how to invest, please contact:

Marek Iwahashi

Head of Investor Relations

miwahashi@crescat.net

(720) 323-2995

Linda Carleu Smith, CPA

Co-Founding Member & Chief Operating Officer

lsmith@crescat.net

(303) 228-7371

© 2025 Crescat Capital LLC

Important Disclosures

This letter is being provided for informational purposes only. It does not have regard to the specific investment objective, financial situation, suitability, or the particular need of any specific person who may receive this presentation and should not be taken as advice on the merits of any investment decision. The letters represent the opinions of CPM, as an exploration industry advocate, on the overall geologic progress of our activist strategy in creating new economic metal deposits in viable mining jurisdictions around the world. Issuers discussed have generally been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. Any securities discussed herein do not represent an entire portfolio and in the aggregate may only represent a small percentage of a strategy’s holdings. The Issuers discussed may or may not be held in such portfolios at any given time. The Issuers discussed do not represent all of the investments purchased or sold by Funds or Strategies managed by CPM. It should not be assumed that any or all of these investments were or will be profitable. Investments in Issuers discussed may not be appropriate for all investors. Actual holdings will vary for each client or fund and there is no guarantee that a particular account will hold any or all of the securities discussed.

Projected results and statements contained in this letter that are not historical facts are based on current expectations and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results.

This letter may contain certain forward-looking statements, opinions and projections that are based on the assumptions and judgments of Crescat with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Crescat. Because of the significant uncertainties inherent in these assumptions and judgments, you should not place undue reliance on these forward looking statements, nor should you regard the inclusion of these statements as a representation by Crescat that these objectives will be achieved. These opinions are current as of the date stated and are subject to change without notice. The information contained in the letter is based on publicly available information with respect to the Issuers as of the date of such letter and will not be updated after such date.

Discussion and details provided is for informational purposes only. This letter is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security, services of Crescat, or its Funds. The information provided in this letter is not intended as investment advice or recommendation to buy or sell any type of investment, or as an opinion on, or a suggestion of, the merits of any particular investment strategy.

CPM has not sought or obtained consent from any third party to use any statements or information indicated herein that have been obtained or derived from statements made or published by such third parties.

All content posted on CPM’s letters including graphics, logos, articles, and other materials, is the property of CPM or others and is protected by copyright and other laws. All trademarks and logos are the property of their respective owners, who may or may not be affiliated with CPM. Nothing contained on CPM’s website or social media networks should be construed as granting, by implication, estoppel, or otherwise, any license or right to use any content or trademark displayed on any site without the written permission of CPM or such other third party that may own the content or trademark displayed on any site.

Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data, including Estimated Performance, is subject to revision following each monthly reconciliation and/or annual audit. Individual performance may be lower or higher than the performance data presented. The currency used to express performance is U.S. dollars. Before January 1, 2003, the results reflect accounts managed at a predecessor firm. Crescat was not responsible for the management of the assets during the period reflected in those predecessor performance results. We have determined the management of these accounts was sufficiently similar and provides relevant performance information.

1 – Net returns reflect the performance of an investor who invested from inception and is eligible to participate in new issues and side pocket investments. Net returns reflect the reinvestment of dividends and earnings and the deduction of all expenses and fees (including the highest management fee and incentive allocation charged, where applicable). An actual client’s results may vary due to the timing of capital transactions, high watermarks, and performance.

Benchmarks

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

Standard and Poor’s 500 Metals & Mining Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The parent index is SPXL3. This is a GICS Level 3 Industries. Intraday values are calculated by Bloomberg and not supported by S&P DJI, however the close price in HP<GO> is the official close price calculated by S&P DJI.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a CPM hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. CPM’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to CPM’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any CPM hedge fund with the SEC. Limited partner interests in the CPM hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in CPM’s hedge funds are not subject to the protections of the Investment Company Act of 1940.

Those who are considering an investment in the Funds should carefully review the relevant Fund’s offering memorandum and the information concerning CPM. Investors may obtain the most current performance data, private offering memoranda for CPM’s hedge funds, and information on CPM’s SMA strategies, including Form ADV Part 2 and 3, emailing info@crescat.net. For additional disclosures including important risk disclosures and Crescat’s ADV click here.