In essence, our investment approach focuses on identifying significant macro trends and strategically positioning ourselves to capitalize on them, primarily by targeting highly inefficient market segments that have historically been mispriced relative to the potential economic shifts we anticipate. Given the current context of one of the most undisciplined monetary and fiscal environments in history, we firmly believe that the best decade-ahead looking strategy today includes preparation for a likely profound capital migration towards hard assets by investing now in the fundamentally undervalued businesses that find and produce them.

To put it plainly, today’s Michael Lewis “Big Short” opportunity, in our view, is the ongoing devaluation of fiat currencies relative to real assets with limited supply, which are imperative to society either as commodities or sound money.

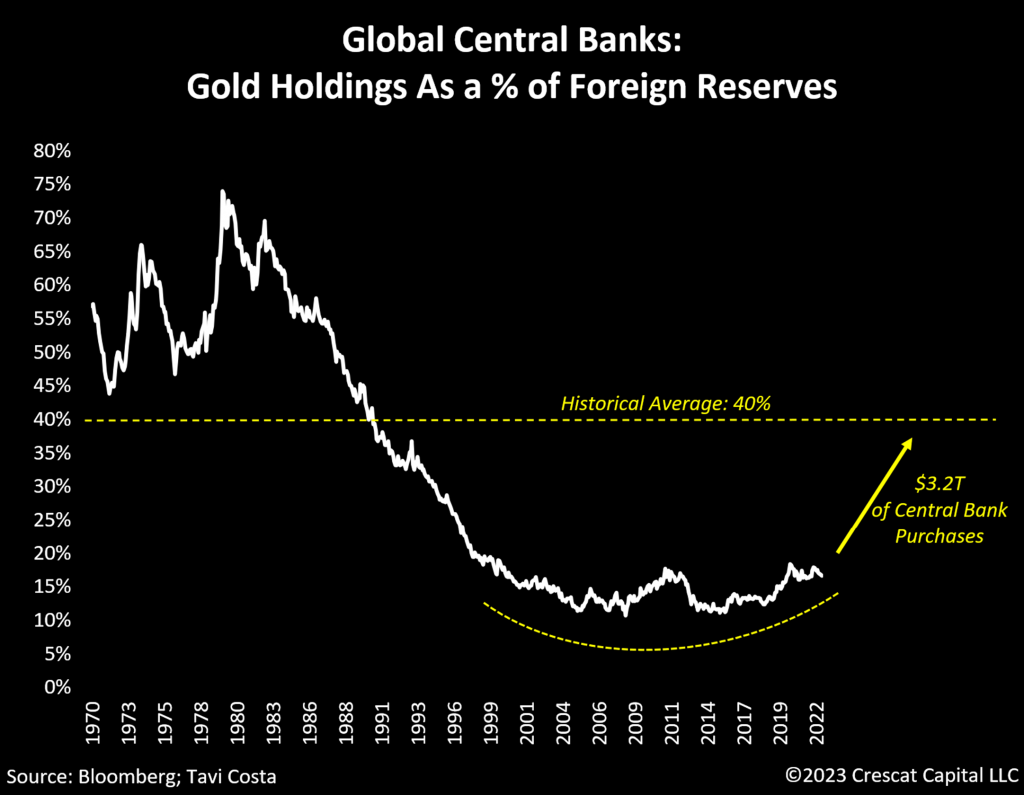

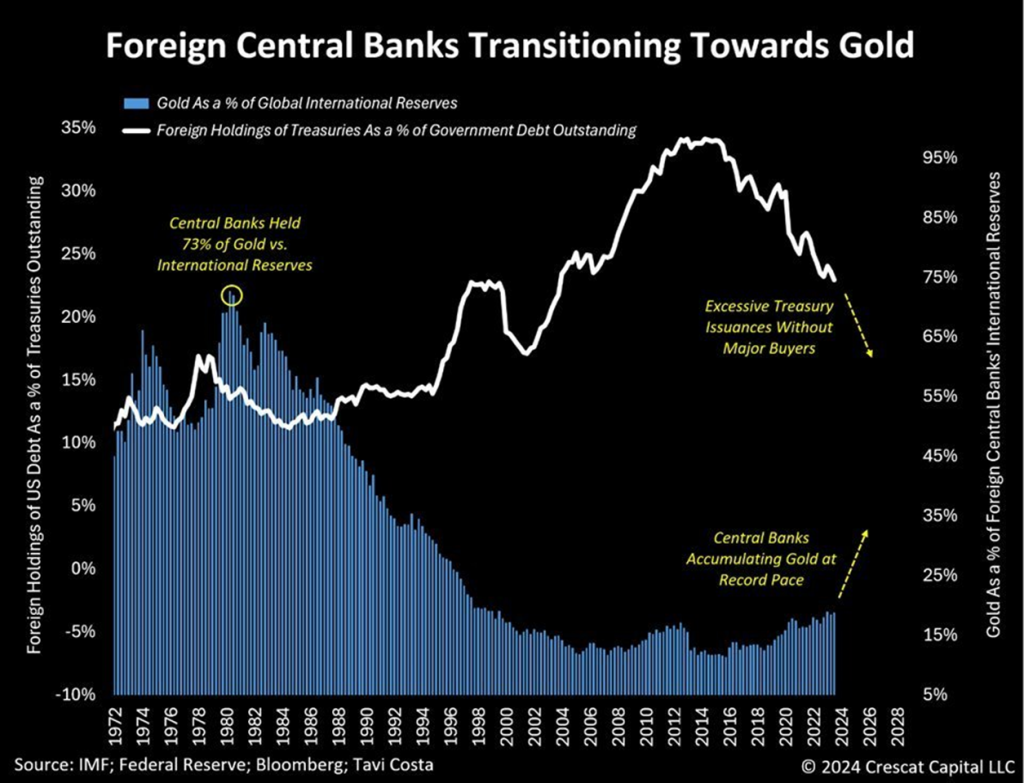

This macro thesis has recently been reinforced by gold’s resurgence as a crucial asset for central banks, particularly following the Russian-Ukraine conflict, when the US froze approximately $300 billion of Russian holdings in Treasuries. While the European Central Bank, the Bank of Japan, and other close US allies still maintain substantial holdings of Treasury securities, China, once the primary financier for the US, has unmistakably shifted its focus towards gold as its core holding. In our perspective, this transition is just the beginning.

A Relief Valve: Further Monetary Dilution

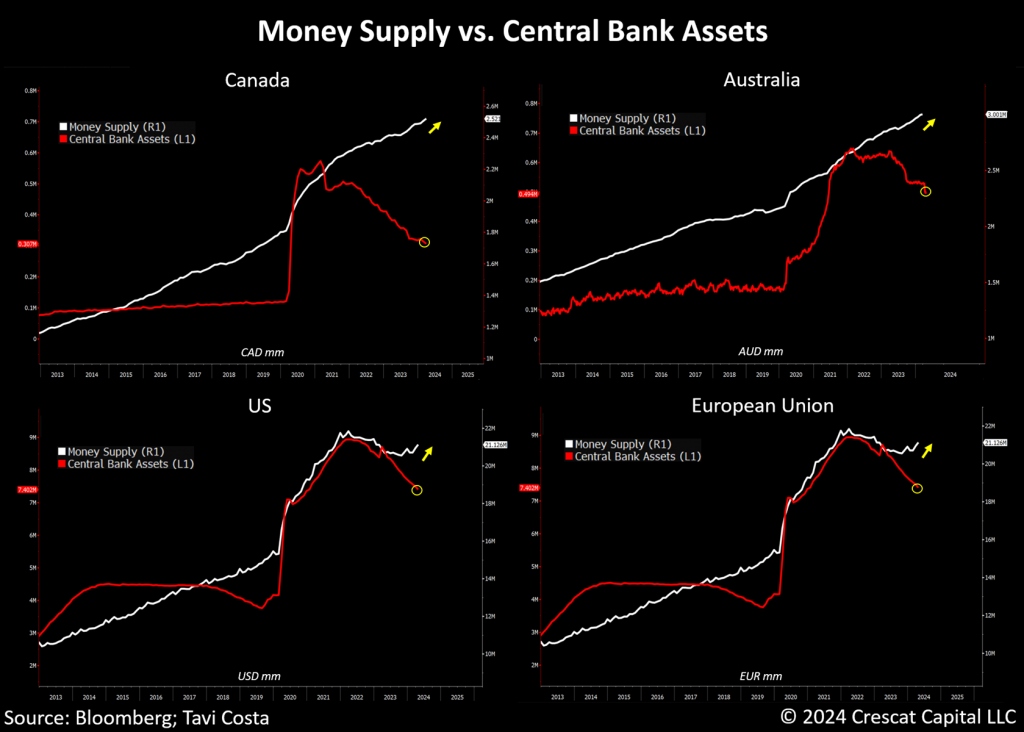

The importance of the current disparity between central banks’ balance sheet assets and the expanding money supply is often overlooked, yet it stands as arguably one of the most important macro developments occurring at present.

Tight monetary conditions in a historically indebted environment are unsustainable, and further monetary dilution serves as a relief valve to alleviate financial stress.

Even with quantitative tightening efforts and maintaining interest rates notably higher than those of the past 15 years, there persists a substantial increase in both the monetary base and M2 money supply. Remarkably, this trend is not exclusive to the US; other developed economies are also witnessing similar phenomena. Below are a few examples for reference.

This combination of expanding money supply alongside one of the most aggressive fiscal spendings we’ve seen outside of a recession could potentially create an explosive mix for inflationary pressures that are firmly embedded. Prolonged higher inflation seems inevitable, and it’s difficult to imagine investors not turning to hard assets as a crucial alternative in response.

The Enduring Era of Inflation

Unlike emerging markets, which have dealt with persistent inflation for decades, developed economies are now facing what appears to be a sustained rise in consumer prices. The aggressive fiscal responses we continue to see from policymakers highlight how long these countries have been unaccustomed to such price pressures. This is concerning because inflation has a psychological component, and once entrenched in people’s minds, it becomes incredibly difficult to eradicate.

This is why inflationary forces tend to build over decades rather than short periods and ultimately become a self-fulfilling prophecy. Businesses, facing margin pressures, raise prices for their goods and services, prompting consumers to demand higher wages to cover the rising cost of living. If governments exacerbate this with highly inflationary policies, these trends worsen.

The social impact is increasingly evident with more protests, labor strikes, crime, and wealth disparity. Inflation impacts lower-income groups disproportionately.

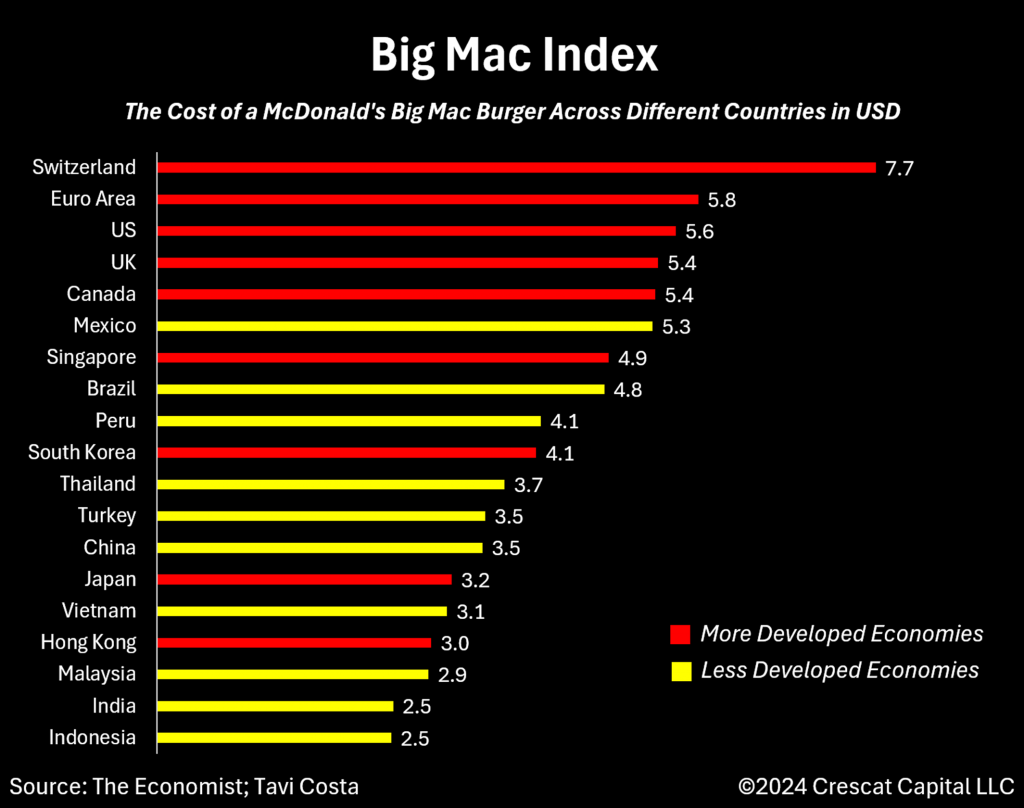

Interestingly, the evident lack of monetary and fiscal discipline in developed economies has led to a higher cost of living compared to some emerging markets.

This phenomenon is clearly illustrated by the Big Mac index, which is an informal way of measuring purchasing power parity (PPP) between currencies and providing a test of the extent to which market exchange rates equilibrate the cost of the same goods in different countries.

The index reveals that developed countries now have higher prices for Big Macs than their less developed counterparts.

More importantly, the last time we observed a similar scenario was in the early 2000s when emerging markets’ investments significantly outperformed developed markets. One of the main reasons for this is that the performance of less developed economies often aligns closely with the commodities cycle, which tends to impact the strength of their currencies.

This alignment helps these countries cope better with inflation. Additionally, their speed and aggressiveness in implementing policies to combat inflation, given the ongoing experience of less developed markets with constant upward pressure on consumer prices, tend to have a major positive impact on their currencies relative to more developed economies.

Strategic Portfolio Reassessment

Long-term inflationary trends create a pressing need for institutions and investors to reassess their portfolio allocations, as these periods often signify a macro regime change that alters asset correlations. What once served as a reliable hedge for a significant exposure to a certain asset class may no longer function effectively as a defensive asset. Moreover, as inflation persists, interest rates face upward pressure, and asset volatility must be readjusted accordingly.

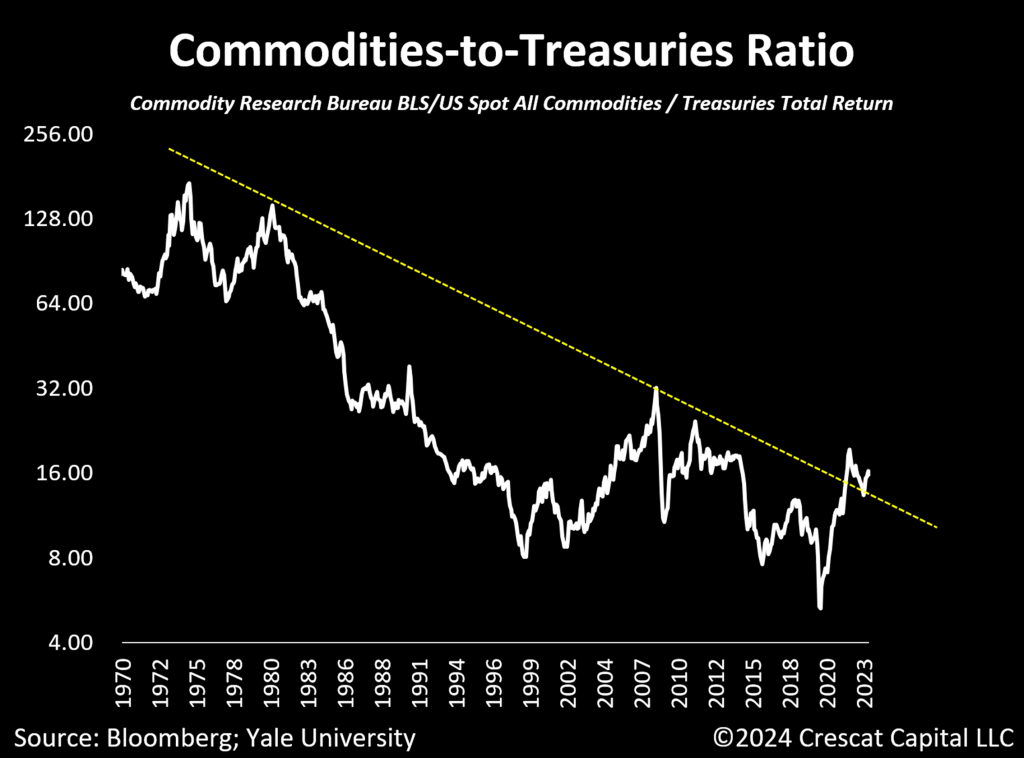

Just as central banks are re-evaluating their asset allocations, traditional 60/40 portfolios are experiencing similar pressures. With sovereign fixed income instruments underperforming, hard assets are being reconsidered as crucial alternatives. After a prolonged period of underperformance, commodities have significantly outperformed U.S. Treasuries since the COVID-19 recession.

Natural resources are increasingly emerging as geopolitically strategic assets for nations, especially as deglobalization trends intensify. The imperative to secure supplies of essential materials is becoming ever more critical as countries pivot towards onshoring to reduce foreign supply-chain dependence.

China’s “Japanification” Moment

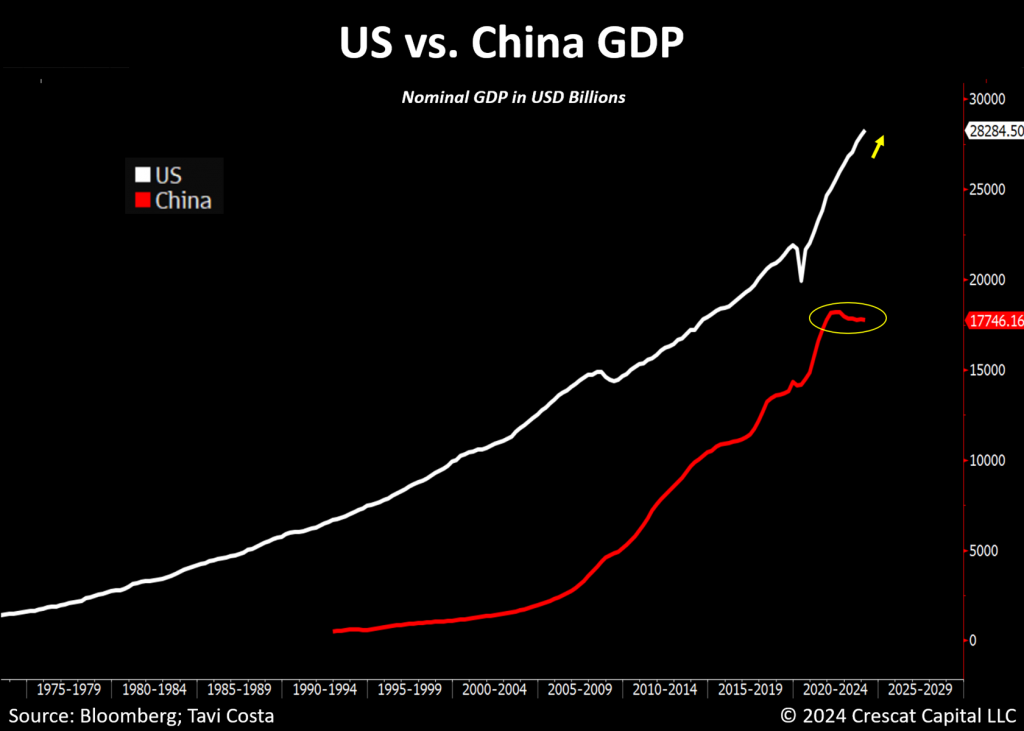

The recent dynamic of China continuing to accumulate gold while does not in any way strengthen the case for investing in China or believing that the yuan is soon to become a reserve currency. In our view, such a narrative is overly stretched and fails to acknowledge the reality of China’s economic stagnation.

The Chinese economy is facing a similar issue to what Japan experienced after the bursting of its asset price bubble in the late 80s, which led to a long period of low growth known as the “Lost Decades”. After three decades of accruing more debt to produce less GDP, the persistent devaluation of the yen since 2011 has emerged as one of the most important resolutions to Japan’s extreme macro imbalances.

The ongoing pressure on China’s monetary system to devalue is precisely what is driving its urgent need to persist in accumulating gold. If anything, China’s macro imbalances only reinforce the case for owning gold.

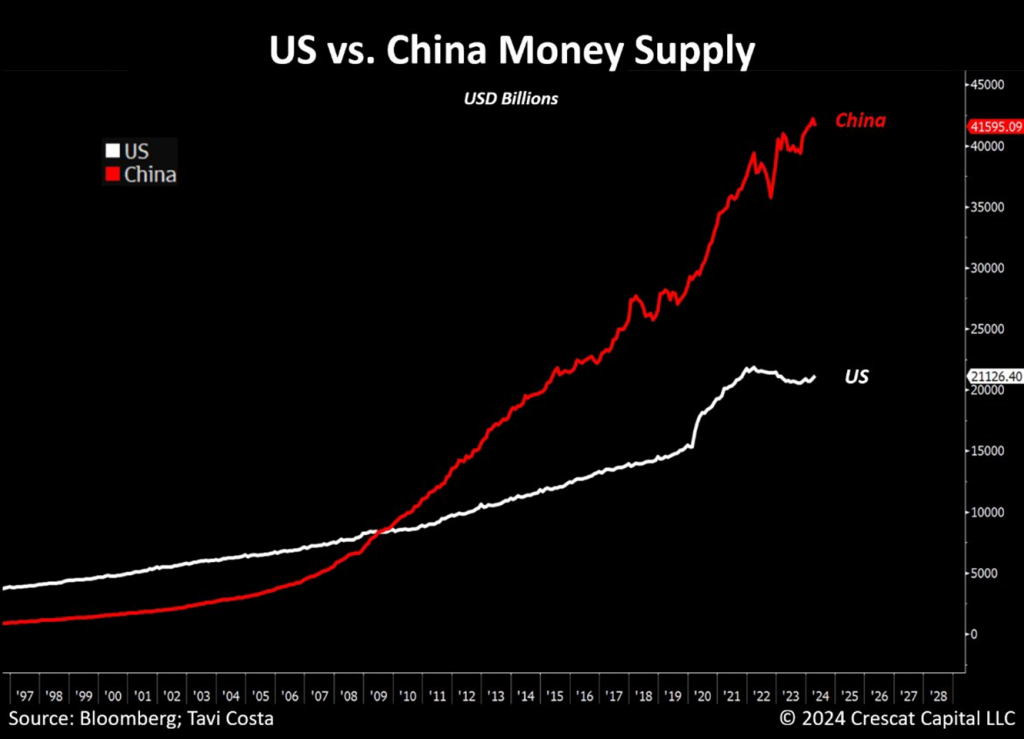

Moreover, if you find the U.S. money supply alarming, consider China’s situation. The Chinese M2 money supply is currently about double that of the U.S., even though China’s economy is 40% smaller.

The pervasive phenomenon of global monetary dilution is a fundamental aspect of today’s macro environment and that is likely to drive the prices of gold and other hard assets significantly higher.

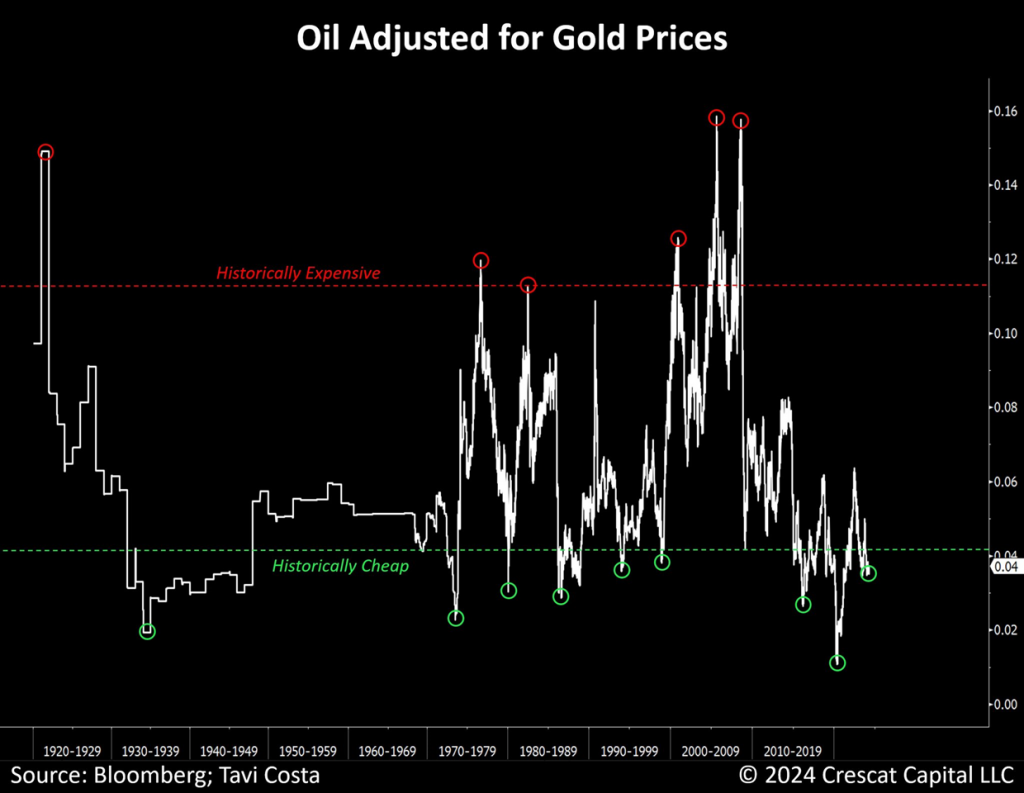

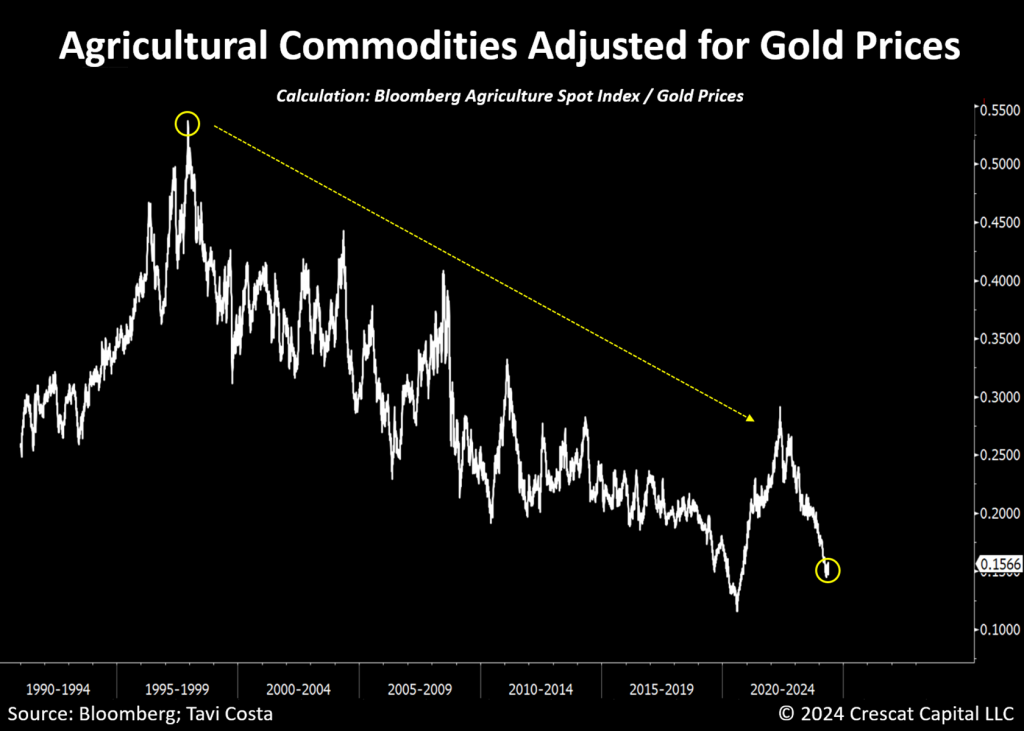

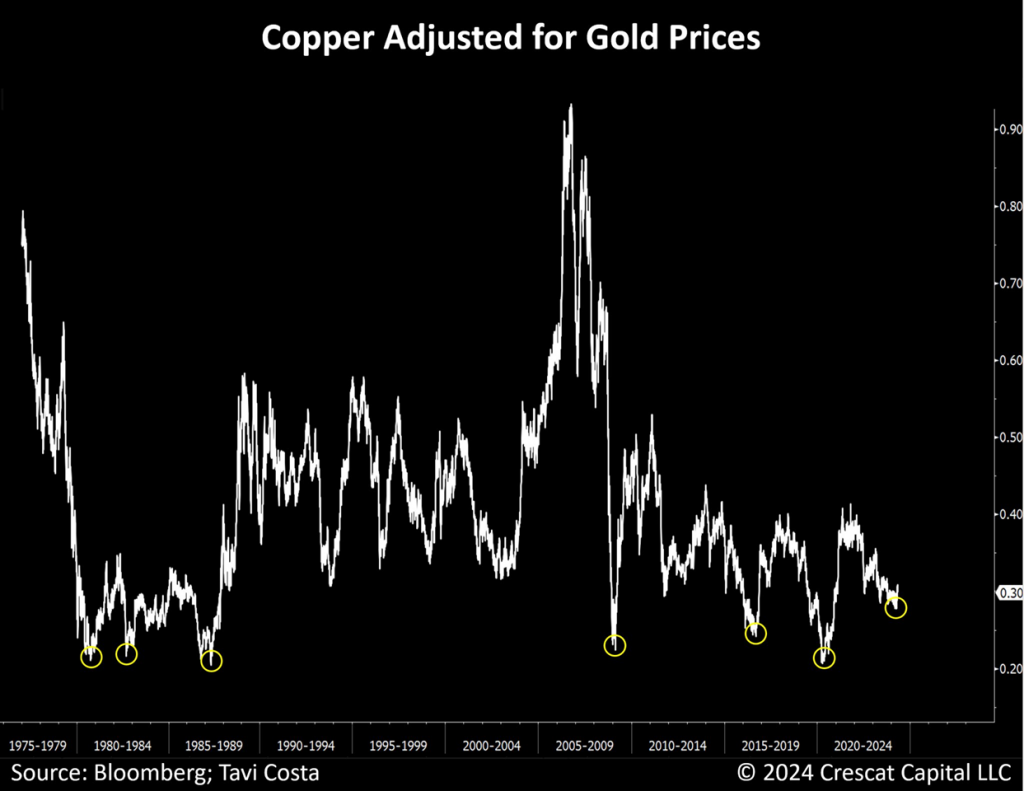

Commodities: Undervalued Against True Inflation

What is surprising, however, is that despite the recent increase in prices of most natural resources over the last three years, most commodities still trade at historically low levels when adjusted for what we consider to be true inflation. In other words, oil, copper, zinc, silver, natural gas, and most agricultural commodities have all experienced major price declines relative to gold prices over the past decade. Refer to the three charts below as examples.

There are a few ways to interpret this data. While some might immediately think that gold prices are expensive, we argue that gold is a leading indicator for these other commodities and highlights how undervalued the other commodities are despite their recent appreciation. Moreover, the long term underperformance in commodity prices versus financial assets has been the key factor in preventing consumer inflation from accelerating. At this stage, with long-term supply being so limited and structural demand forces at play, commodity prices are likely to become a significant driver of inflation.

The Capex Dilemma

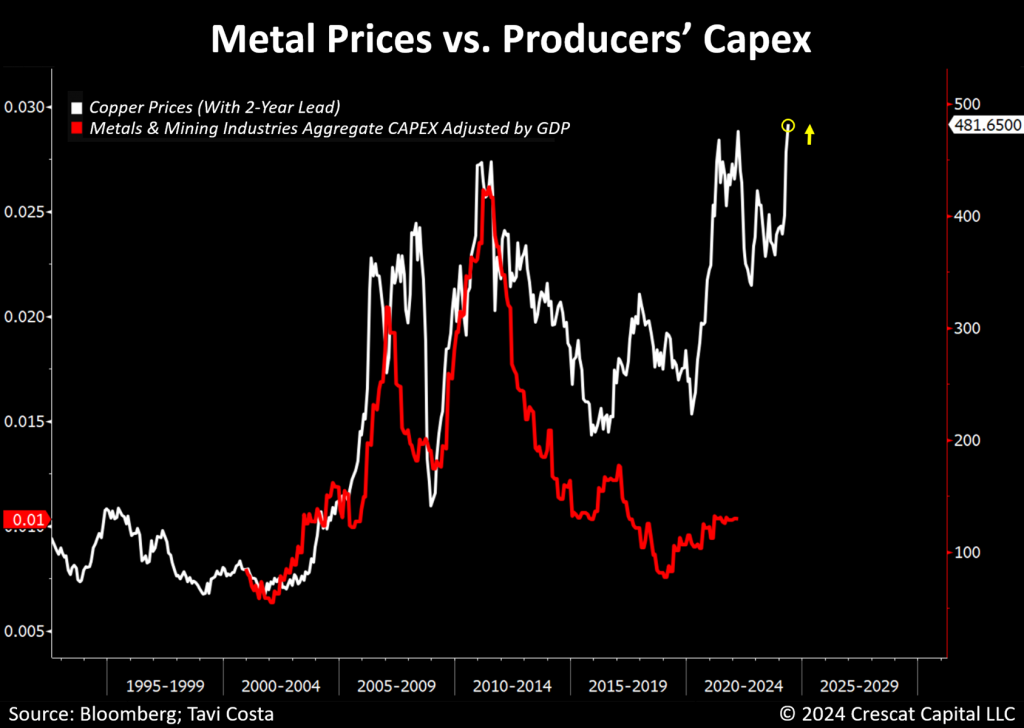

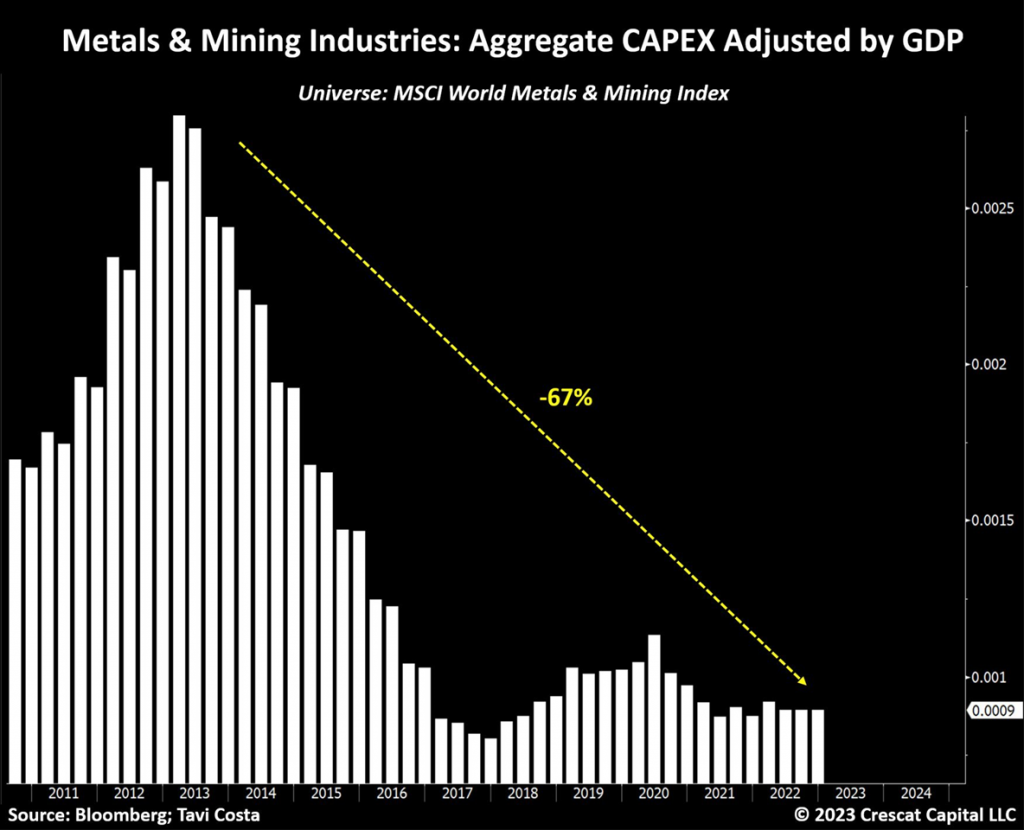

The surge in metal prices often leads to a spending boom among producers, causing aggregate capital expenditure to lag by about two years before companies feel confident that commodity prices are sustainably higher.

However, the current environment is markedly more pronounced than in previous commodity cycles. Several factors may explain this, including political pressure, ESG-related policies, depressed investor flows into the metals and mining industry, and more recently, the tightening of monetary conditions, all of which have contributed to historically compressed capital investment relative to GDP.

In the commodity market, the metals and mining industry has a long duration from mineral discovery to production. This extended timeline results in longstanding supply dynamics, making metal cycles inherently lengthy.

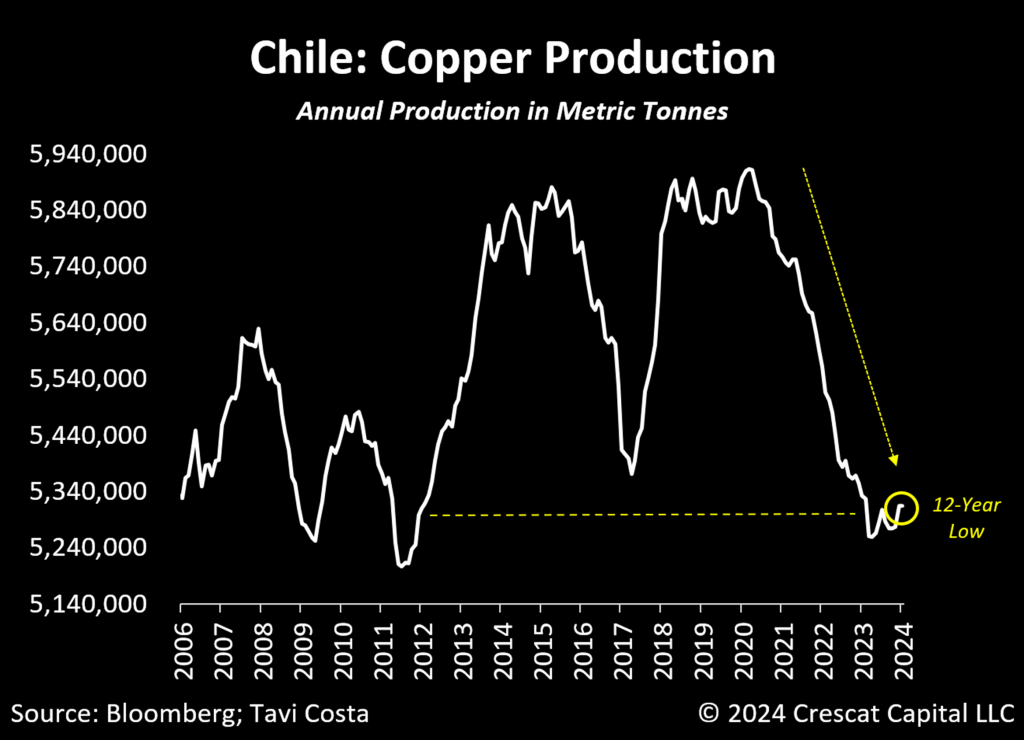

The Saudi Arabia of Copper Production

Chile’s copper production remains at the same level it was 12 years ago. To put this in perspective, Chile is to copper what Saudi Arabia is to oil, currently accounting for 27% of global production. Meanwhile, global GDP has increased by at least 35% since then. Copper’s critical role in electrical infrastructure is underscored by the fact that a single ChatGPT request consumes about 17 times more energy than a Google search.

The increasing prevalence of electric cars, electric heating, and AI is creating a significant electricity demand, potentially leading to a shortage in the global economy. This is not to mention the reshoring efforts and other green-revolution-related projects that are expected to unfold, backed by $1.7 trillion in infrastructure bills passed since the pandemic.

While copper rose slightly ahead of itself price-wise in the near term, and has pulled back in the last week, the metal remains one of the best opportunities in the commodities market for the coming decade.

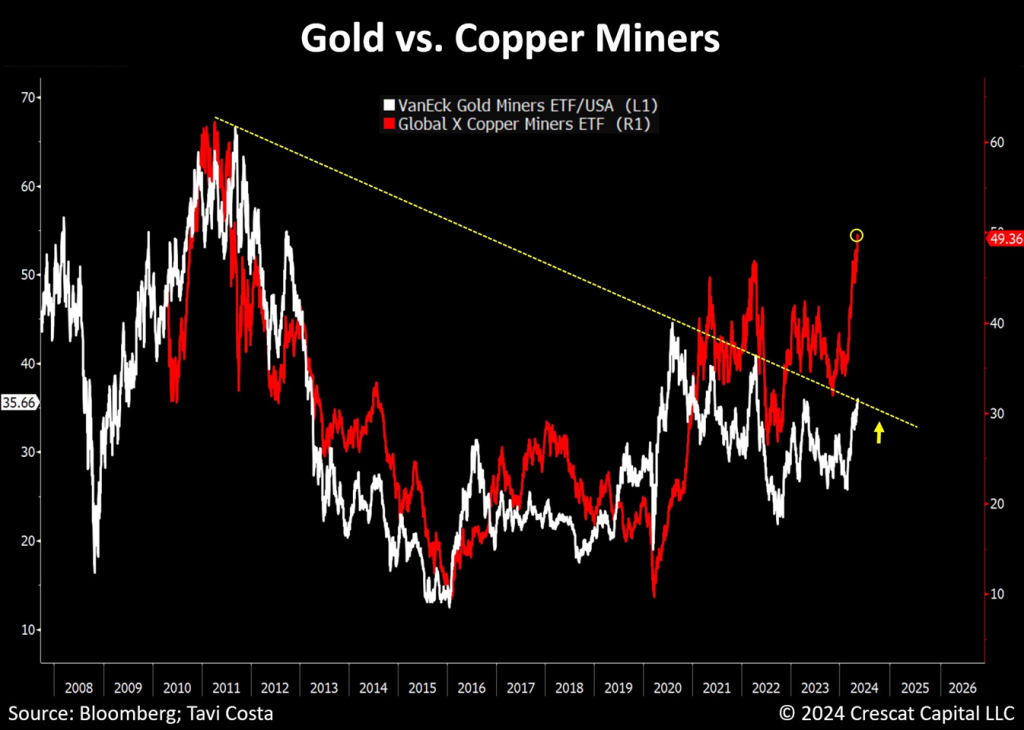

Gold Miners to Follow Copper’s Lead

For those wondering whether gold miners will ever catch up to the recent surge in metal prices, look no further than copper mining companies. As the profitability of copper miners has improved with the rising price of their underlying metal, so it is with the gold producers.

Despite the longstanding pessimism surrounding this industry, we believe precious metals stocks are currently on the brink of a major breakout.

It’s rather peculiar to find ourselves going to great lengths to clarify that throughout history, when metal prices have consistently risen, as they have in recent years, mining companies have achieved improved bottom lines. The skepticism that escalating production costs will hinder miners from benefiting from increased revenues is at odds with past commodity bull markets and inflationary cycles.

Moreover, it’s worth noting that perhaps the time for pessimism toward this industry was thirteen years ago at the peak of its capital investment cycle in 2011. With commodity equity valuations currently at historically low levels and the capex cycle in its early innings, getting long precious and base metal miners is one of the best macro opportunities we’ve seen in our careers.

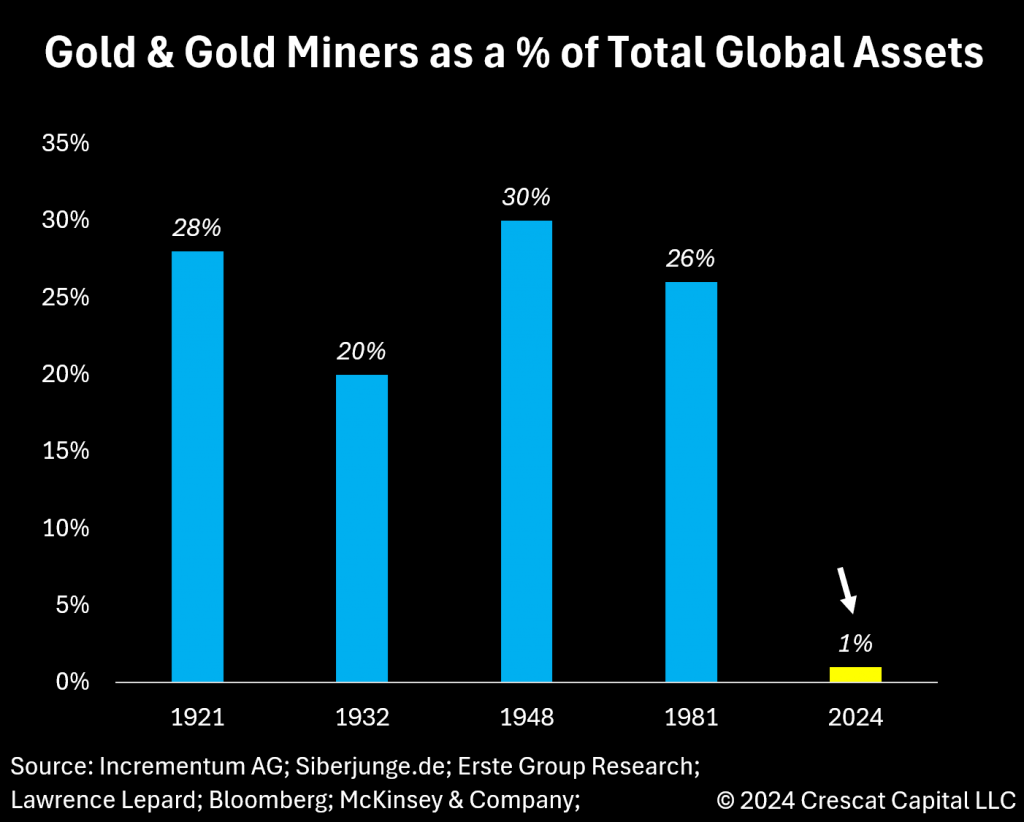

Once Large, Soon to Rise Again

Multiple times in history, the precious metals industry was considered the largest market among global assets. Today, however, it has shrunk so much in relative value that it’s a rounding error away from a zero percent allocation.

The potential for capital to flow back into this industry is substantial, especially as central banks urgently seek to accumulate metals and traditional 60/40 portfolios face pressure to redefine their capital allocation and incorporate hard assets. Even a minor increase in investment could significantly impact the entire mining sector.

This chart is provided courtesy of our friends Lawrence Lepard and the team at Incrementum AG.

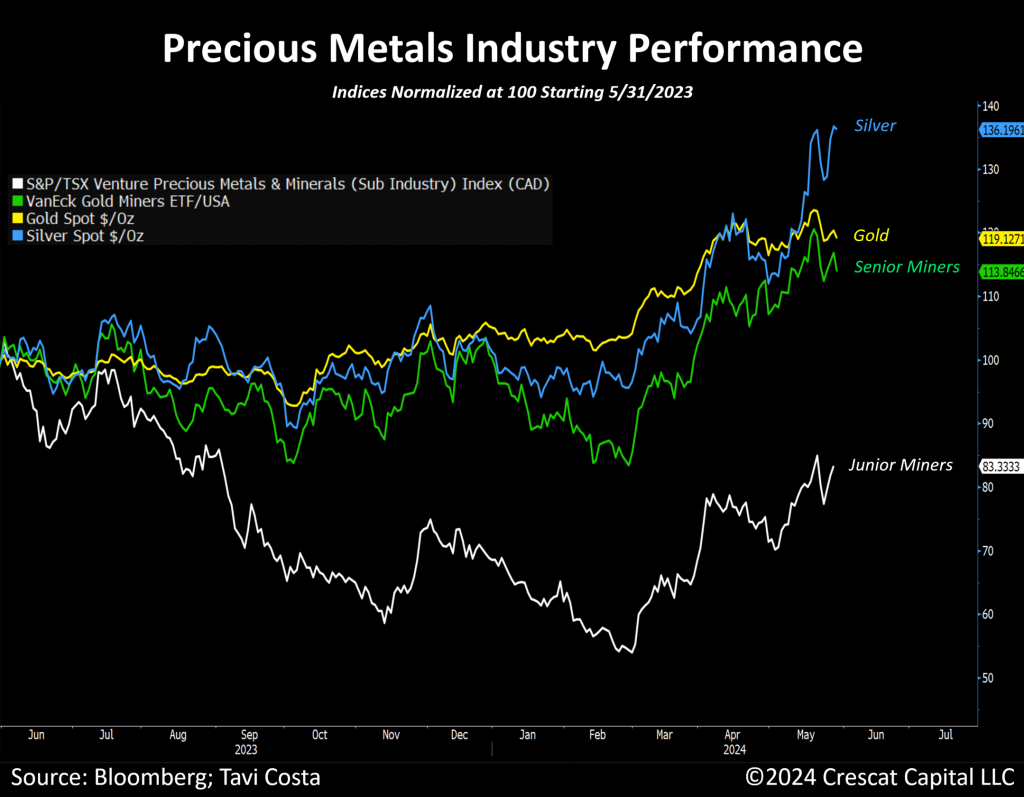

The Lag Is Your Friend

The most critical question facing investors in the precious metals sector today:

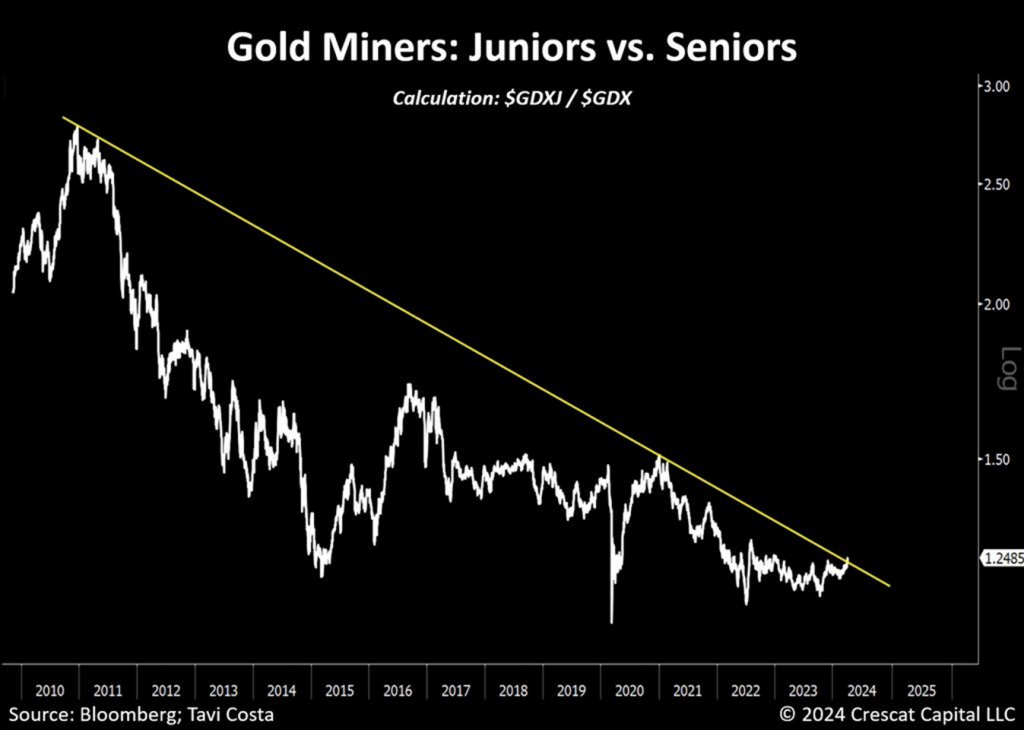

If this truly marks the inception of a new secular bull cycle for gold, why are junior miners significantly lagging?

In our opinion, the answer can be distilled into two primary points:

- This is a common phenomenon, and we think the lag is your friend for those looking to add exposure now. Initially, funds typically gravitate towards larger and more liquid companies, before investors begin seeking higher returns in the more undervalued yet riskier small and microcaps.

- Following numerous failed attempts, investors are understandably disillusioned with trying to time the market bottom and are now understandably skeptical about the prospects of this industry.

Inception of a Gold Cycle: Understanding the Catalysts

The reality is that market participants tend to fall into the trap of believing that “this time will be different”.

Hence, the lingering question remains, are we truly witnessing the onset of another gold cycle?

We firmly uphold this viewpoint, and throughout the remainder of this letter, we will elucidate the main reasons reinforcing our strong conviction.

As shown in the chart below, central banks currently allocate less than 20% of their balance sheet to gold, compared to the peak of 75% observed in the early 1980s.

It’s noteworthy that global monetary authorities have already begun to accumulate gold for various reasons. This move is crucial to enhancing the quality of their international reserves after a prolonged period of imprudent monetary policies. Instead of filling their balance sheets with debt instruments from other indebted economies, it is vital for global central banks to hold a neutral alternative with centuries of proven credibility as a hard asset to return as the cornerstone of their monetary systems.

We anticipate that these policy changes will significantly influence other major institutions to also gradually adopt gold as their first-choice haven asset above sovereign debt denominated in fiat currencies.

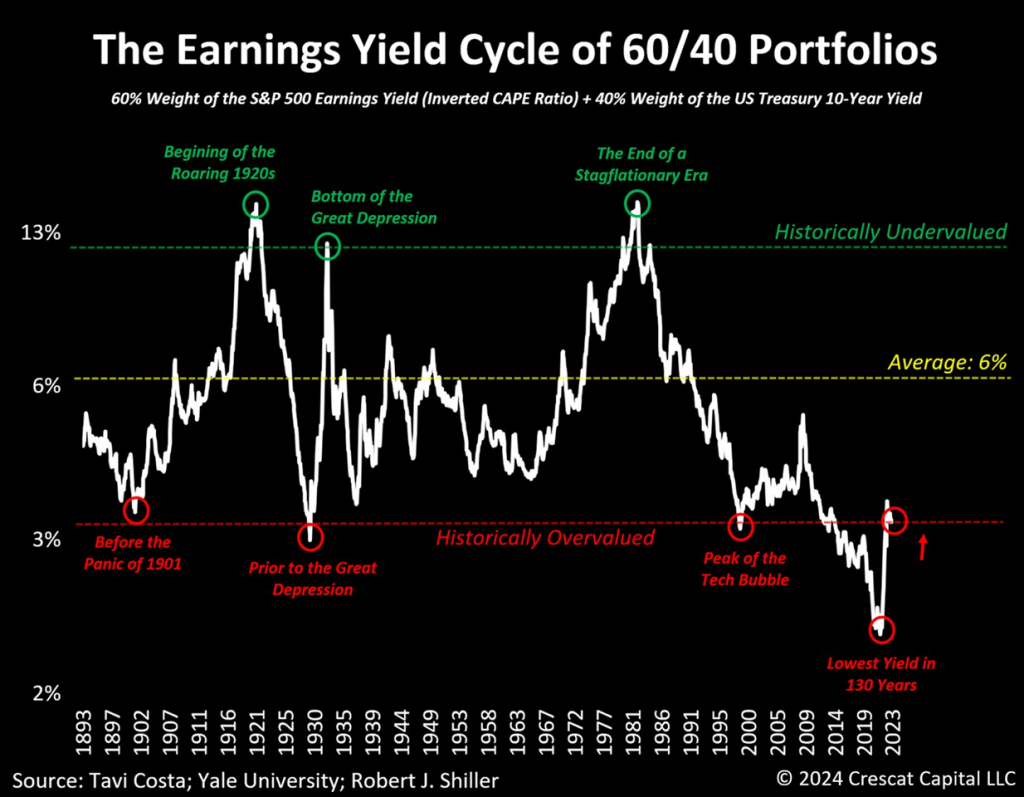

The Pending Shift Within 60/40 Portfolios Toward Gold

Conventional portfolio strategies are only beginning to re-define their allocations to incorporate hard assets like gold. See below how the valuation history of the traditional 60/40 stock and bond portfolio unfolds through extended cycles. We are currently experiencing another critical juncture in this dynamic.

The surge in popularity and former astounding success of this simple investment strategy can be chalked up to four decades of disinflation, culminating in one of the most speculative environments in financial market history which is likely in the process of sharply reversing given entrenched inflation and its negative impact on the Treasury bond market.

We believe it is improbable that equities and bonds, given their current inflated prices, will collectively yield significant returns over the next decade. This is especially true in a world where structural inflationary pressures persist in the system and will likely continue to drive the cost of capital further above recent accustomed norms.

As a result, we believe gold and commodities are set to see substantial inflows from these potential shifts in capital allocation in the near future, initiating a long-term bull market for these assets as capital moves back into inflation-hedging instruments.

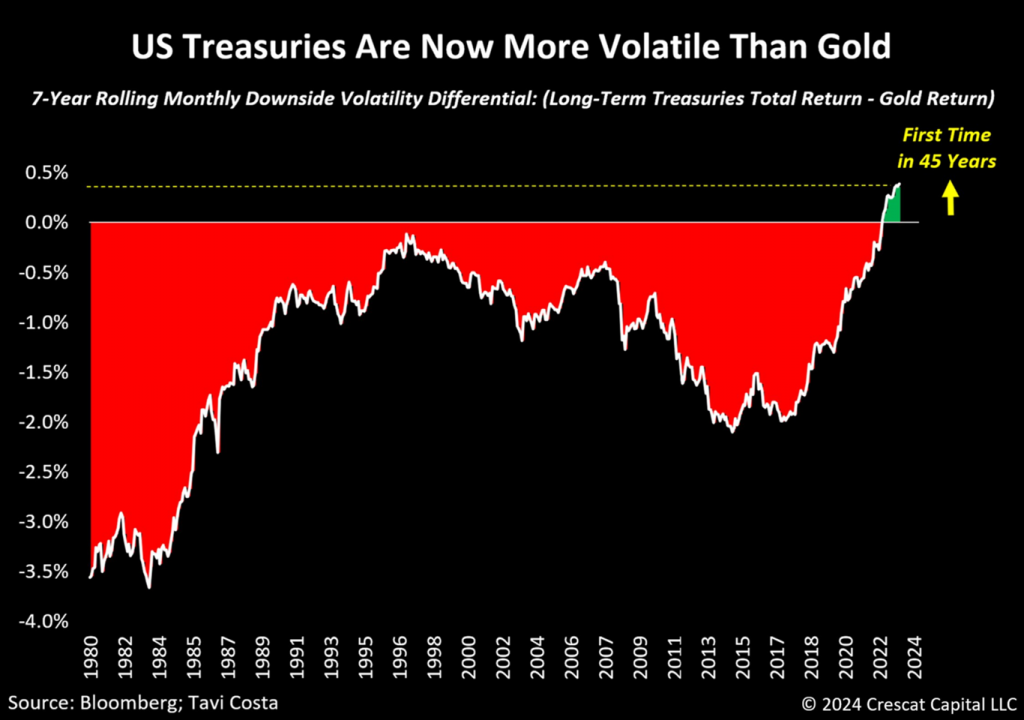

Gold Resurgence as the Safer Alternative

As commonly recognized, the 40% portion of these conventional portfolios, largely composed of fixed-income assets, has been grappling with substantial performance challenges, prompting investment managers to give fundamental consideration to the potential necessity of restructuring this allocation. Investors primarily include bonds in their portfolios as the safe-haven assets with minimal downside volatility, that typically performs well during economic downturns when stocks are struggling.

Nevertheless, institutions should deeply reflect upon this crucial analysis:

This is the first time in 45 years that gold has become less volatile than Treasuries. In other words, Treasuries are no longer the safest alternative.

The Critical Role of a Neutral Asset

In the midst of today’s macroeconomic imbalances, developed economies find themselves with limited maneuverability, leading to a significant surge in their debt burdens. This surge is propelled by both higher global interest rates and ongoing historically high levels of fiscal spending. Comparisons with historical periods below highlight an unprecedented rise in sovereign debt issuances.

Even during the 1940s, marked by high government debt levels, a certain stability existed with the US monetary system anchored to gold. However, the current landscape presents a stark departure from this historical context. Despite prevailing inflationary pressures, we are witnessing what could be described as the most undisciplined monetary and fiscal environment in history.

Consequently, gold’s role as a universal, neutral asset with millennia of history as money, is experiencing a resurgence relative to US Treasuries for global central bank reserve accumulations.

Supply and Demand Mismatch

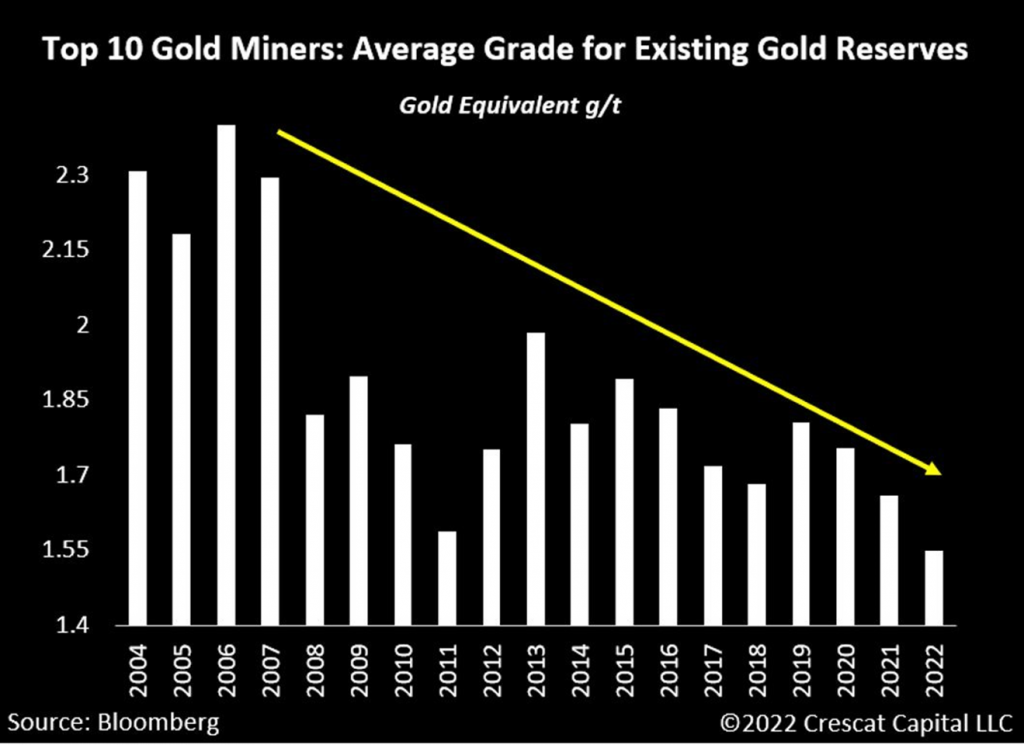

The marginal gold supply available from new mining production is currently at its most restricted given not only the lack of new reserves but also the declining quality of reserves. The average grade for gold reserves by the top 10 miners in the world has been in a secular decline. Furthermore, according to McKinsey & Company, one-fourth of the existing gold reserves today are considered refractory deposits, which require expensive treatment methods to achieve acceptable metallurgical recovery rates. Higher gold prices are thus necessary to make these deposits economically viable.

Shifting From Gold to Copper: Perversely Bullish

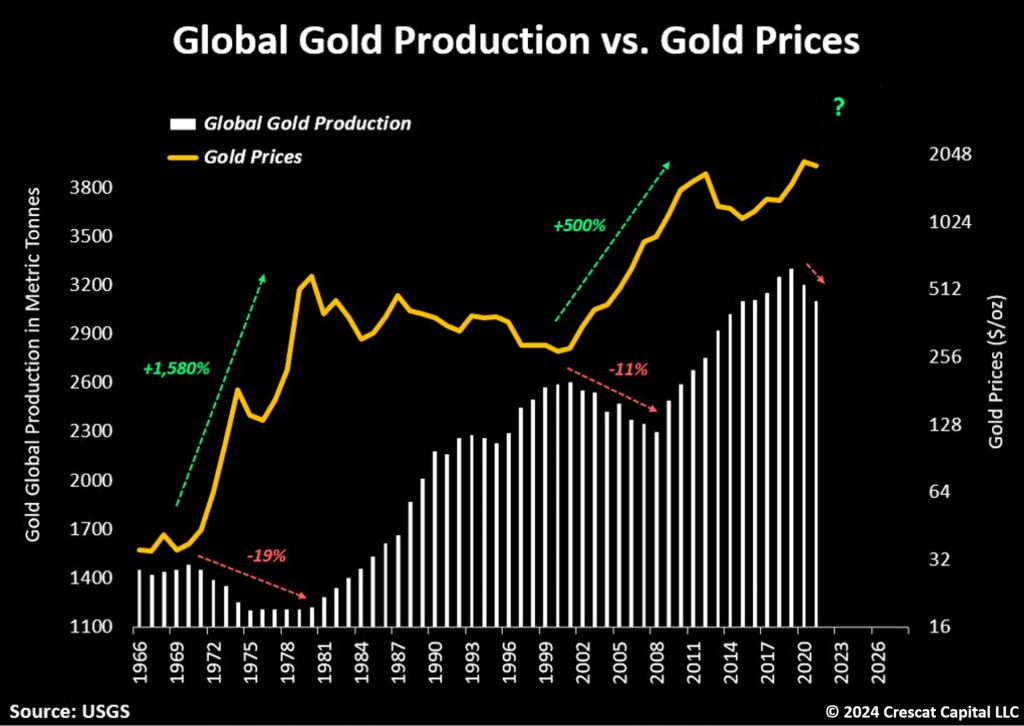

Additionally, we are at a key inflection point for the gold industry today. Due to the overwhelming pressure to adopt the green revolution, there has been a declining interest from miners in deploying capital to gold-focused projects. Perversely, this dynamic tends to be incredibly bullish for the industry. Since the end of the Bretton Woods system in 1971, there have been two major gold bull markets: a raging one in the 1970s and another substantial one in the early 2000s.

Among the multiple idiosyncrasies causing the metal price to rise in each of them, one key macro driver precipitated the move higher in both, a multi-year decline in gold production worldwide. These contractions had a significant impact on fueling the strength and length of prior gold cycles.

Today, we see the same macro development unfolding. Global gold production has been falling since 2019 and is likely in the early stages of a new secular downtrend.

Miners that have traditionally focused on precious metals have been redirecting their capital to battery metals and other mineral resources that comply with the green agenda. Many gold-focused miners have significantly shrunk their production.

It is important to highlight that during prior periods of similar significant decline in total global production of gold, like that which began in 2020, related mining stocks performed exceptionally well for the next decade.

Capex Depressed

Capital expenditure trends for mining companies are currently at historically low levels, despite efforts towards reshoring, manufacturing revamp, and the green revolution.

Metal producers remain so financially restrained to invest in their businesses that they are almost giving more capital back to shareholders than what they spend on capex. This is a classic sign of a commodities bull market cycle in its early innings.

Inflation: Higher For Longer

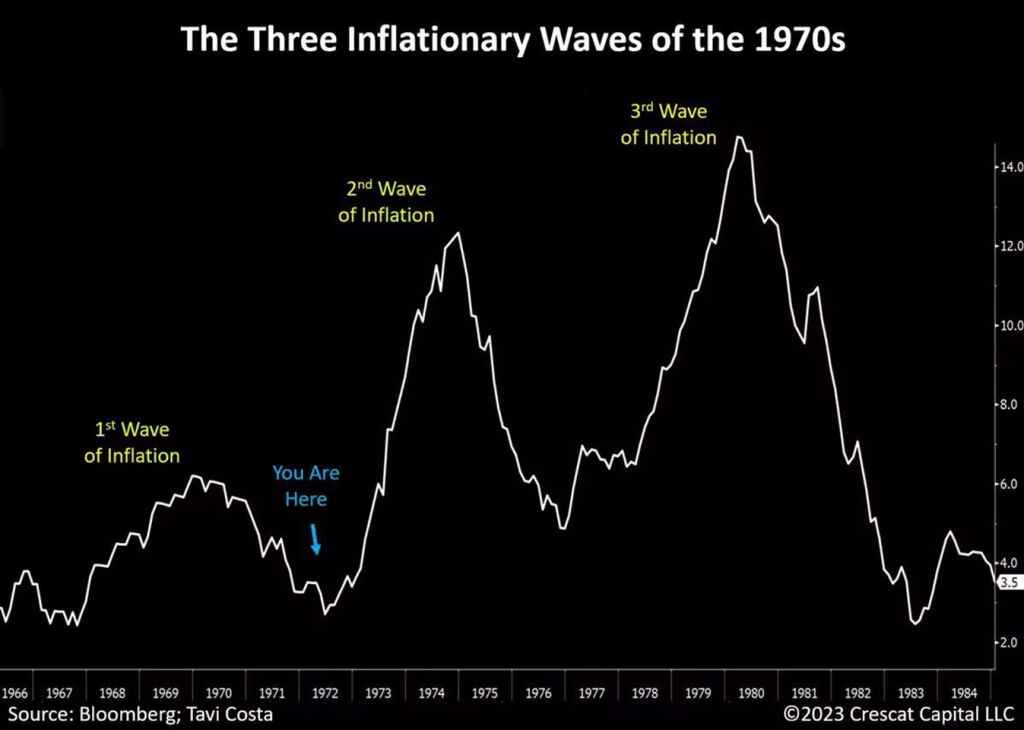

While the macro environment today differs from that of the 1970s or 1940s, a lesson from history remains: Inflation tends to develop through waves.

Despite all the debate regarding the 1940s and 1970s, inflation turned out to be structural in nature and manifested itself through waves during both periods. Take note of that in perspective of what is unfolding today. Inflation is likely in a bottoming process, and the recent developments in commodity prices and breakeven rates are adding to that case.

This is unlikely to be a cyclical issue; instead, the main drivers of today’s inflationary regime are:

- Deglobalization,

- Irresponsible levels of government spending,

- Ongoing commodity supply constraints,

- Wage-price spiral, especially among lower-income workers.

Stubborn inflationary pressures are priming investors to once again favor hard assets as a portfolio allocation.

Reckless Fiscal Spending

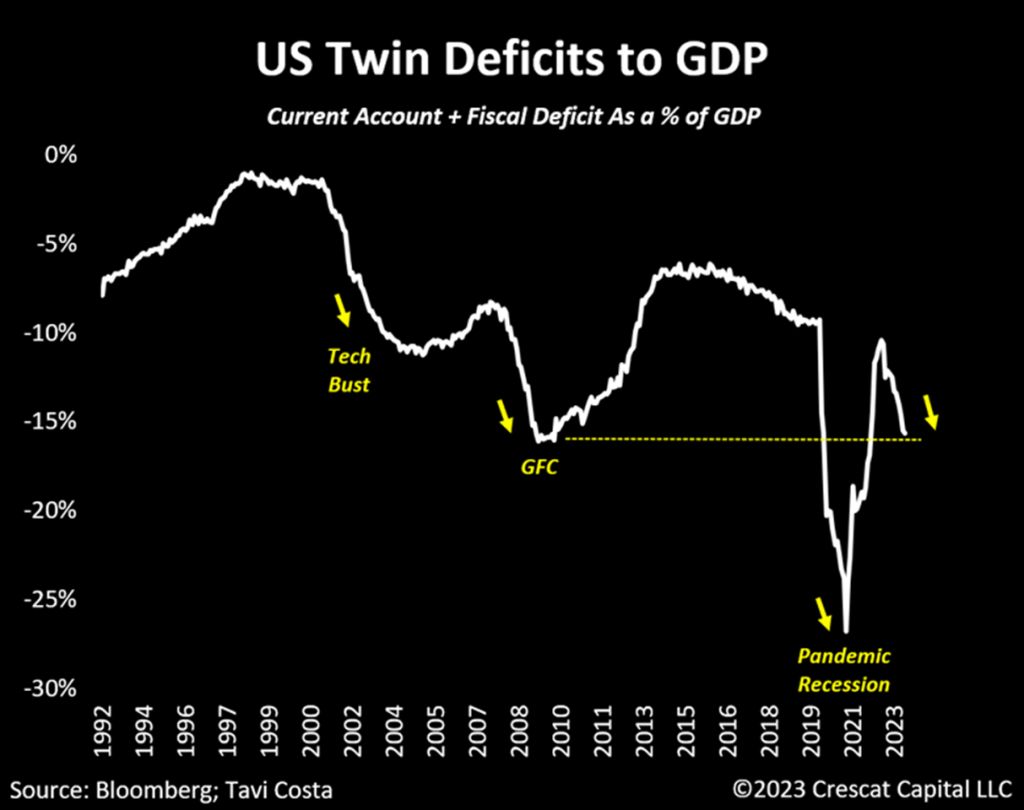

To underscore the importance of owning gold and commodities in today’s environment, consider that the US is currently facing twin deficits as severe as those during the worst parts of the Global Financial Crisis. More concerning is the indication that this is an ongoing structural issue still evolving. With each prior recession, these deficits have reached new lows.

Reckless fiscal spending and a dearth of monetary discipline are compelling investors to seek alternatives beyond government-backed securities.

A Multitude of Macro Drivers

We believe gold prices could rise significantly in the coming decade as long-term imbalances inevitably apply considerable upward pressure on the metal.

The multitude of macro drivers supporting the onset of another gold cycle is truly remarkable. Amplified by the prevailing skepticism surrounding the metal, we are arguably experiencing the most important time in gold’s history.

An Allocation Shift Towards Gold

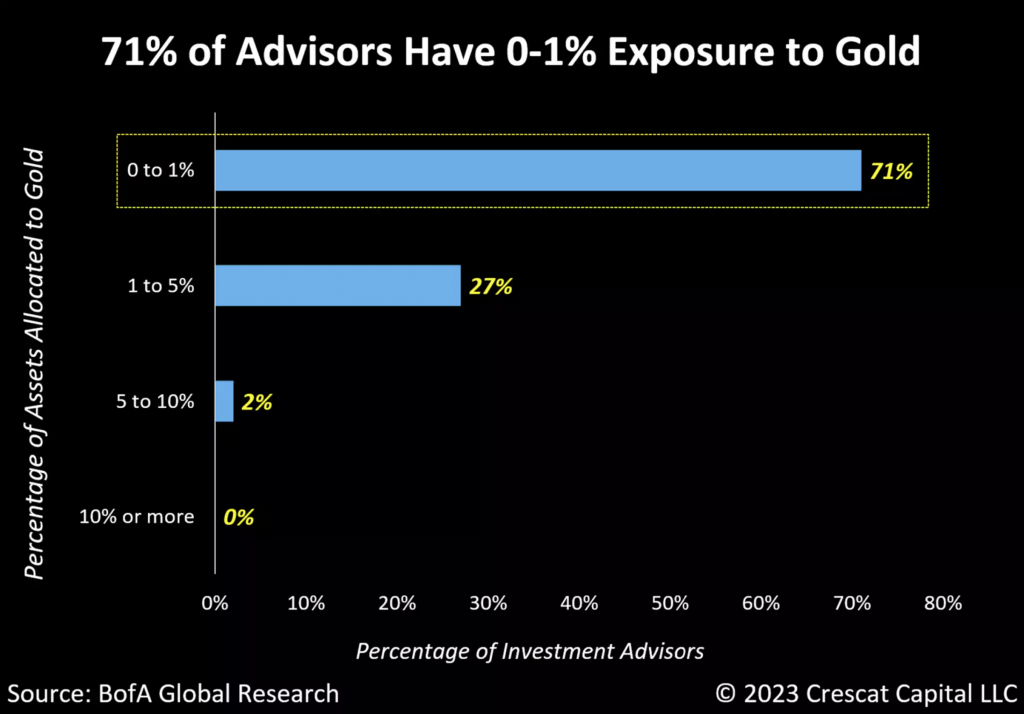

The macroeconomic reasons for owning gold are undeniably strong. Our confidence is further bolstered by the consistent neglect of the metal as a defensive alternative over the past few decades, evident in the significant underrepresentation of precious metals among traditional investment strategists. According to Bank of America, 71% of wealth advisors currently allocate only 0-1% of their portfolios to gold.

Even more striking is the notable absence of any investors holding 10% or more of the metal, as shown in the data below.

Juniors: The Transition from Lag to Lead

Junior miners are an exceptional opportunity, in our opinion, given their depressed valuations after a long bear market and ahead of a likely transformative wave of mergers and acquisitions that is poised to unlock the potential of this long-overlooked segment of the industry. As gold prices have already begun to ascend, while small-cap mining companies remain historically depressed, it is important to reiterate a popular quote from Steve Hanke, an American economist and professor of applied economics at the Johns Hopkins University:

“Bull markets make you money, bear markets make you rich”.

While these are subjective terms, the idea is that bear markets, such as that which has already transpired in the junior mining industry, especially within the small and microcap exploration segment, provide the chance to make transformative investments that can lead to significant long-term wealth creation. The key is having the capital, patience, and conviction to act wisely when prices are substantially undervalued.

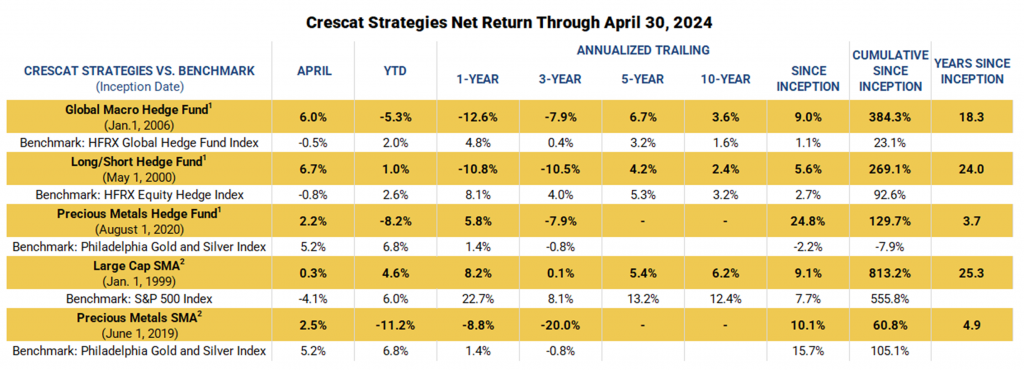

Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Individual performance may be lower or higher than the performance data presented. The currency used to express performance is U.S. dollars. Before January 1, 2003, the results reflect accounts managed at a predecessor firm. See additional performance disclosures below.

We encourage you to reach out to any of us listed below if you would like to learn more about how our vehicles might fit with your individual needs and objectives.

Sincerely,

Kevin C. Smith, CFA

Founding Member & Chief Investment Officer

Tavi Costa

Member & Macro Strategist

Quinton T. Hennigh, PhD

Member & Geologic and Technical Director

For more information including how to invest, please contact:

Marek Iwahashi

Head of Investor Relations

(720) 323-2995

Linda Carleu Smith, CPA

Co-Founding Member & Chief Operating Officer

(303) 228-7371

© 2024 Crescat Capital LLC

Important Disclosures

The purpose of this letter is to provide access to analyses prepared by Crescat Portfolio Management LLC (“CPM”) with respect to certain companies (“Issuers”) in which CPM and certain of the Funds and accounts it manages are shareholders. The letters enable CPM to share macro themes and newsworthy geologic updates, good and bad, across our Issuers as they arise. The letters represent the opinions of CPM, as an exploration industry advocate, on the overall geologic progress of our activist strategy in creating new economic metal deposits in viable mining jurisdictions around the world. Each Issuer discussed has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and in the aggregate may only represent a small percentage of a strategies holdings. The Issuers discussed may or may not be held in such portfolios at any given time. The Issuers discussed do not represent all of the investments purchased or sold by Funds managed by CPM. It should not be assumed that any or all of these investments were or will be profitable.

Projected results and statements contained in this letter that are not historical facts are based on current expectations and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results. While investing in the mining industry is inherently risk, CPM believes that under a professionally managed portfolio approach with the guidance of Quinton Hennigh, PhD, CPM’s full-time Geologic and Technical Director, and our proprietary exploration and mining model, we will be able to generate long-term capital appreciation.

These opinions are current opinions as of the date appearing in the relevant material and are subject to change without notice. The information contained in the letters is based on publicly available information with respect to the Issuers as of the date of such white papers and has not been updated since such date.

This letter is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security. The information provided in this letter is not intended as investment advice or recommendation to buy or sell any type of investment, or as an opinion on, or a suggestion of, the merits of any particular investment strategy.

This letter is not intended to be, nor should it be construed as, a marketing or solicitation vehicle for CPM or its Funds. The information herein does not provide a complete presentation of the investment strategies or portfolio holdings of the Funds and should not be relied upon for purposes of making an investment or divestment decision with respect to the Funds. Those who are considering an investment in the Funds should carefully review the relevant Fund’s offering memorandum and the information concerning CPM, including its SEC Form ADV Brochure which is available at: www.adviserinfo.sec.gov.

This presentation should not be construed as legal, tax, investment, financial or other advice. It does not have regard to the specific investment objective, financial situation, suitability, or the particular need of any specific person who may receive this presentation and should not be taken as advice on the merits of any investment decision. The views expressed in this presentation represent the opinions of CPM and are based on publicly available information with respect to the Issuer. CPM recognizes that there may be confidential information in the possession of the Issuer that could lead the Issuer to disagree with CPM’s conclusions.

CPM currently beneficially owns, and/or has an economic interest in, shares of the Issuers discussed in these letters. Therefore, CPM’s clients, principals and employees may stand to realize significant gains or losses if the price of the companies’ securities move. After the publication or posting of any video, CPM, its principals and employees will continue transacting in the securities discussed, and may be long, short or neutral at any time thereafter regardless of their initial position or recommendation. While certain individuals affiliated with CPM are current or former directors of certain of the Issuers referred to herein, none of the information contained in this presentation or otherwise provided to you is derived from non-public information of such publicly traded companies. CPM has not sought or obtained consent from any third party to use any statements or information indicated herein that have been obtained or derived from statements made or published by such third parties.

The estimates, projections, pro forma information and potential impact of CPM’s analyses set forth herein are based on assumptions that CPM believes to be reasonable as of the date of this presentation, but there can be no assurance or guarantee (i) that any of the proposed actions set forth in this presentation will be completed, (ii) that actual results or performance of the Issuer will not differ, and such differences may be material or (iii) that any of the assumptions provided in this presentation are accurate.

All content posted on CPM’s letters including graphics, logos, articles, and other materials, is the property of CPM or others and is protected by copyright and other laws. All trademarks and logos are the property of their respective owners, who may or may not be affiliated with CPM. Nothing contained on CPM’s website or social media networks should be construed as granting, by implication, estoppel, or otherwise, any license or right to use any content or trademark displayed on any site without the written permission of CPM or such other third party that may own the content or trademark displayed on any site.

Performance

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Individual performance may be lower or higher than the performance data presented. The currency used to express performance is U.S. dollars. Before January 1, 2003, the results reflect accounts managed at a predecessor firm.

1 – Net returns reflect the performance of an investor who invested from inception and is eligible to participate in new issues. Net returns reflect the reinvestment of dividends and earnings and the deduction of all expenses and fees (including the highest management fee and incentive allocation charged, where applicable). An actual client’s results may vary due to the timing of capital transactions, high watermarks, and performance.

2 – The SMA composites include all accounts that are managed according to CPM’s precious metals or large cap SMA strategy over which it has full discretion. Investment results shown are for taxable and tax-exempt accounts. Any possible tax liabilities incurred by the taxable accounts are not reflected in net performancePerformance results are time weighted and reflect the deduction of advisory fees, brokerage commissions, and other expenses that a client would have paid, and includes the reinvestment of dividends and other earnings.

Risks of Investment Securities: Diversity in holdings is an important aspect of risk management, and CPM works to maintain a variety of themes and equity types to capitalize on trends and abate risk. CPM invests in a wide range of securities depending on its strategies, as described above, including but not limited to long equities, short equities, mutual funds, ETFs, commodities, commodity futures contracts, currency futures contracts, fixed income futures contracts, private placements, precious metals, and options on equities, bonds and futures contracts. The investment portfolios advised or sub-advised by CPM are not guaranteed by any agency or program of the U.S. or any foreign government or by any other person or entity. The types of securities CPM buys and sells for clients could lose money over any timeframe. CPM’s investment strategies are intended primarily for long-term investors who hold their investments for substantial periods of time. Prospective clients and investors should consider their investment goals, time horizon, and risk tolerance before investing in CPM’s strategies and should not rely on CPM’s strategies as a complete investment program for all of their investable assets. Of note, in cases where CPM pursues an activist investment strategy by way of control or ownership, there may be additional restrictions on resale including, for example, volume limitations on shares sold. When CPM’s private investment funds or SMA strategies invest in the precious metals mining industry, there are particular risks related to changes in the price of gold, silver and platinum group metals. In addition, changing inflation expectations, currency fluctuations, speculation, and industrial, government and global consumer demand; disruptions in the supply chain; rising product and regulatory compliance costs; adverse effects from government and environmental regulation; world events and economic conditions; market, economic and political risks of the countries where precious metals companies are located or do business; thin capitalization and limited product lines, markets, financial resources or personnel; and the possible illiquidity of certain of the securities; each may adversely affect companies engaged in precious metals mining related businesses. Depending on market conditions, precious metals mining companies may dramatically outperform or underperform more traditional equity investments. In addition, as many of CPM’s positions in the precious metals mining industry are made through offshore private placements in reliance on exemption from SEC registration, there may be U.S. and foreign resale restrictions applicable to such securities, including but not limited to, minimum holding periods, which can result in discounts being applied to the valuation of such securities. In addition, the fair value of CPM’s positions in private placements cannot always be determined using readily observable inputs such as market prices, and therefore may require the use of unobservable inputs which can pose unique valuation risks. Furthermore, CPM’s private investment funds and SMA strategies may invest in stocks of companies with smaller market capitalizations. Small- and medium-capitalization companies may be of a less seasoned nature or have securities that may be traded in the over-the-counter market. These “secondary” securities often involve significantly greater risks than the securities of larger, better-known companies. In addition to being subject to the general market risk that stock prices may decline over short or even extended periods, such companies may not be well-known to the investing public, may not have significant institutional ownership and may have cyclical, static or only moderate growth prospects. Additionally, stocks of such companies may be more volatile in price and have lower trading volumes than larger capitalized companies, which results in greater sensitivity of the market price to individual transactions. CPM has broad discretion to alter any of the SMA or private investment fund’s investment strategies without prior approval by, or notice to, CPM clients or fund investors, provided such changes are not material.

Benchmarks

HFRX GLOBAL HEDGE FUND INDEX. The HFRX Global Hedge Fund Index represents a broad universe of hedge funds with the capability to trade a range of asset classes and investment strategies across the global securities markets. The index is weighted based on the distribution of assets in the global hedge fund industry. It is a tradeable index of actual hedge funds. It is a suitable benchmark for the Crescat Global Macro private fund which has also traded in multiple asset classes and applied a multi-disciplinary investment process since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Equity Hedge Index represents an investable index of hedge funds that trade both long and short in global equity securities. Managers of funds in the index employ a wide variety of investment processes. They may be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding periods, concentrations of market capitalizations and valuation ranges of typical portfolios. It is a suitable benchmark for the Crescat Long/Short private fund, which has also been predominantly composed of long and short global equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Separately Managed Account (SMA) disclosures: The Crescat Large Cap Composite and Crescat Precious Metals Composite include all accounts that are managed according to those respective strategies over which the manager has full discretion. SMA composite performance results are time-weighted net of all investment management fees and trading costs including commissions and non-recoverable withholding taxes. Investment management fees are described in CPM’s Form ADV 2A. The manager for the Crescat Large Cap strategy invests predominantly in equities of the top 1,000 U.S. listed stocks weighted by market capitalization. The manager for the Crescat Precious Metals strategy invests predominantly in a global all-cap universe of precious metals mining stocks.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a CPM hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. CPM’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to CPM’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any CPM hedge fund with the SEC. Limited partner interests in the CPM hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in CPM’s hedge funds are not subject to the protections of the Investment Company Act of 1940.

Investors may obtain the most current performance data, private offering memoranda for CPM’s hedge funds, and information on CPM’s SMA strategies, including Form ADV Part 2 and 3, by contacting Linda Smith at (303) 271-9997 or by sending a request via email to lsmith@crescat.net. See the private offering memorandum for each CPM hedge fund for complete information and risk factors.