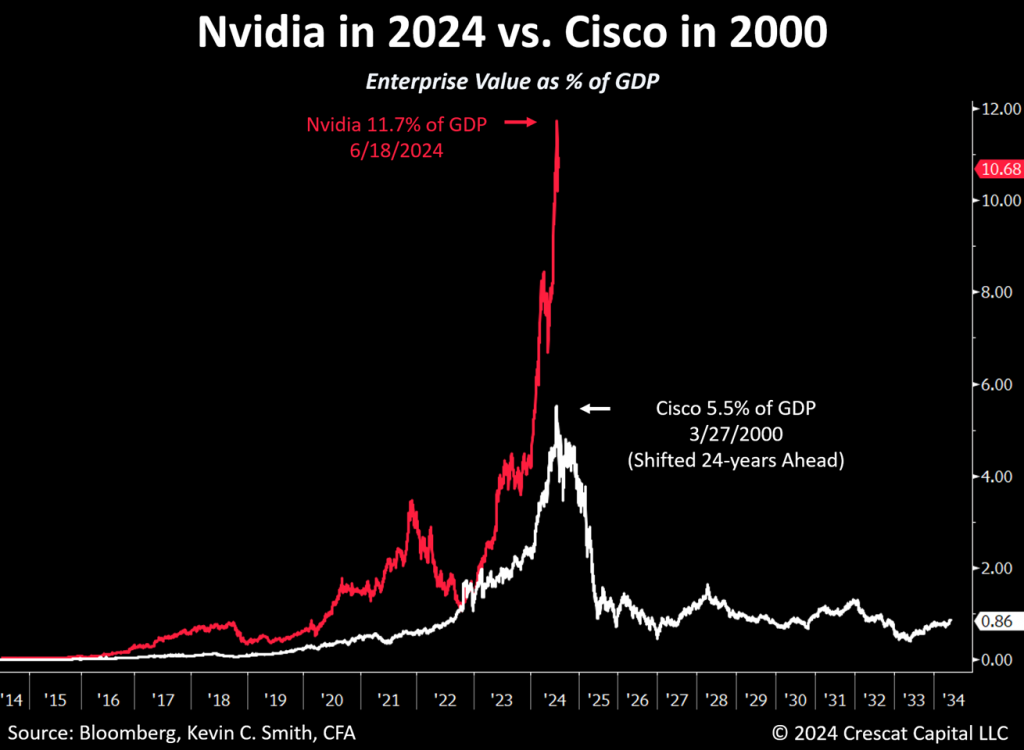

Cisco Systems was the most valuable company in the world at the peak of the dot-com bubble in March 2000. Its stock price had reached a high of $80.06 per share giving the company an enterprise value (EV) of $548 billion or 5.5% of US GDP and 37 times sales. Investor exuberance over tech stocks was high. The future economic promise of the Internet for the world economy was strong, but the forward earnings growth rates implicit in tech stock valuations were not achievable. Stocks had overshot. Tech earnings were getting ready to inflect sharply downward in the course of the normal business cycle. Cisco’s stock price would fall 89% over the next two-and-a-half years. The stock price has yet to return to its prior high in the 24 years since. Advancements in AI technologies today portend enormous productivity benefits for the long-term growth of the economy, just like the Internet did in 2000. But valuations among the leading technology companies are even more stretched today than they were then implying future earnings growth rates that once again should prove impossible to achieve. For instance, Nvidia recently earned the most valuable company in the world status with an EV of $3.3 trillion, a record 11.7% of total US GDP at its recent peak on June 18, more than twice as high as Cisco’s achievement in 2000. It also has an even richer multiple of 41 times revenues. We think it has impossible future growth expectations to live up to.

Valuations Shockingly Stretched vs. the Economy at Large

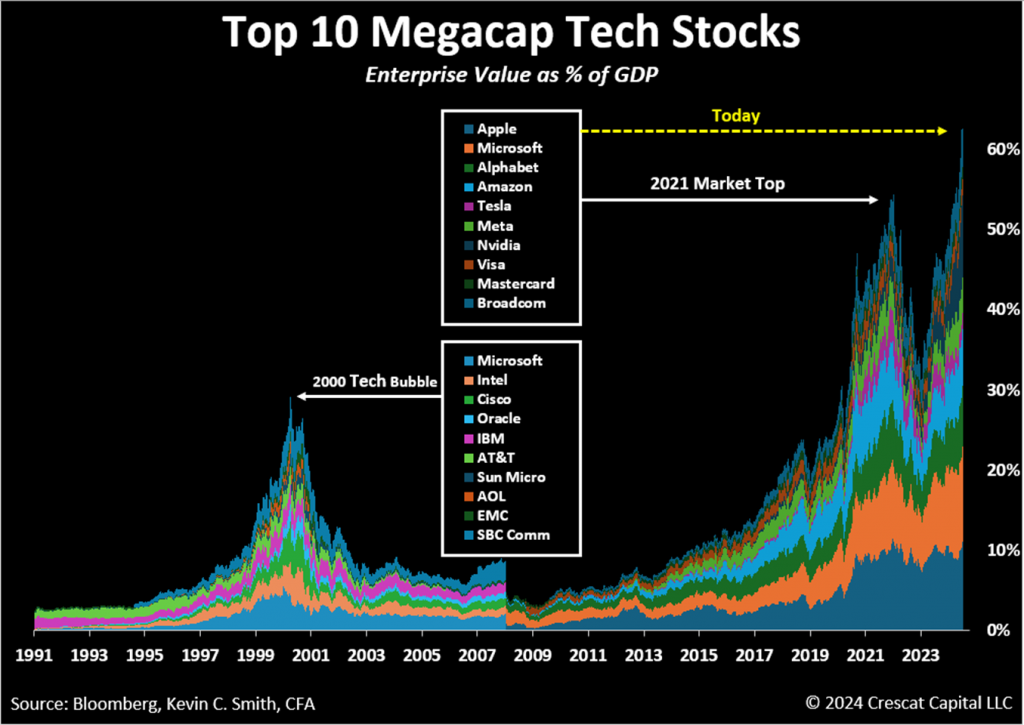

But it is not just Nvidia. When we look at all of the largest ten tech stocks’ combined EV relative to GDP in 2000 vs. today, the valuation is also about twice as big, over 60% compared to about 30%. The basic law of economics that we postulate works like this: Valuation comparisons relative to GDP matter because the economy at large can only grow so much and there is only so much total economic spending to go around to drive the earnings and stock price multiples of competing free market enterprises, and a lot more than just 10 companies are gunning for this market share.

Furthermore, just like the Internet proved to be, we believe that AI is a highly disruptive technological innovation, that will allow new companies to rise by attacking the monopolistic business models of the entrenched tech giants. Joseph Schumpeter, the Austrian Economist called this process “creative destruction”. As just one example of how it is already at work today, we encourage everyone to experiment with the Perplexity LLM-based Internet search engine and see how it threatens Google’s business model.

Indeed, competition is critical to expanding the real GDP growth pool necessary to make AI a truly positive-sum game for overall economic progress. We are highly confident that advancements in AI are at a critical mass phase for long-term economic progress. But for us, this means that we must first prepare for creative destruction in the short term which means a significant bear market ahead for the leading large-cap tech stocks and the S&P 500 including potentially a substantial stock market crash.

The securities discussed herein do not represent an entire portfolio and in the aggregate may only represent a small percentage of a strategy’s holdings. The Issuers discussed may or may not be held in such portfolios at any given time. This letter is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security.

Valuations Relative to Underlying Fundamentals also at Record Highs

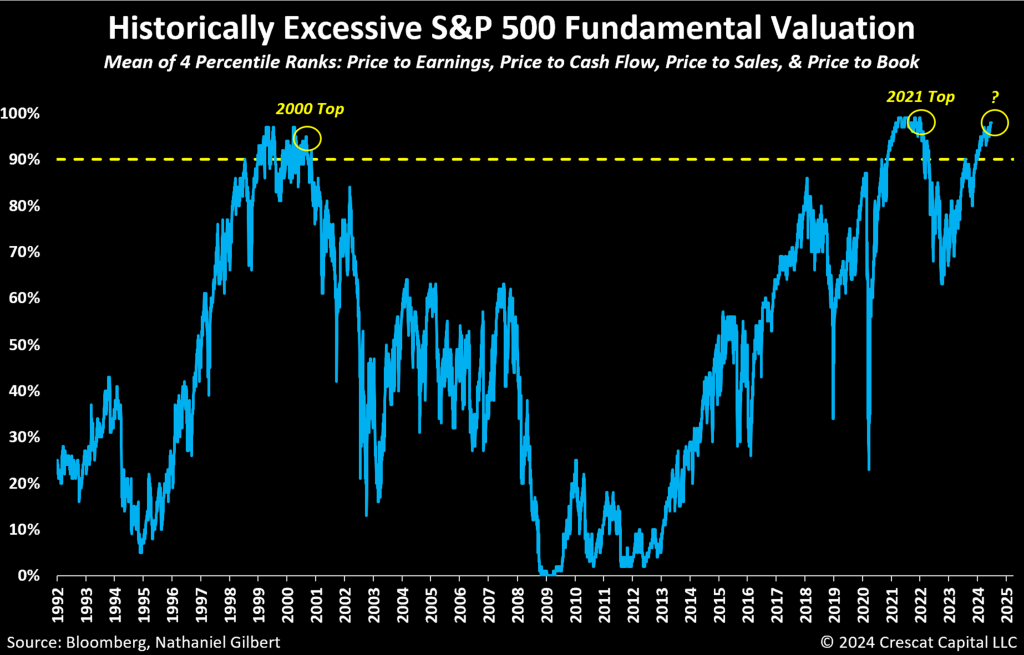

Many will argue that underlying fundamentals are much stronger for the leading tech companies today than we were at the peak of the 2000 bubble. But if the fundamentals, such as profit margins and earnings growth rates are unusually strong, we should be suspect of the potential sustainability of that condition, and thus should be stacking a low multiple on top of it, not a historically high one. AI capital investment spending growth is likely already cresting at an unsustainable rate because most of the companies doing that spending are simply in a race to invest in AI infrastructure but do not have a viable business model for getting a return on that investment. This is just like with the Internet infrastructure spending in 2000. This is how tops in the business cycle are made. Meanwhile, valuations relative to fundamentals such as earnings, cash flow from operations, revenues, and book value for the entire S&P 500 are as high as they have ever been, levels that coincided with large cap growth stock market tops in 2000 and late 2021.

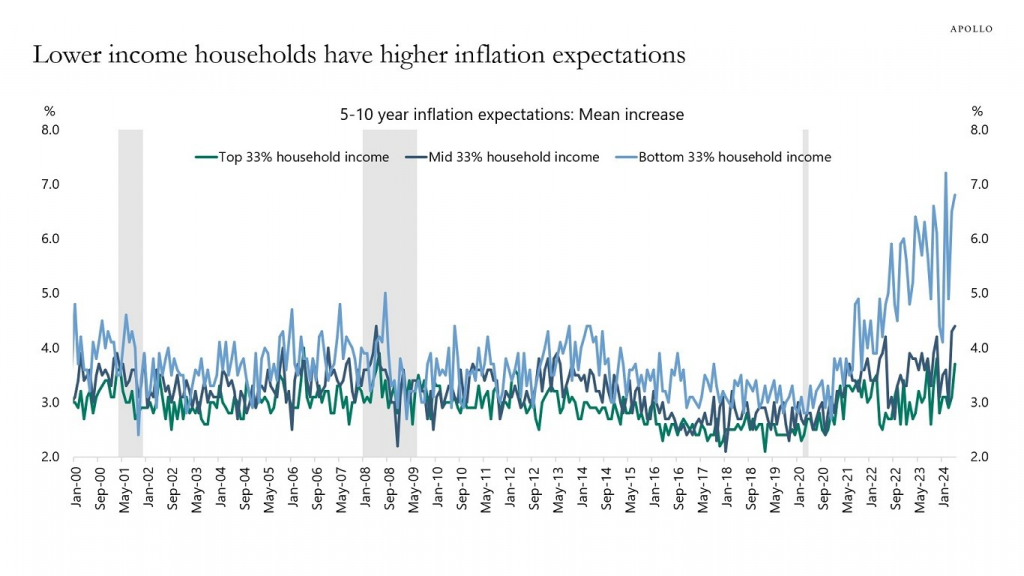

Inflation a Major Catalyst for Recession

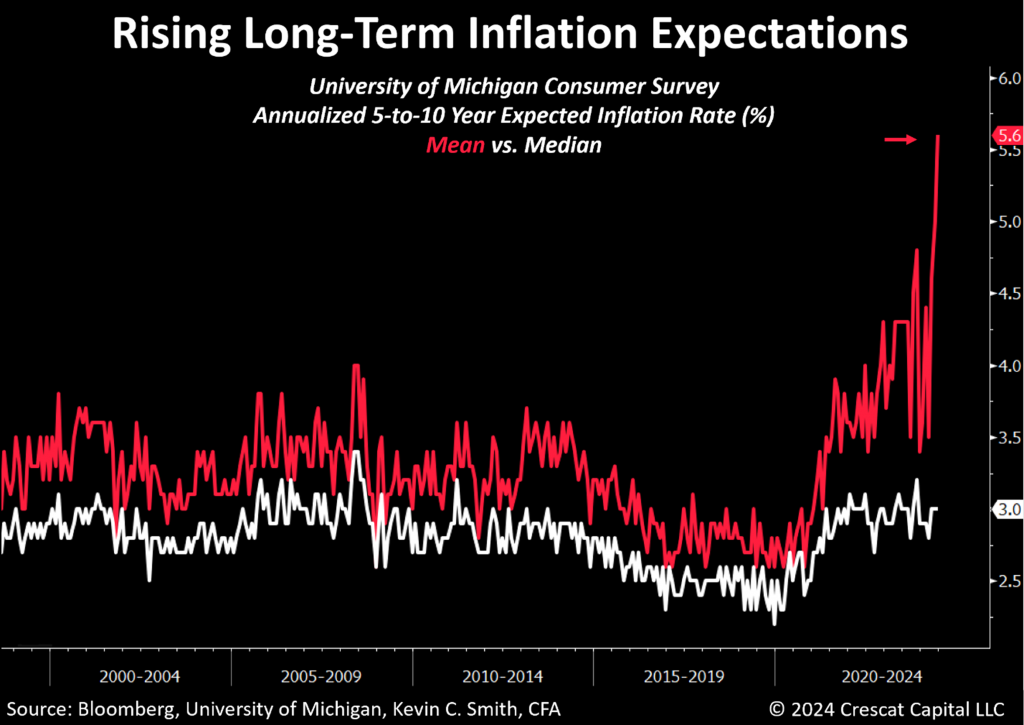

One truly unique wrinkle to this business cycle as compared to the 2000 tech bubble and ensuing bust is that we need to overlay a much bigger rising inflation cycle with it. While the bursting of the tech bubble also coincided with the start of a new ten-year commodity bull market, the setup for a new commodity bull market today is even stronger, in our analysis, due to more significant structural inflationary drivers. Reckless deficit spending and central bank debt monetization combined with long-term commodity supply constraints leave no other viable path in our analysis. Long-term inflation expectations are already becoming unanchored as we can see by looking at both the median and mean 5 to 10-year inflation expectations in the University of Michigan’s latest Survey of Consumers. The Fed has been losing control of this critical, self-fulfilling inflationary driver. Interestingly, the highest inflation expectations in this survey are coming from lower and middle-income cohorts where inflation stings the most while the high-income group that dominates investment allocation in the securities markets appears to be only just starting to wake up.

Policy Makers Forced to Give Up on the Fight Against Inflation

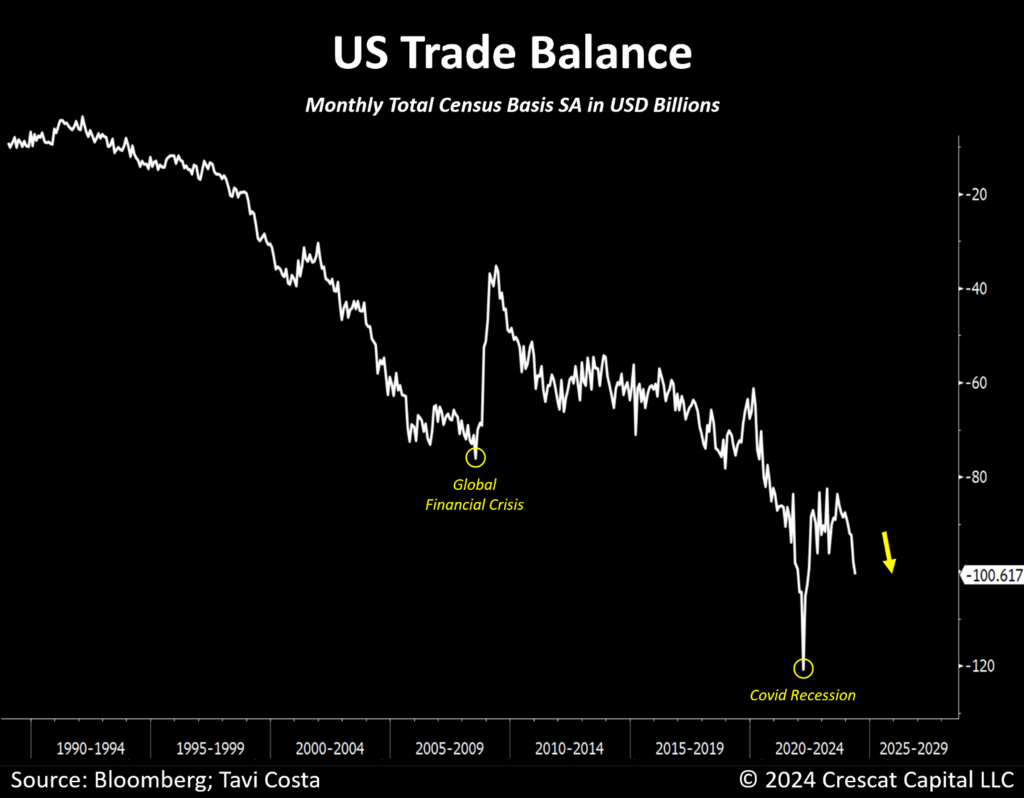

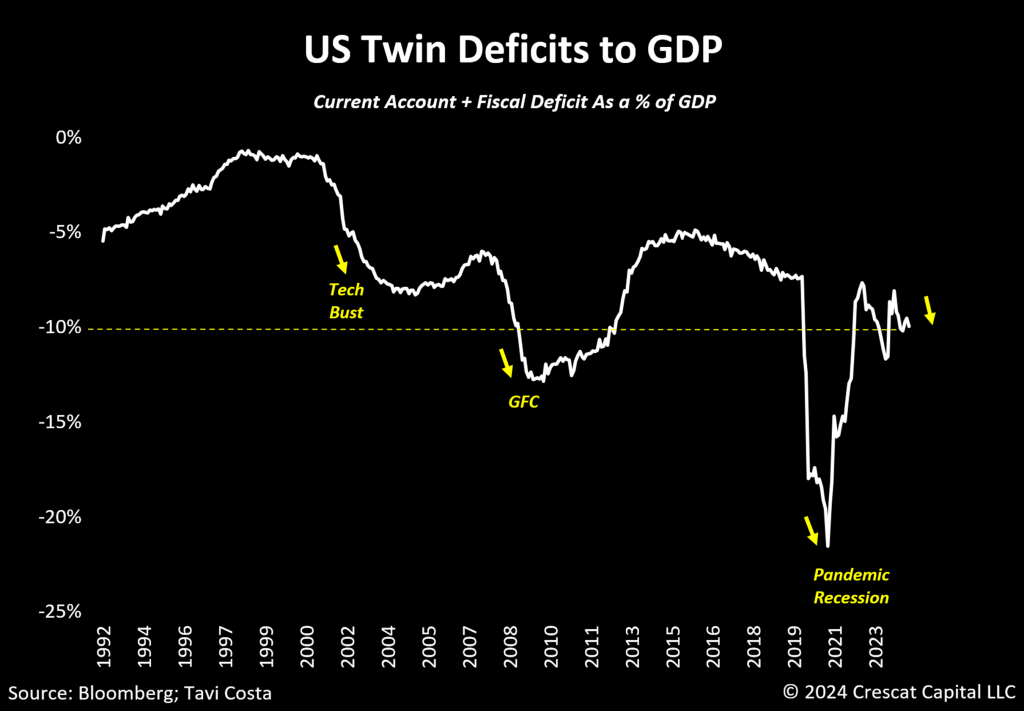

The recent report on the US trade balance shows a continued and substantial decline, primarily driven by a significant increase in imports. At first glance, this might seem irrelevant. However, when a country also runs a fiscal deficit exceeding 6% of GDP, we believe a trade balance deficit approaching 4% is certainly noteworthy. The reality is that the US now has a 10% twin deficit, worse than during the Tech Bust and not far from the depths of the Global Financial Crisis.

This is a critical issue at the heart of funding risks for US Treasuries, forcing the Fed to increasingly resume its role as the primary financier of government debt. This is why, despite the inflationary pressures that have driven the drastic shift in market expectations from seven rate cuts to now only two, we believe several more interest rate cuts are indeed more likely than not. The central point for this view is that the potential benefits of cutting interest rates to alleviate surging debt service payments are beginning to outweigh the fight against inflation. To put this in perspective, three Fed cuts could reduce the annual cost of federal debt by one-third. In that sense, today’s environment is remarkably similar to the 1940s.

Back then, when the debt problem was as severe as it is today, the Fed had to set aside inflation concerns to focus almost solely on the government’s ability to service its debt through yield curve control measures. However, today’s inflation problem is arguably more entrenched than it was then. Two main differences are that, in the 1940s, we were at the tail end of a highly deglobalized macro environment with the end of World War II, and the US monetary system operated under a much more disciplined policy with the dollar strictly pegged to gold. Today, the situation is almost the opposite. Geopolitical risks continue to escalate, the money supply appears to be in an unending increase, government spending is on a reckless path, and global economies desperately need to rebuild their infrastructure capabilities in a historically constrained commodity environment. This serves as a strong reminder of how hard assets will likely re-emerge as a key alternative for investors in the coming decade.

Metals Supply Insufficient to Meet Demands of the Modern Economy

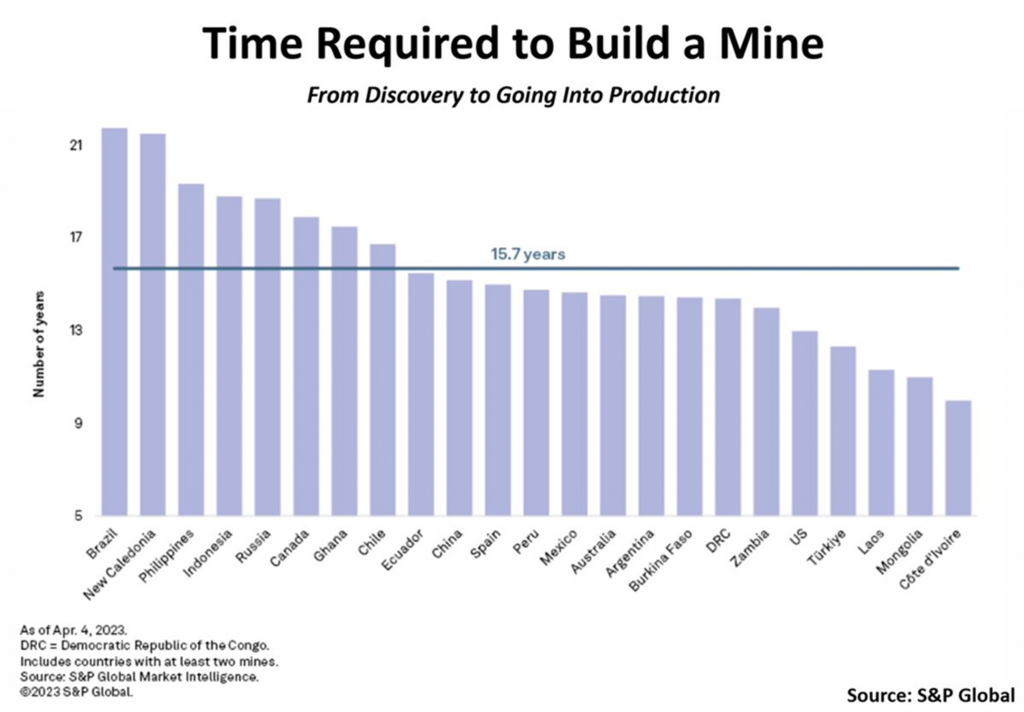

The global average time to build a mine has increased to nearly 16 years.

The shocking aspect of these calculations is that they assume the macro environment we experienced over the last 20-30 years:

- Low energy costs

- Historically low interest rates

- A more globalized environment

- Relatively low labor costs

- Low material costs

We are currently facing almost the complete opposite of this situation. Additionally, ESG efforts will likely exacerbate the situation, creating one of the most constrained long-term supply dynamics in metals we have seen in history.

Moreover, the construction boom driven by onshoring, revamping the electric grid, new data center developments, new industrial capabilities, and infrastructure developments are all poised to increase the long-term demand for these commodities.

Ironically, despite the challenging cost environment, the likely surge in metal prices will pave the way for one of the most bullish periods for the mining industry, making it an increasingly vital and strategic sector for the global economy.

More importantly, the looming supply cliff for existing reserves among major companies is expected to ignite one of the most intense M&A cycles in the industry’s history.

In the decade ahead, those holding high-quality exploration and development stage assets are likely to emerge as major winners in this environment.

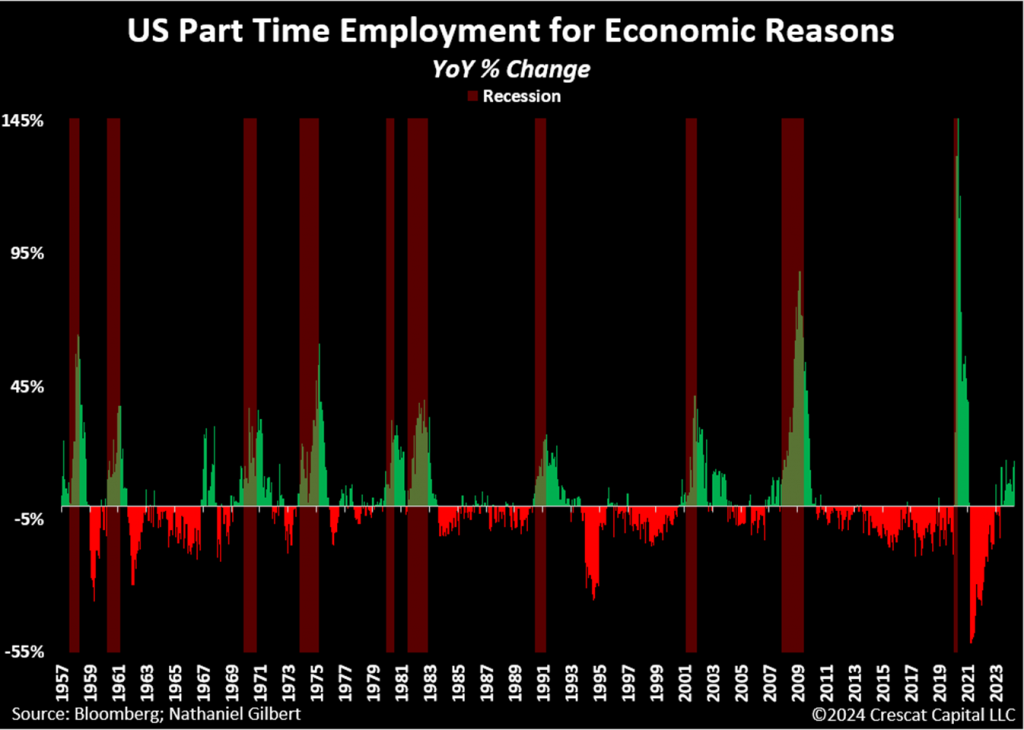

Warning Signs in Part-Time Employment for Economic Reasons

The rise in part-time employment for economic reasons is further evidence of how inflation is forcing people to go back to work including taking on part-time jobs just to make ends meet. This is a condition as shown below that we normally see at the beginning of a recession.

Further Signals from the Labor Market

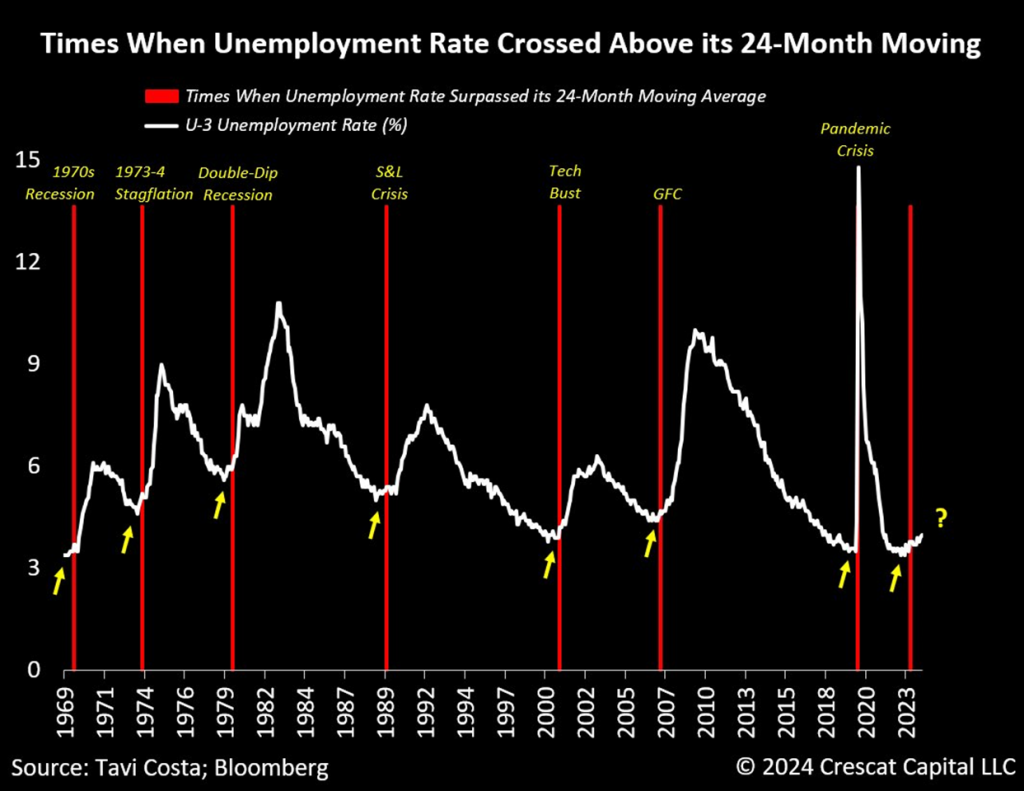

Low unemployment ratios combined with high valuations in financial markets are a common setup immediately preceding financial crises and recessions due to the cyclical nature of the economy. When the unemployment rate crosses above its 2-year moving average, we believe it is time to be on high alert. This is not the time to be extrapolating the growth trends of the prior cycle. It is time to get positioned for the inevitable unwinding of the last business cycle. This one in our view coincides with an even larger economic cycle that has been building up imbalances since 2009 and needs to unwind. We think inflation and technologically driven creative destruction will be the catalyst.

The recent rise in the unemployment rate, however small it may seem, is a critical macro signal that has consistently predicted a larger downturn ahead in the economy. If history is any guide, this is the beginning of an upward trend in unemployment rates, not the end of one.

Positioning

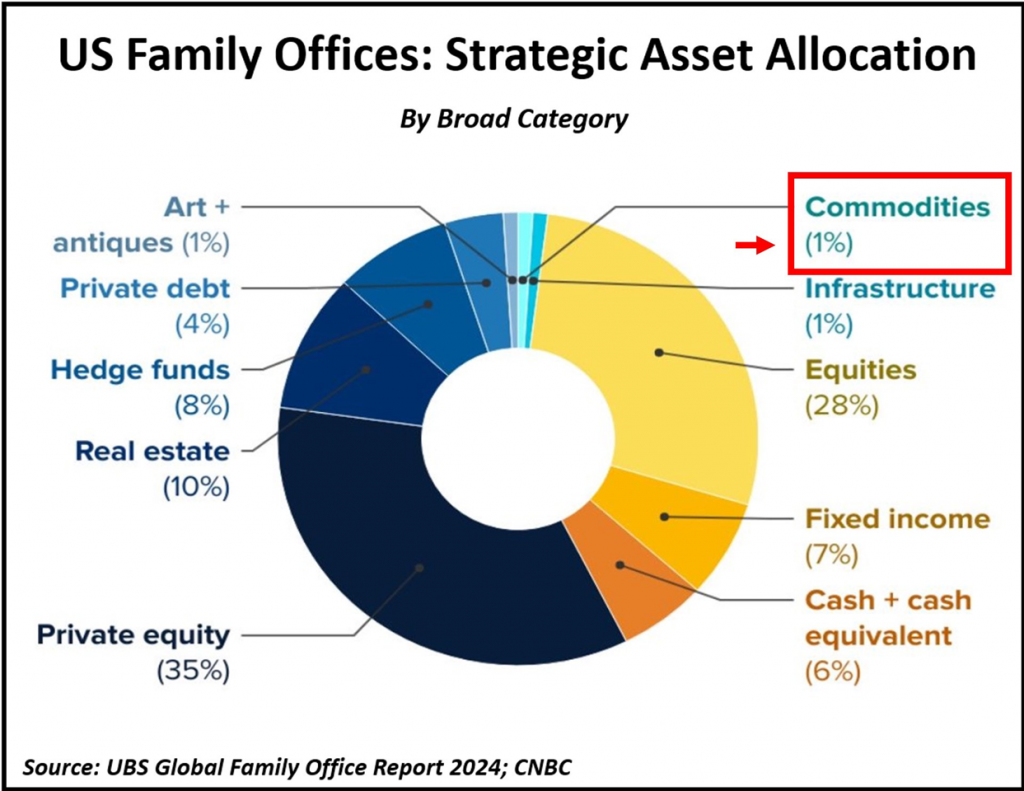

At Crescat, we want to skate to where the puck is going next, not to where it has already been. That is where high absolute return and high alpha opportunities lie at critical inflection points in the economy. We believe we are on the cusp of a Great Rotation out of overvalued financial assets and into undervalued commodities and commodity equities, particularly in the energy and metals markets. We are extremely excited about the opportunity for our activist metals positions in the likely new secular commodity bull market ahead.

US family offices currently allocate just 1% of their assets to commodities, including gold. We expect them along with institutional investors to soon start moving into these markets in earnest. Extended periods of neglect in natural resource sectors often precede the emergence of secular opportunities. That is particularly the case in an escalating deglobalized environment, marked by highly constrained supply and the gradual buildup of structural demand forces from central banks, traditional 60/40 portfolios, and other major capital allocators.

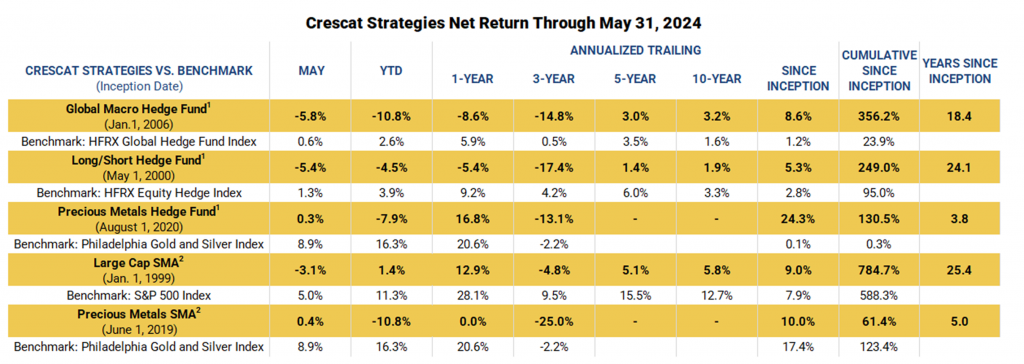

Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Individual performance may be lower or higher than the performance data presented. The currency used to express performance is U.S. dollars. Before January 1, 2003, the results reflect accounts managed at a predecessor firm. See additional performance disclosures below.

We encourage you to reach out to any of us listed below if you would like to learn more about how our vehicles might fit with your individual needs and objectives.

Sincerely,

Kevin C. Smith, CFA

Founding Member & Chief Investment Officer

Tavi Costa

Member & Macro Strategist

Quinton T. Hennigh, PhD

Member & Geologic and Technical Director

For more information including how to invest, please contact:

Marek Iwahashi

Head of Investor Relations

miwahashi@crescat.net

(720) 323-2995

Linda Carleu Smith, CPA

Co-Founding Member & Chief Operating Officer

(303) 228-7371

© 2024 Crescat Capital LLC

Important Disclosures

The purpose of this letter is to provide access to analyses prepared by Crescat Portfolio Management LLC (“CPM”) with respect to certain companies (“Issuers”) in which CPM and certain of the Funds and accounts it manages are shareholders. The letters enable CPM to share macro themes and newsworthy geologic updates, good and bad, across our Issuers as they arise. The letters represent the opinions of CPM, as an exploration industry advocate, on the overall geologic progress of our activist strategy in creating new economic metal deposits in viable mining jurisdictions around the world. Each Issuer discussed has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and in the aggregate may only represent a small percentage of a strategies holdings. The Issuers discussed may or may not be held in such portfolios at any given time. The Issuers discussed do not represent all of the investments purchased or sold by Funds managed by CPM. It should not be assumed that any or all of these investments were or will be profitable.

Projected results and statements contained in this letter that are not historical facts are based on current expectations and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results. While investing in the mining industry is inherently risk, CPM believes that under a professionally managed portfolio approach with the guidance of Quinton Hennigh, PhD, CPM’s full-time Geologic and Technical Director, and our proprietary exploration and mining model, we will be able to generate long-term capital appreciation.

These opinions are current opinions as of the date appearing in the relevant material and are subject to change without notice. The information contained in the letters is based on publicly available information with respect to the Issuers as of the date of such white papers and has not been updated since such date.

This letter is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security. The information provided in this letter is not intended as investment advice or recommendation to buy or sell any type of investment, or as an opinion on, or a suggestion of, the merits of any particular investment strategy.

This letter is not intended to be, nor should it be construed as, a marketing or solicitation vehicle for CPM or its Funds. The information herein does not provide a complete presentation of the investment strategies or portfolio holdings of the Funds and should not be relied upon for purposes of making an investment or divestment decision with respect to the Funds. Those who are considering an investment in the Funds should carefully review the relevant Fund’s offering memorandum and the information concerning CPM, including its SEC Form ADV Brochure which is available at: www.adviserinfo.sec.gov.

This presentation should not be construed as legal, tax, investment, financial or other advice. It does not have regard to the specific investment objective, financial situation, suitability, or the particular need of any specific person who may receive this presentation and should not be taken as advice on the merits of any investment decision. The views expressed in this presentation represent the opinions of CPM and are based on publicly available information with respect to the Issuer. CPM recognizes that there may be confidential information in the possession of the Issuer that could lead the Issuer to disagree with CPM’s conclusions.

CPM currently beneficially owns, and/or has an economic interest in, shares of the Issuers discussed in these letters. Therefore, CPM’s clients, principals and employees may stand to realize significant gains or losses if the price of the companies’ securities move. After the publication or posting of any video, CPM, its principals and employees will continue transacting in the securities discussed, and may be long, short or neutral at any time thereafter regardless of their initial position or recommendation. While certain individuals affiliated with CPM are current or former directors of certain of the Issuers referred to herein, none of the information contained in this presentation or otherwise provided to you is derived from non-public information of such publicly traded companies. CPM has not sought or obtained consent from any third party to use any statements or information indicated herein that have been obtained or derived from statements made or published by such third parties.

The estimates, projections, pro forma information and potential impact of CPM’s analyses set forth herein are based on assumptions that CPM believes to be reasonable as of the date of this presentation, but there can be no assurance or guarantee (i) that any of the proposed actions set forth in this presentation will be completed, (ii) that actual results or performance of the Issuer will not differ, and such differences may be material or (iii) that any of the assumptions provided in this presentation are accurate.

All content posted on CPM’s letters including graphics, logos, articles, and other materials, is the property of CPM or others and is protected by copyright and other laws. All trademarks and logos are the property of their respective owners, who may or may not be affiliated with CPM. Nothing contained on CPM’s website or social media networks should be construed as granting, by implication, estoppel, or otherwise, any license or right to use any content or trademark displayed on any site without the written permission of CPM or such other third party that may own the content or trademark displayed on any site.

Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Individual performance may be lower or higher than the performance data presented. The currency used to express performance is U.S. dollars. Before January 1, 2003, the results reflect accounts managed at a predecessor firm.

1 – Net returns reflect the performance of an investor who invested from inception and is eligible to participate in new issues. Net returns reflect the reinvestment of dividends and earnings and the deduction of all expenses and fees (including the highest management fee and incentive allocation charged, where applicable). An actual client’s results may vary due to the timing of capital transactions, high watermarks, and performance.

2 – The SMA composites include all accounts that are managed according to CPM’s precious metals or large cap SMA strategy over which it has full discretion. Investment results shown are for taxable and tax-exempt accounts. Any possible tax liabilities incurred by the taxable accounts are not reflected in net performance. Performance results are time weighted and reflect the deduction of advisory fees, brokerage commissions, and other expenses that a client would have paid, and includes the reinvestment of dividends and other earnings.

Risks of Investment Securities: Diversity in holdings is an important aspect of risk management, and CPM works to maintain a variety of themes and equity types to capitalize on trends and abate risk. CPM invests in a wide range of securities depending on its strategies, as described above, including but not limited to long equities, short equities, mutual funds, ETFs, commodities, commodity futures contracts, currency futures contracts, fixed income futures contracts, private placements, precious metals, and options on equities, bonds and futures contracts. The investment portfolios advised or sub-advised by CPM are not guaranteed by any agency or program of the U.S. or any foreign government or by any other person or entity. The types of securities CPM buys and sells for clients could lose money over any timeframe. CPM’s investment strategies are intended primarily for long-term investors who hold their investments for substantial periods of time. Prospective clients and investors should consider their investment goals, time horizon, and risk tolerance before investing in CPM’s strategies and should not rely on CPM’s strategies as a complete investment program for all of their investable assets. Of note, in cases where CPM pursues an activist investment strategy by way of control or ownership, there may be additional restrictions on resale including, for example, volume limitations on shares sold. When CPM’s private investment funds or SMA strategies invest in the precious metals mining industry, there are particular risks related to changes in the price of gold, silver and platinum group metals. In addition, changing inflation expectations, currency fluctuations, speculation, and industrial, government and global consumer demand; disruptions in the supply chain; rising product and regulatory compliance costs; adverse effects from government and environmental regulation; world events and economic conditions; market, economic and political risks of the countries where precious metals companies are located or do business; thin capitalization and limited product lines, markets, financial resources or personnel; and the possible illiquidity of certain of the securities; each may adversely affect companies engaged in precious metals mining related businesses. Depending on market conditions, precious metals mining companies may dramatically outperform or underperform more traditional equity investments. In addition, as many of CPM’s positions in the precious metals mining industry are made through offshore private placements in reliance on exemption from SEC registration, there may be U.S. and foreign resale restrictions applicable to such securities, including but not limited to, minimum holding periods, which can result in discounts being applied to the valuation of such securities. In addition, the fair value of CPM’s positions in private placements cannot always be determined using readily observable inputs such as market prices, and therefore may require the use of unobservable inputs which can pose unique valuation risks. Furthermore, CPM’s private investment funds and SMA strategies may invest in stocks of companies with smaller market capitalizations. Small- and medium-capitalization companies may be of a less seasoned nature or have securities that may be traded in the over-the-counter market. These “secondary” securities often involve significantly greater risks than the securities of larger, better-known companies. In addition to being subject to the general market risk that stock prices may decline over short or even extended periods, such companies may not be well-known to the investing public, may not have significant institutional ownership and may have cyclical, static or only moderate growth prospects. Additionally, stocks of such companies may be more volatile in price and have lower trading volumes than larger capitalized companies, which results in greater sensitivity of the market price to individual transactions. CPM has broad discretion to alter any of the SMA or private investment fund’s investment strategies without prior approval by, or notice to, CPM clients or fund investors, provided such changes are not material.

Benchmarks

HFRX GLOBAL HEDGE FUND INDEX. The HFRX Global Hedge Fund Index represents a broad universe of hedge funds with the capability to trade a range of asset classes and investment strategies across the global securities markets. The index is weighted based on the distribution of assets in the global hedge fund industry. It is a tradeable index of actual hedge funds. It is a suitable benchmark for the Crescat Global Macro private fund which has also traded in multiple asset classes and applied a multi-disciplinary investment process since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Equity Hedge Index represents an investable index of hedge funds that trade both long and short in global equity securities. Managers of funds in the index employ a wide variety of investment processes. They may be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding periods, concentrations of market capitalizations and valuation ranges of typical portfolios. It is a suitable benchmark for the Crescat Long/Short private fund, which has also been predominantly composed of long and short global equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Separately Managed Account (SMA) disclosures: The Crescat Large Cap Composite and Crescat Precious Metals Composite include all accounts that are managed according to those respective strategies over which the manager has full discretion. SMA composite performance results are time-weighted net of all investment management fees and trading costs including commissions and non-recoverable withholding taxes. Investment management fees are described in CPM’s Form ADV 2A. The manager for the Crescat Large Cap strategy invests predominantly in equities of the top 1,000 U.S. listed stocks weighted by market capitalization. The manager for the Crescat Precious Metals strategy invests predominantly in a global all-cap universe of precious metals mining stocks.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a CPM hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. CPM’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to CPM’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any CPM hedge fund with the SEC. Limited partner interests in the CPM hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in CPM’s hedge funds are not subject to the protections of the Investment Company Act of 1940.

Investors may obtain the most current performance data, private offering memoranda for CPM’s hedge funds, and information on CPM’s SMA strategies, including Form ADV Part 2 and 3, by contacting Linda Smith at (303) 271-9997 or by sending a request via email to lsmith@crescat.net. See the private offering memorandum for each CPM hedge fund for complete information and risk factors.

HFRX GLOBAL HEDGE FUND INDEX. The HFRX Global Hedge Fund Index represents a broad universe of hedge funds with the capability to trade a range of asset classes and investment strategies across the global securities markets. The index is weighted based on the distribution of assets in the global hedge fund industry. It is a tradeable index of actual hedge funds. It is a suitable benchmark for the Crescat Global Macro private fund which has also traded in multiple asset classes and applied a multi-disciplinary investment process since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Equity Hedge Index represents an investable index of hedge funds that trade both long and short in global equity securities. Managers of funds in the index employ a wide variety of investment processes. They may be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding periods, concentrations of market capitalizations and valuation ranges of typical portfolios. It is a suitable benchmark for the Crescat Long/Short private fund, which has also been predominantly composed of long and short global equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Separately Managed Account (SMA) disclosures: The Crescat Large Cap Composite and Crescat Precious Metals Composite include all accounts that are managed according to those respective strategies over which the manager has full discretion. SMA composite performance results are time-weighted net of all investment management fees and trading costs including commissions and non-recoverable withholding taxes. Investment management fees are described in CPM’s Form ADV 2A. The manager for the Crescat Large Cap strategy invests predominantly in equities of the top 1,000 U.S. listed stocks weighted by market capitalization. The manager for the Crescat Precious Metals strategy invests predominantly in a global all-cap universe of precious metals mining stocks.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a CPM hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. CPM’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to CPM’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any CPM hedge fund with the SEC. Limited partner interests in the CPM hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in CPM’s hedge funds are not subject to the protections of the Investment Company Act of 1940.

Investors may obtain the most current performance data, private offering memoranda for CPM’s hedge funds, and information on CPM’s SMA strategies, including Form ADV Part 2 and 3, by contacting Linda Smith at (303) 271-9997 or by sending a request via email to lsmith@crescat.net. See the private offering memorandum for each CPM hedge fund for complete information and risk factors.