Dear Investors:

At Crescat, we have three overriding, high-conviction macro themes supported by our independent research and proprietary models that we believe are poised to unfold in rapid succession over the short and medium term:

- We see highly overvalued long-duration financial assets as ripe for a second major leg down due to the rising cost of capital and the imminent trigger of a deluge of new US Treasury issuances now hitting the market after the recent debt ceiling deal that the Fed will ultimately need to accommodate.

- We believe a powerful new demand wave for gold is coming in the short term from both institutional and retail investors. In aggregate, global central banks are already ahead of the curve as they have been accumulating the monetary metal recently as a reserve asset in preference over USTs. Gold is a haven asset that can provide an inflation hedge while also offering strong absolute and relative real return potential in the stagflationary hard-landing environment that our models are now forecasting.

- Over the medium term, we envision a coming fiscal-stimulus-driven secular demand boom for commodities in G7 economies to rival China’s commodity demand boom of the 2000s. In the US, three new open-ended Congressional spending Acts are ready to lead the world out of the likely upcoming recession and drive the next global economic expansion cycle.

Short Opportunities Abound

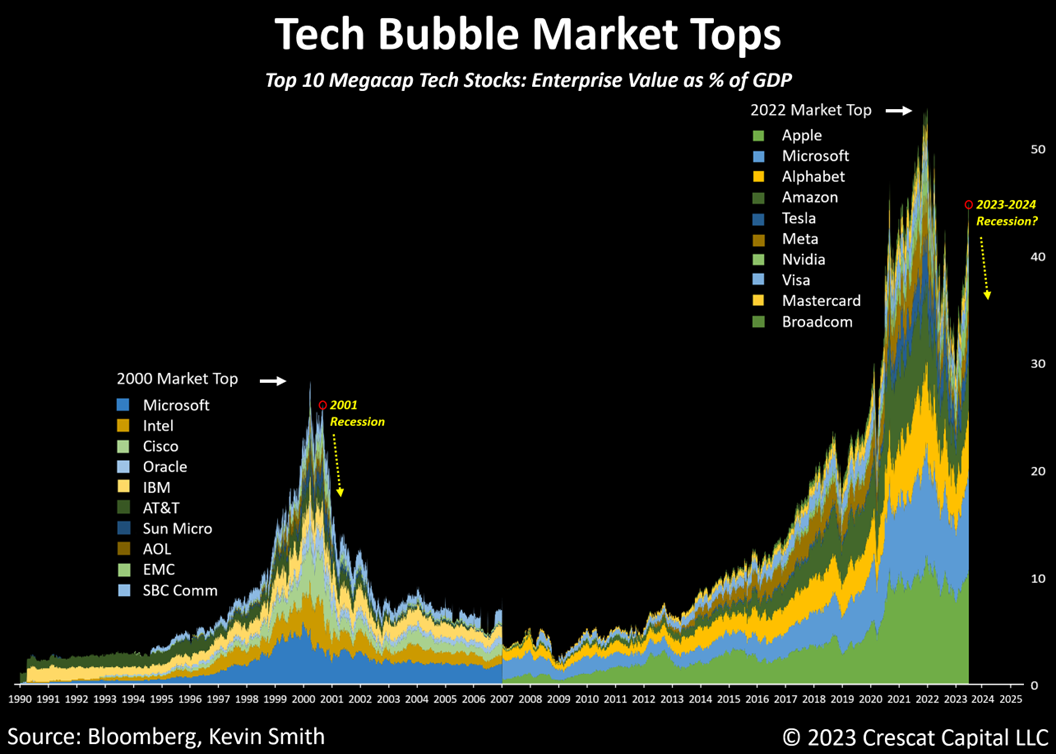

It is our belief that the S&P 500 already peaked at the beginning of 2022 for this economic cycle. It was one of the most overvalued market tops in history according to our valuation analysis. While Nvidia is the outlier still experiencing rapid growth, one is paying an extraordinarily high multiple for it. The overall fundamental earnings and free-cash-flow growth fundamentals at the median for the top-ten megacap tech stocks meanwhile have dropped precipitously with many of these companies already in profits and free-cash-flow downturns. That these companies were the former growth juggernauts of an unprecedented 14-year cycle is itself a signal of a forthcoming economic downturn.

Recessions normally follow euphoric market tops, and we think one is coming soon.

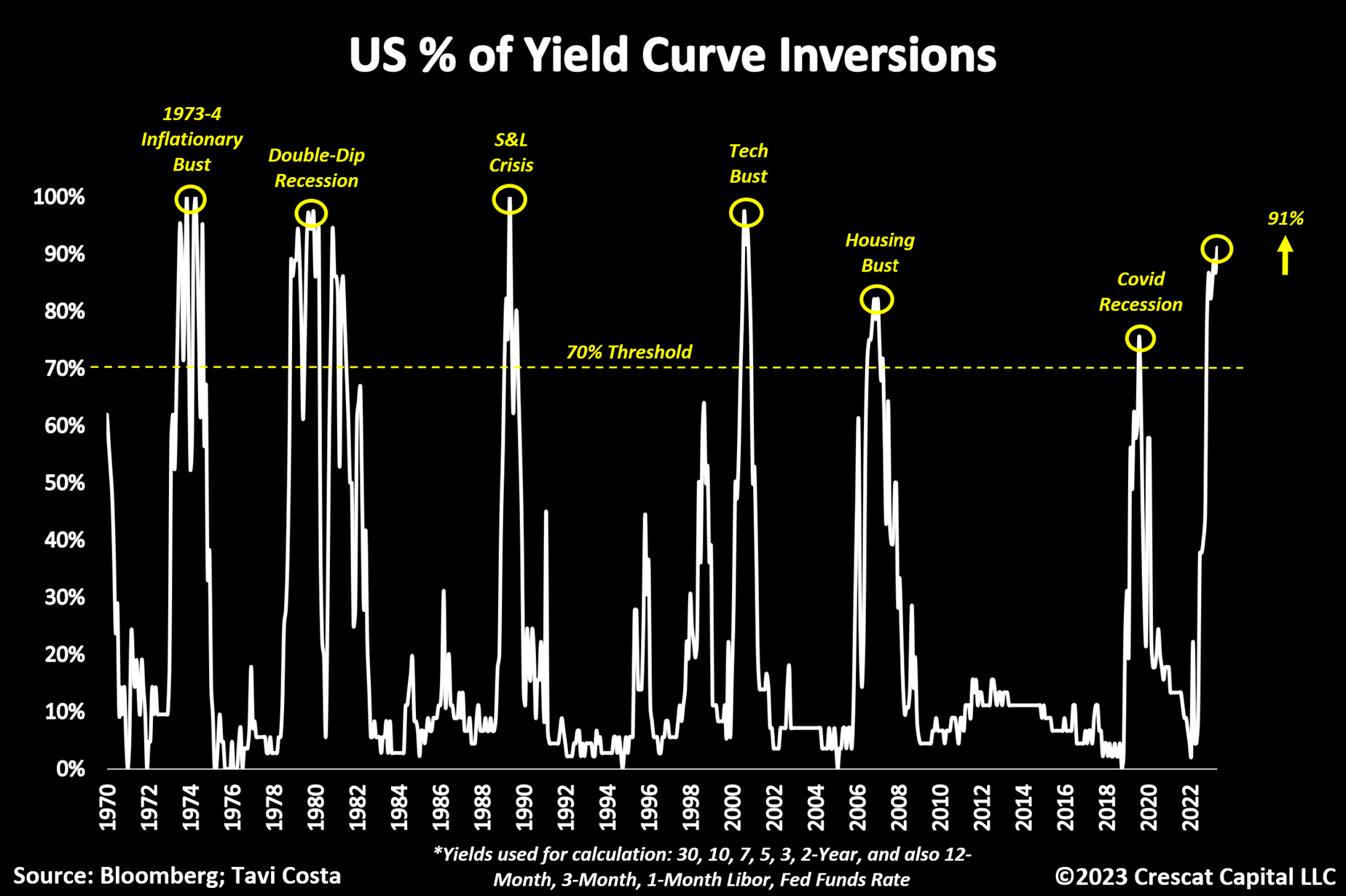

This yield curve signal developed here at Crescat by Tavi Costa foretold seven of the last seven near-term recessions over the last six decades including its first out-of-sample hit with the recent Covid one. With zero false positives yet, this macro model, which is totally independent of our tech bubble analysis, is forecasting a near-term economic contraction.

The countertrend rally year to date in the megacap techs has been based on the hope of a soft landing as well as hype over advances in artificial intelligence. In our view, this is a massive head fake. The above yield curve analysis is in strong opposition to such dreams.

In the 2000 market top, the stock prices of the top-ten mega-cap tech leaders had a similar bear market rally and attempted to retest their highs. These were the companies that built the infrastructure for the Internet, but they were way ahead of themselves on similar hype and hope. Their stock prices were decimated in the naturally ensuing recession in 2001 which was also forecasted independently by this yield curve model.

AI is indeed exciting today, just like the Internet was then, but as our chart also shows, the top-ten megacap tech stock prices are even more inflated in size today relative to the economy than their 2000-era analogs. Like their counterparts that built the Internet, today’s tech mega caps are the ones that have built the infrastructure for AI, including the cloud, neural network training software, and GPUs. EVs and smartphones by extension could also be considered part of the AI infrastructure today. Currently, we think investors in these companies have more to lose through potential stock price collapse than to gain through future earnings growth. This risk is particularly pronounced during the likely impending recession and should only be continued as truly new disruptive competition emerges.

Remember, Google and Facebook were two disruptive Internet growth businesses that took advantage of the incumbents’ infrastructure to build massive entirely new technology growth businesses and take share from them. These companies did not even emerge until well after the dot-com bust. Similarly, Amazon became one of the biggest growth disruptors of the Internet era, but not before its stock price went down about 95% from its 1999 peak into 2001.

In our analysis, now is not the time to be following the crowd into frothy AI stocks, especially among the top-10 mega caps.

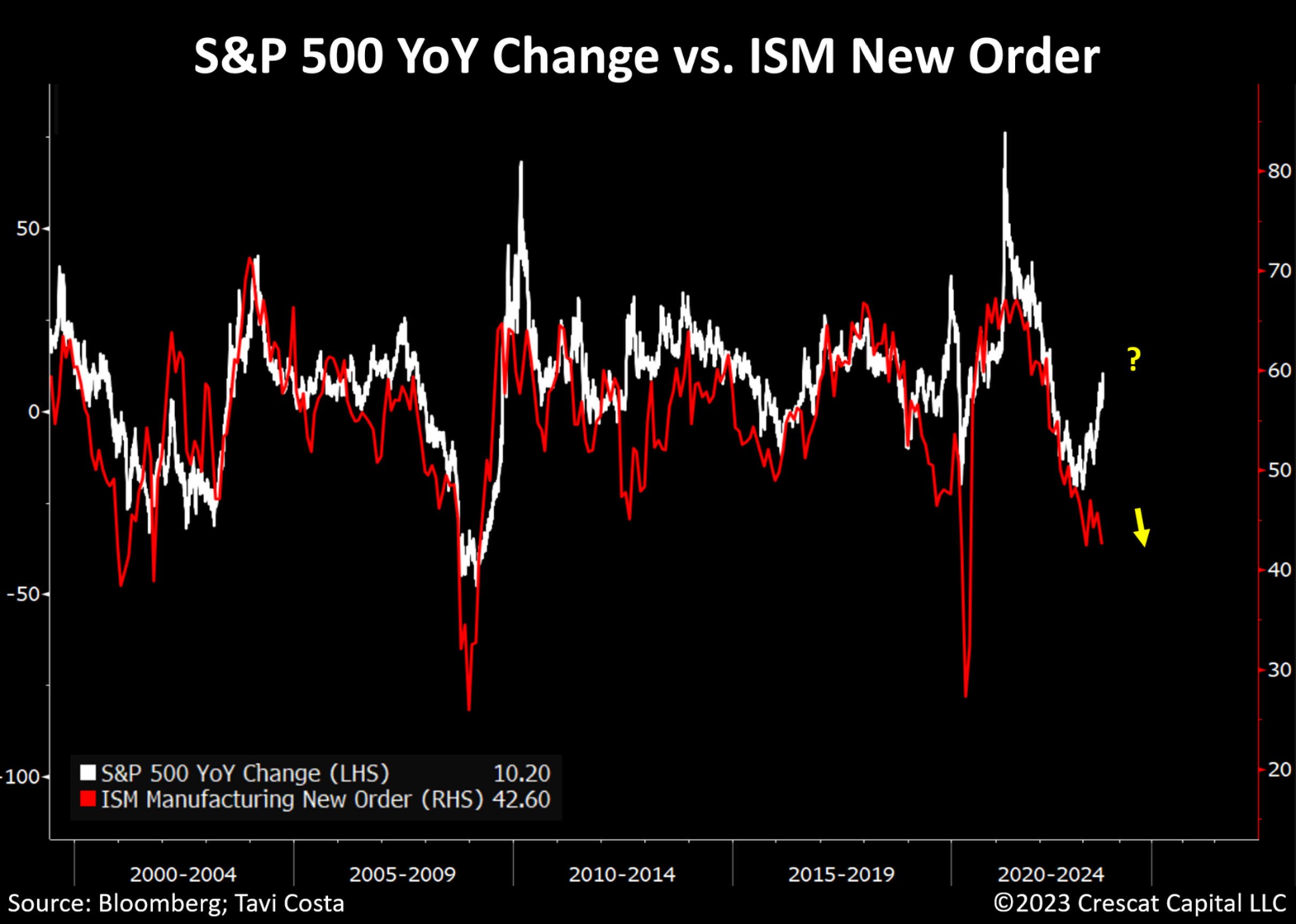

The following chart of the ISM Manufacturing New Orders Index is yet another indicator that has not been this low in the last 25 years without an ensuing recession. Note its divergence with the S&P 500 today that is very similar to the setup just prior to the March 2020 Covid market crash and real-GDP contraction.

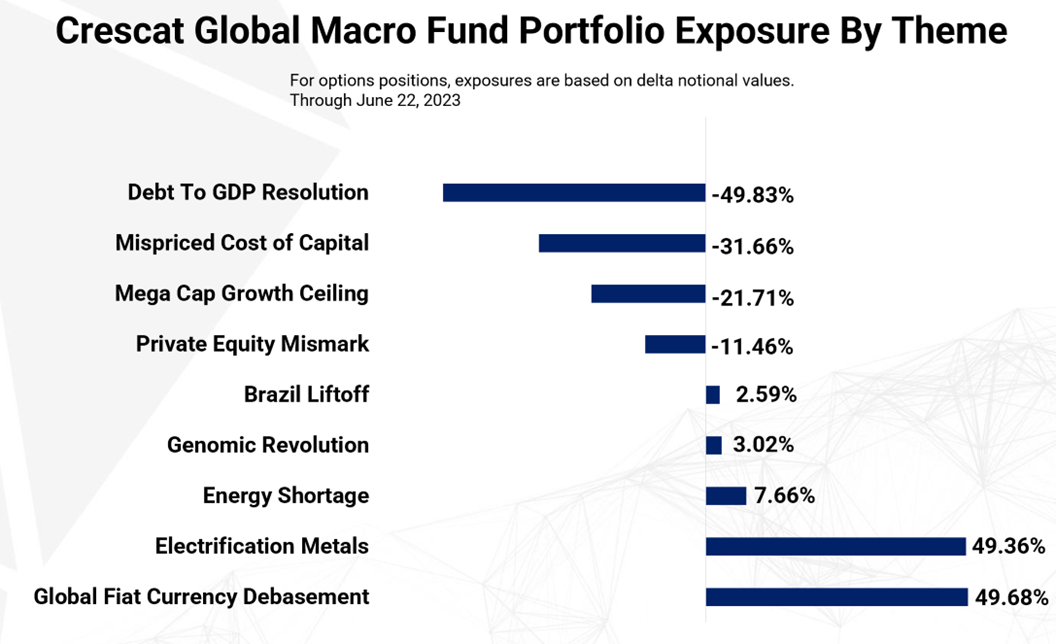

Crescat Recently Increased its Short Exposure in its Global Macro and Long/Short Funds

Given the conditions we have outlined above, over the past two weeks, we have substantially beefed up our positions across all four of our short themes at Crescat in our Global Macro fund: mega-cap tech, private equity, mispriced cost of capital which is our general model-driven equity short bucket, and junk bonds.

We believe Treasuries are one of the major financial asset bubbles today. We are playing this mostly through junk bond put options in our Debt-to-GDP-Resolution theme. There, we not only get the 10-year yield potential to rise further but also the credit spread blowout that we foresee in the likely coming stagflationary, hard-landing.

We have also significantly increased the same three equity short themes in our Long/Short fund. Given all the analysis we have laid out herein, we believe there is a high probability of a pending Volmageddon-style event coming in the short term for over-valued financial assets, and we are determined to capitalize on it.

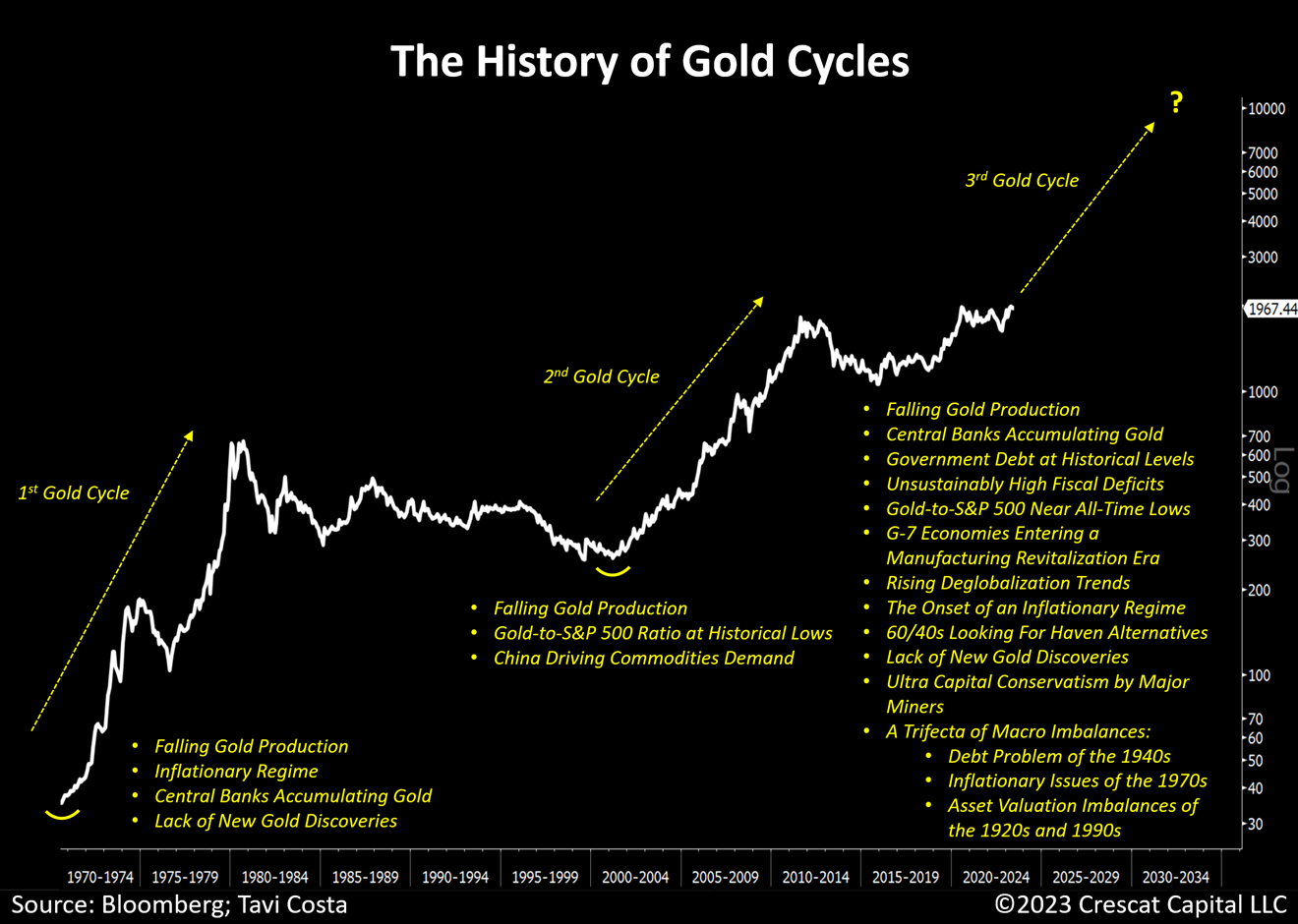

A Gold Cycle Ready to Unfold

The indicators pointing to a new gold bull market are robust with a combination of factors that worked in both the 1970s and 2000s long-term upward trending markets. In addition, there are unique factors today that add to the bull case as we show in the chart below. The multitude of macro drivers supporting the onset of another gold cycle is truly remarkable.

Amplified by the prevailing skepticism surrounding the metal, we think we are experiencing one of the most important setups in gold’s history.

We believe the stars have aligned and that gold is on the verge of a major breakout to the upside from its recent triple-top formation.

The month-to-date rise in many of Crescat’s deeply undervalued activist metals holdings could also be an advance signal that gold itself is getting ready to break out to new all-time highs. There is a high risk of a stagflationary recession and economic hard landing that in our view will resemble a combination of the 1973-74 inflationary crisis and the early 2000s tech bust. Both of these environments were ones where prices for long-duration financial assets including mega-cap growth and technology stocks collapsed at the same time as major secular commodity bull markets began with an explosion to the upside.

Crescat’s Activist Metals Strategy

At Crescat, we are determined to capitalize on a new gold cycle through the most deeply undervalued/high-appreciation-potential opportunities in the mining and metals industries that will be its biggest beneficiaries. We believe that is especially the case within the exploration segment of the mining industry today.

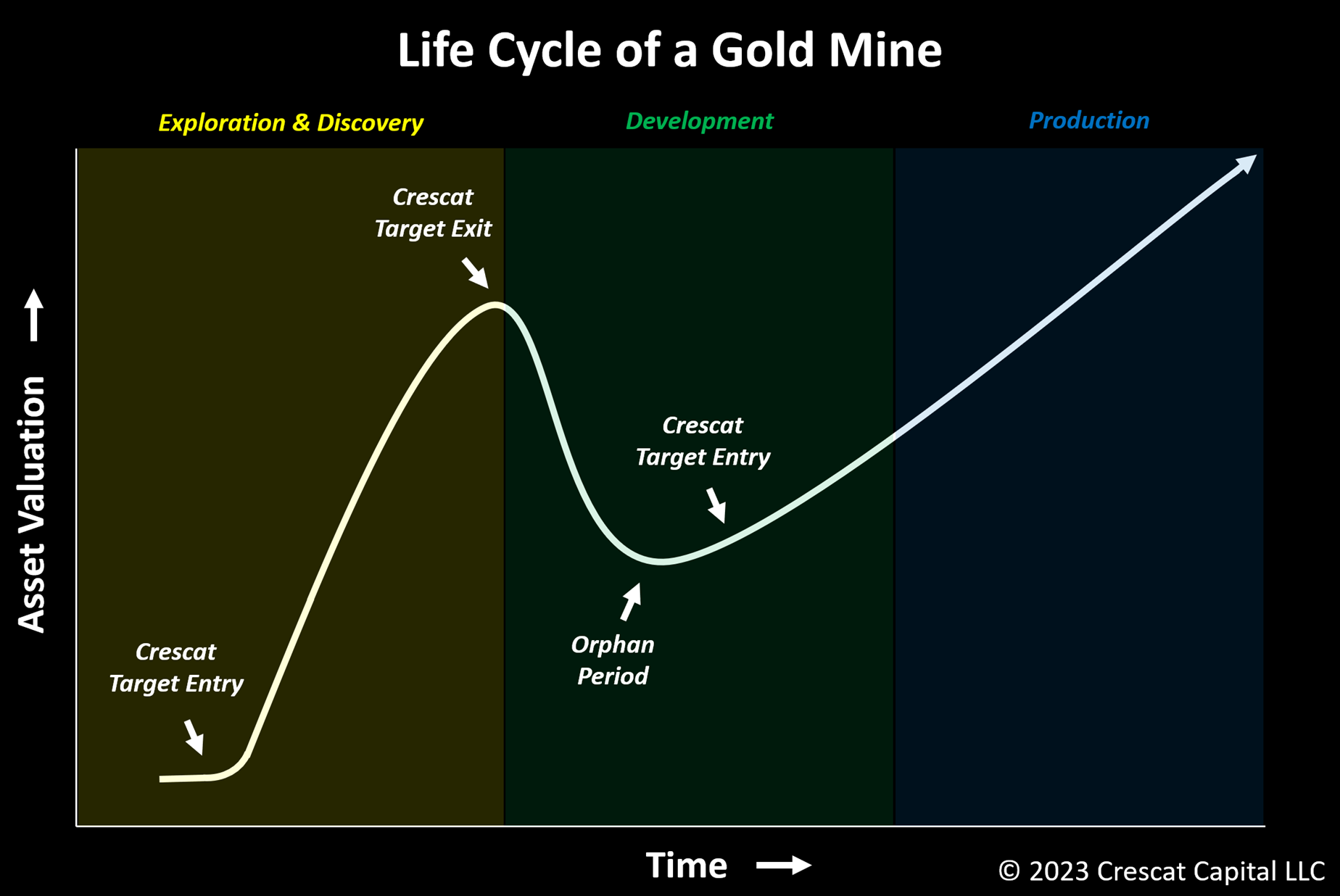

Our activist metals strategy is about identifying opportunities across all segments of the life-cycle-of-a-mine curve. However, we believe that the exploration segment presents the biggest upside opportunity today given economy-wide structural supply and demand imbalances. Furthermore, our goal is to be well-positioned ahead of a likely M&A wave.

As part of Crescat’s activist metals strategy, we strive to:

- Acquire significant early-stage stakes in high-growth exploration-focused companies through PIPEs and pre-IPO rounds;

- Inject capital into companies for exploration, drilling, and development work;

- Provide geologic and technical advice;

- Help place management and directors, including a Crescat director in select cases;

- Help build the geologic and technical team;

- Share the story with the investment community; and

- Introduce our companies to strategic major and mid-tier producers

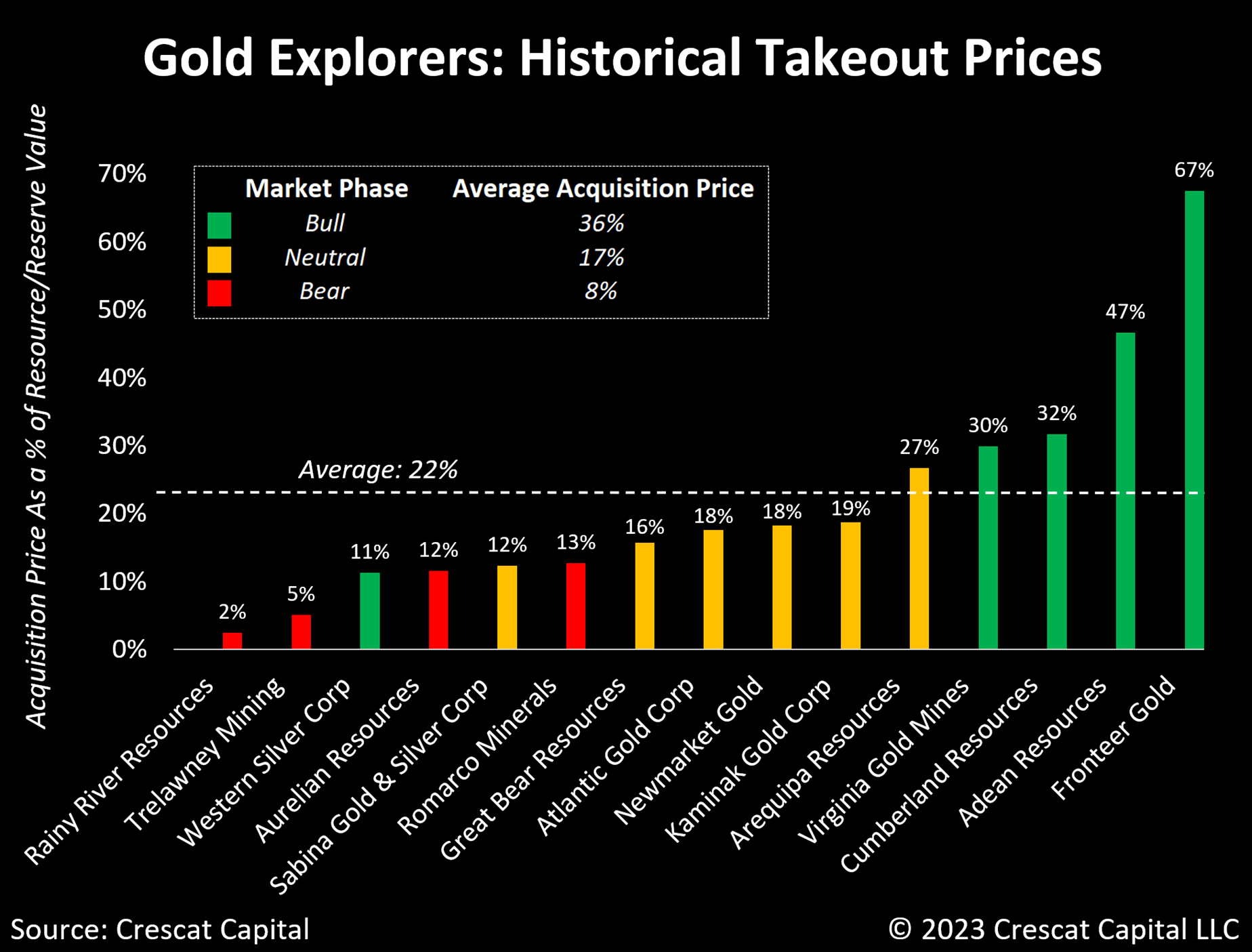

M&A Takeout Valuations of Explorers

In the chart below, we look at all acquisitions where a major or mid-tier mining company bought a gold explorer primarily for a specific discovery based on advanced drilling going back to the mid-1990s. We used only companies where we could get good data on a published resource or reserve near the acquisition date. We also only focused on primary gold explorers for this study. In most cases, the acquisition happened immediately prior to a resource or reserve publication, but in a few cases, the metal endowment was published first.

We only eliminated transactions where the data was not available or where there were numerous complicating factors. Examples of such factors include companies that had multiple assets contributing to their valuation rather than just one major discovery.

Crescat’s Activist Model

In our target appreciation/margin-of-safety model, which we show below, we eliminate the outliers and use the all-market average of 20%.

Thanks to the industry experience of Crescat’s geologic and technical director, Quinton Hennigh, PhD, over the last three years, we have built a portfolio of deeply undervalued, high-appreciation potential companies that have made major world-class discoveries of gold and electrification metals ahead of a likely substantial coming M&A wave. Over the last three years, Crescat’s activist portfolio companies have had more greenfield drills turning around the world than all the major mining companies combined. No other fund manager specializing in the metals industries that we are aware of has accomplished anything comparable. We now have over 50 activist holdings in our portfolio where Crescat’s funds own between 5 and 25% of these companies on a partially diluted basis including warrants.

Many institutional investors and fund managers have been afraid to tread into the mining exploration space because it is viewed as highly speculative with many small and microcap companies and limited liquidity. Our goal has been to exploit this inefficiency by bringing a highly experienced industry leader onto our investment team while also reducing the risks through a portfolio approach. Crescat’s activist metals fund and themes inside its Global Macro and Long/Short funds are now proven structures for major institutional capital to invest in this otherwise fragmented and formerly capital-starved industry segment offering the potential to capitalize on what is an enormous macro supply/demand imbalance.

Through our portfolio approach, we have 64 companies in our activist metals portfolio that range from potential 10 to 100 baggers in our appreciation potential/margin of safety model to get to their 20% average takeout value. This is based on Quinton’s net target resource estimates which factor in analysis of drilling progress to date that has translated into bona fide and incipient discoveries. We also factor in adjustments in arriving at these targets, including discounts for certain jurisdictions, and adjustments for expected ultimate mine profitability including metallurgy studies and analysis of grade, as well as discounts for expected future equity dilution.

Two Buckets: Gold and Electrification Metals

While our majority focus to date has been on precious metals miners, particularly gold and silver explorers, we have also made a substantial allocation to copper explorers. As a result, we recently made the decision to separate our activist metals portfolio into two distinct categories. The first one is the gold bucket which aligns with our traditional Global Fiat Debasement theme. The second category we now call Electrification Metals where we have placed silver to better emphasize its increased role in the grid and renewables, particularly solar panels. The separation also allows us to incorporate additional base metal exposures within the electrification theme, providing for increased allocation to copper, nickel, lithium, and other base metals including battery metals.

Gold has a use in technology and electrification too, perhaps 5 to 8% of its annual demand, because it is the best non-corrosive conductor of electricity on the periodic table. We are keeping it in the Global Fiat Debasement bucket, nonetheless, because we are primarily interested in it for its monetary and inflation hedge properties.

We are particularly excited about copper and have already built a substantial allocation to new large copper discoveries in anticipation of demand primarily driven by the electric grid, EVs, and the likely coming manufacturing/infrastructure boom that should drive the post-recession recovery and next economic expansion within the G7 economies amidst extremely tight supplies. In the US, we have the Chips Act, Infrastructure Act, and Inflation Reduction Act. The latter is focused on the energy transition: electric grid, nuclear, and renewable energy technologies where a variety of metals will be in high demand and the supply simply is not there today though might be possible in the future through our portfolio. Collectively, these Congressional Acts are open-ended fiscal stimulus programs that have the potential to be like Roosevelt’s New Deal or Johnson’s Great Society. They portend a commodity resource boom at the core of the next secular economic growth cycle. In the near term, a stagflationary recession is what we believe will serve as the initial catalyst for commodity prices.

Portrait of a 619-Bagger

The extraordinary appreciation potential among gold explorers is exemplified by Great Bear and its recent acquisition by Kinross at just 16% of its resource value published shortly after the acquisition. We were invested in Great Bear in our Global Macro and Long/Short funds in 2020 and did extremely well with it before exiting because Quinton was not a huge fan of the grade and thought it had reached its peak valuation potential based on his modeling.

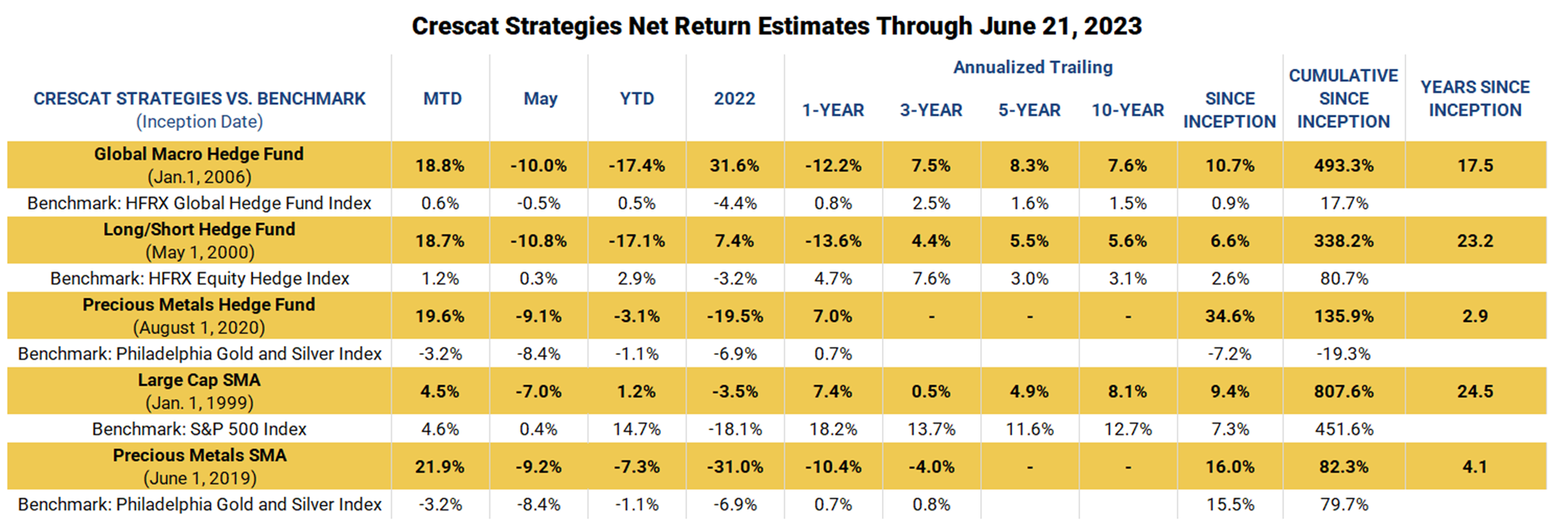

Crescat’s Strong June MTD Performance

Crescat has been experiencing strong performance in June month to date across all its strategies driven mostly by broad strength in our exploration-focused mining stocks in both the gold and electrification metals buckets. We are likely at the early stages of a resurgence in performance for our activist-metals portfolio. We believe gold is poised to break out to new all-time highs as it now competes with Treasuries as the ultimate haven asset for the current macro environment.

We also believe the short and medium-term supply/demand imbalance for electrification metals is also extraordinarily favorable for our strategy. These two themes had been the biggest detractors in our portfolio in the last fourteen months as the Fed has been raising interest rates. However, with the flood of new Treasury issuances now hitting the market and poised to continue relentlessly, we believe that the Fed will soon be forced to return to accommodative monetary policy which should be highly supportive of both of our metals’ buckets. Conveniently, the agreement to increase the debt ceiling coincided with the recent Fed rate-hike pause.

The likely upcoming next leg down for traditional long-only 60/40 stock and bond portfolios in the near term should also be a compelling reason for the central bank to at least refrain from further hikes.

Performance data represents past performance, and past performance does not guarantee future results. Performance data is subject to revision following each monthly reconciliation and/or annual audit. Historical net returns reflect the performance of an investor who invested from inception and is eligible to participate in new issues. Net returns reflect the reinvestment of dividends and earnings and the deduction of all fees and expenses (including a management fee and incentive allocation, where applicable). Individual performance may be lower or higher than the performance data presented. Commodity interests trading represents the potential risk of significant losses. The performance of Crescat’s private funds may not be directly comparable to the performance of other private or registered funds. Investors may obtain the most current performance data and private offering memorandum for Crescat’s private funds by emailing a request to info@crescat.net. The currency used to express performance is U.S. dollars. Investors may obtain the most current performance data and private offering memorandum for Crescat’s private funds by emailing a request to info@crescat.net.

Please reach out to Marek Iwahashi via email miwahashi@crescat.net or call him at 720-323-2995 if you have any questions.

Sincerely,

Kevin C. Smith, CFA

Member & Chief Investment Officer

Tavi Costa

Member & Portfolio Manager

For more information including how to invest, please contact:

Marek Iwahashi

Client Service Associate

303-271-9997

Cassie Fischer

Client Service Associate

cfischer@crescat.net

(303) 350-4000

Linda Carleu Smith, CPA

Member & COO

(303) 228-7371

© 2023 Crescat Capital LLC

Important Disclosures

Performance data represents past performance, and past performance does not guarantee future results. An individual investor’s results may vary due to the timing of capital transactions. Performance for all strategies is expressed in U.S. dollars. Cash returns are included in the total account and are not detailed separately. Investment results shown are for taxable and tax-exempt clients and include the reinvestment of dividends, interest, capital gains, and other earnings. Any possible tax liabilities incurred by the taxable accounts have not been reflected in the net performance. Performance is compared to an index, however, the volatility of an index varies greatly and investments cannot be made directly in an index. Market conditions vary from year to year and can result in a decline in market value due to material market or economic conditions. There should be no expectation that any strategy will be profitable or provide a specified return. Case studies are included for informational purposes only and are provided as a general overview of our general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of our strategies or of the entirety of our investments, and we reserve the right to use or modify some or all of the methodologies mentioned herein.

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Securities of a fund managed by Crescat may be offered to selected qualified investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of an investment in the Fund and which supersedes information herein in its entirety. Any decision to invest must be based solely upon the information set forth in the Offering Documents, regardless of any information investors may have been otherwise furnished, and should be made after reviewing such Offering Documents, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the Fund.

Risks of Investment Securities: Diversity in holdings is an important aspect of risk management, and CPM works to maintain a variety of themes and equity types to capitalize on trends and abate risk. CPM invests in a wide range of securities depending on its strategies, as described above, including but not limited to long equities, short equities, mutual funds, ETFs, commodities, commodity futures contracts, currency futures contracts, fixed income futures contracts, private placements, precious metals, and options on equities, bonds and futures contracts. The investment portfolios advised or sub-advised by CPM are not guaranteed by any agency or program of the U.S. or any foreign government or by any other person or entity. The types of securities CPM buys and sells for clients could lose money over any timeframe. CPM’s investment strategies are intended primarily for long-term investors who hold their investments for substantial periods of time. Prospective clients and investors should consider their investment goals, time horizon, and risk tolerance before investing in CPM’s strategies and should not rely on CPM’s strategies as a complete investment program for all of their investable assets. Of note, in cases where CPM pursues an activist investment strategy by way of control or ownership, there may be additional restrictions on resale including, for example, volume limitations on shares sold. When CPM’s private investment funds or SMA strategies invest in the precious metals mining industry, there are particular risks related to changes in the price of gold, silver and platinum group metals. In addition, changing inflation expectations, currency fluctuations, speculation, and industrial, government and global consumer demand; disruptions in the supply chain; rising product and regulatory compliance costs; adverse effects from government and environmental regulation; world events and economic conditions; market, economic and political risks of the countries where precious metals companies are located or do business; thin capitalization and limited product lines, markets, financial resources or personnel; and the possible illiquidity of certain of the securities; each may adversely affect companies engaged in precious metals mining related businesses. Depending on market conditions, precious metals mining companies may dramatically outperform or underperform more traditional equity investments. In addition, as many of CPM’s positions in the precious metals mining industry are made through offshore private placements in reliance on exemption from SEC registration, there may be U.S. and foreign resale restrictions applicable to such securities, including but not limited to, minimum holding periods, which can result in discounts being applied to the valuation of such securities. In addition, the fair value of CPM’s positions in private placements cannot always be determined using readily observable inputs such as market prices, and therefore may require the use of unobservable inputs which can pose unique valuation risks. Furthermore, CPM’s private investment funds and SMA strategies may invest in stocks of companies with smaller market capitalizations. Small- and medium-capitalization companies may be of a less seasoned nature or have securities that may be traded in the over-the-counter market. These “secondary” securities 12 often involve significantly greater risks than the securities of larger, better-known companies. In addition to being subject to the general market risk that stock prices may decline over short or even extended periods, such companies may not be well-known to the investing public, may not have significant institutional ownership and may have cyclical, static or only moderate growth prospects. Additionally, stocks of such companies may be more volatile in price and have lower trading volumes than larger capitalized companies, which results in greater sensitivity of the market price to individual transactions. CPM has broad discretion to alter any of the SMA or private investment fund’s investment strategies without prior approval by, or notice to, CPM clients or fund investors, provided such changes are not material.

Benchmarks

HFRX GLOBAL HEDGE FUND INDEX. The HFRX Global Hedge Fund Index represents a broad universe of hedge funds with the capability to trade a range of asset classes and investment strategies across the global securities markets. The index is weighted based on the distribution of assets in the global hedge fund industry. It is a tradeable index of actual hedge funds. It is a suitable benchmark for the Crescat Global Macro private fund which has also traded in multiple asset classes and applied a multi-disciplinary investment process since inception.

HFRX EQUITY HEDGE INDEX. The HFRX Equity Hedge Index represents an investable index of hedge funds that trade both long and short in global equity securities. Managers of funds in the index employ a wide variety of investment processes. They may be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding periods, concentrations of market capitalizations and valuation ranges of typical portfolios. It is a suitable benchmark for the Crescat Long/Short private fund, which has also been predominantly composed of long and short global equities since inception.

PHILADELPHIA STOCK EXCHANGE GOLD AND SILVER INDEX. The Philadelphia Stock Exchange Gold and Silver Index is the longest running index of global precious metals mining stocks. It is a diversified, capitalization-weighted index of the leading companies involved in gold and silver mining. It is a suitable benchmark for the Crescat Precious Metals private fund and the Crescat Precious Metals SMA strategy, which have also been predominately composed of precious metals mining companies involved in gold and silver mining since inception.

RUSSELL 1000 INDEX. The Russell 1000 Index is a market-cap weighted index of the 1,000 largest companies in US equity markets. It represents a broad scope of companies across all sectors of the economy. It is a commonly followed index among institutions. This index contains many of the same securities as the S&P 500 but is broader and includes some mid-cap companies. It is a suitable benchmark for the Crescat Large Cap SMA strategy, which has predominantly held and traded similar securities since inception.

S&P 500 INDEX. The S&P 500 Index is perhaps the most followed stock market index. It is considered representative of the U.S. stock market at large. It is a market cap-weighted index of the 500 largest and most liquid companies listed on the NYSE and NASDAQ exchanges. While the companies are U.S. based, most of them have broad global operations. Therefore, the index is representative of the broad global economy. It is a suitable benchmark for the Crescat Global Macro and Crescat Long/Short private funds, and the Large Cap and Precious Metals SMA strategies, which have also traded extensively in large, highly liquid global equities through U.S.-listed securities, and in companies Crescat believes are on track to achieve that status. The S&P 500 Index is also used as a supplemental benchmark for the Crescat Precious Metals private fund and Precious Metals SMA strategy because one of the long-term goals of the precious metals strategy is low correlation to the S&P 500.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Reference to an index does not imply that the fund or separately managed account will achieve returns, volatility or other results similar to that index. The composition of an index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking.

Separately Managed Account (SMA) disclosures: The Crescat Large Cap Composite and Crescat Precious Metals Composite include all accounts that are managed according to those respective strategies over which the manager has full discretion. SMA composite performance results are time-weighted net of all investment management fees and trading costs including commissions and non-recoverable withholding taxes. Investment management fees are described in Crescat’s Form ADV 2A. The manager for the Crescat Large Cap strategy invests predominantly in equities of the top 1,000 U.S. listed stocks weighted by market capitalization. The manager for the Crescat Precious Metals strategy invests predominantly in a global all-cap universe of precious metals mining stocks.

Hedge Fund disclosures: Only accredited investors and qualified clients will be admitted as limited partners to a Crescat hedge fund. For natural persons, investors must meet SEC requirements including minimum annual income or net worth thresholds. Crescat’s hedge funds are being offered in reliance on an exemption from the registration requirements of the Securities Act of 1933 and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The SEC has not passed upon the merits of or given its approval to Crescat’s hedge funds, the terms of the offering, or the accuracy or completeness of any offering materials. A registration statement has not been filed for any Crescat hedge fund with the SEC. Limited partner interests in the Crescat hedge funds are subject to legal restrictions on transfer and resale. Investors should not assume they will be able to resell their securities. Investing in securities involves risk. Investors should be able to bear the loss of their investment. Investments in Crescat’s hedge funds are not subject to the protections of the Investment Company Act of 1940. Performance data is subject to revision following each monthly reconciliation and annual audit. Current performance may be lower or higher than the performance data presented. The performance of Crescat’s hedge funds may not be directly comparable to the performance of other private or registered funds. Hedge funds may involve complex tax strategies and there may be delays in distribution tax information to investors.

Investors may obtain the most current performance data, private offering memoranda for Crescat’s hedge funds, and information on Crescat’s SMA strategies, including Form ADV Part II, by contacting Linda Smith at (303) 271-9997 or by sending a request via email to lsmith@crescat.net. See the private offering memorandum for each Crescat hedge fund for complete information and risk factors.